Insight Focus

- Cumulative rains from December to January have been the worst since 2014.

- Weather going forward will struggle to compensate for the loss.

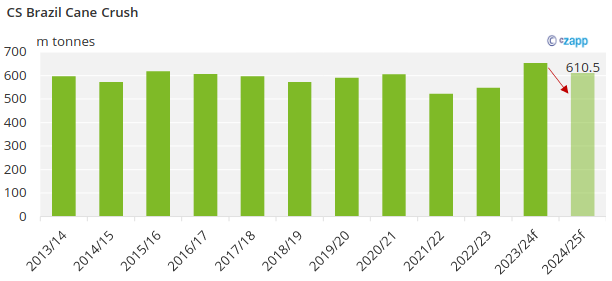

- We have revised our cane crush forecast from 637m tonnes to 610m.

Weather is always a focus when discussing agricultural commodities, either during the planting season, development period or during the harvest. Last season, rains in Centre South Brazil, the world’s largest cane growing region, were on (even above in some periods) average, leading to the highest agricultural yields on record, at 87.8 tonnes of cane per ha. As a result, cane crush in 2023/24 should end over 650m tonnes – 36m tonnes above the previous record set in 2015/16.

However, it is very rare to have 2 consecutive excellent seasons in agriculture. With that in mind, we were already running a lower crop for 2024/25 at 637m tonnes of cane crush. But this figure is now looking rather high when considering how rains have been since October. But how much less should the market expect from CS Brazil?

30% Less Rains Since October

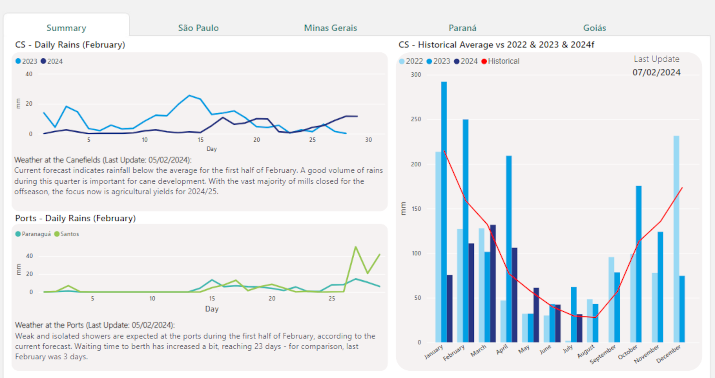

We usually wait to see how the weather will behave in Q1 before running a crop revision, since the rains during this period are critical to cane development. However, a red flag has been raised after 3 consecutive months of rains below historical average – and the forecast until the end of Q1 is not very promising.

See our daily forecast for the CS Cane Regions on Czapp

Between October and January, cumulative rains were 30% below historical average. The last time this happened was the months before the 2014/15 season, when CS Brazil saw yields going down by 7%. The impact could have been bigger, but cane fields were at an optimal age that season at around 3.3 years – the older the cane fields, the more sensitive to adverse weather conditions.

The 2021/22 season saw the biggest drop in agricultural yields of the past decade, with the TCH (tonnes of cane per hectare) going down by 13%. Rains during Q1’21 were not as bad as in 2014 (and were even higher than what is registered so far this year), but cane fields were much older at 3.45 years. This ended up impacting cane development along with poorer rains.

This upcoming season, CS Brazil cane region is facing 2 problems: lower rains, as mentioned earlier, and a slightly older cane field.

Is It Time for a Revision?

We are still at the start of February, and by the looks of it will be hard for weather to improve. All meteorologists we have consulted mentioned more rains at the start of each month, but with precipitation falling after. In short: rains will be less and with poorer distribution.

With such poor weather so far, we have opted to reduce our cane crush figure down to 610mmt. However, we stress that there is even further downside depending on rains going forward.

Yes, I have lost the count of how many times we wrote “rains” so far, but you sense the importance and weight it has for cane development and availability.

Less Sugar by How Much?

Even though we are reducing cane crush by 26mmt from the previous estimate, the change in sugar output is not so drastic. CS Brazil will continue to maximize sugar mix, and with less cane and more investments made in crystallization capacity, sugar mix should be able to reach at least 51%.

Therefore, sugar output is expected at 41.7m tonnes, which is 1m tonnes less than our previous estimate and 600k tonnes lower year-on-year.

However, the world market doesn’t need to be alarmed, as we know everyone is counting with Brazilian sugar this year – more than usual. Although there is a reduction in sugar output, it does not mean a reduction for world supply. CS Brazil was expected to cope with logistical pressure again this season, and a higher production would only be allocated to stocks. At least now sugar stocks will be a bit lighter, but still far from easily manageable.