Insight Focus

- Both companies bullish on margins for H2’23.

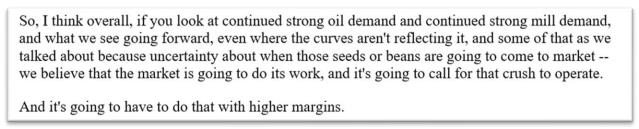

- US renewable diesel demand for oilseeds remains strong.

- Oilseed processing margins remain firm; energy costs dropping.

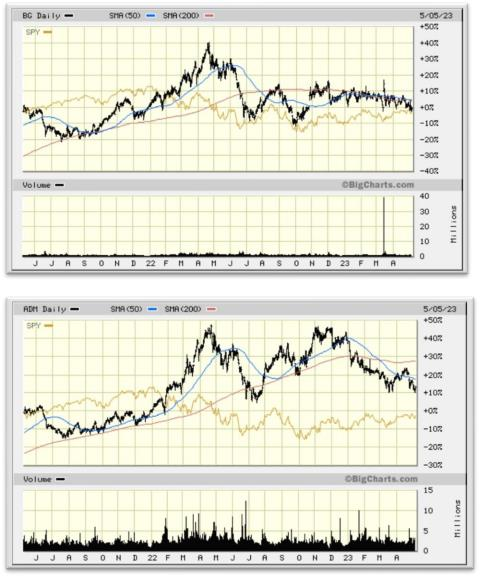

Global oilseed and grain traders received more thoughts on the status and future for oilseed crushing this week as the world’s largest oilseed processor, Bunge Limited (NYSE:BG), reported earnings and hosted an earnings call. Top 3 player Archer Daniels Midland (NYSE:ADM) reported and hosted a call last week.

Both management teams remain very bullish on margins for the second half of the year as demand from the US Renewable Diesel (RD) industry in particular feels robust (one man’s opinion, the management teams’ commentary, especially Bunge’s, played into the sharp rally for Soy Bean Oil (SBO) at the back half of the week). The Bean Oil N/Z inverse is still a very important indicator for me (see last week’s note) for the trajectory of soybean and all vegetable oil prices and leadership for a greater risk on rally across grains and protein meals over the coming weeks.

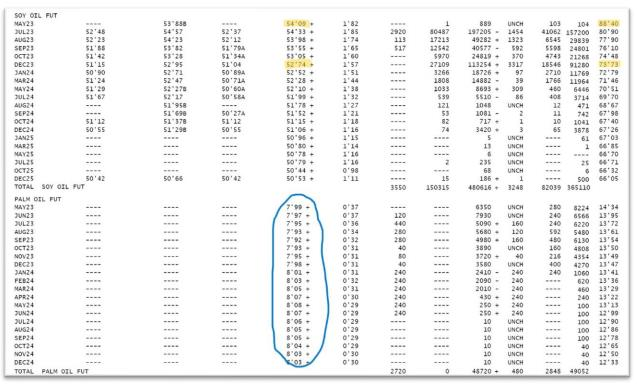

The below snippet features the CME’s soybean oil and palm curves as of Friday’s close. I yellow highlighted the year ago prices in the far-right column as well; notice the $.14 inverse for May to December year ago versus $.015 today; the “availability risk” premium via sharply higher prices and a steeply inverted curve associated with outsized feedstock demand relative to production from the US renewable diesel (RD) industry and the risk to an Ukrainian oilseed crop failure (rapeseed and sunflower) has collapsed to date:

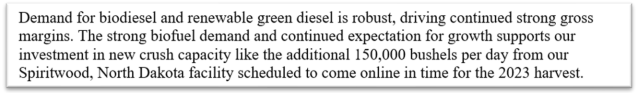

Will feedstock demand from the RD industry rally the bulls? Juan Luciano, ADM’s CEO, said this:

Greg Heckman, BG’s CEO, said this (translation: oil takes over the leadership in the complex):

Earnings for both companies continue to be extremely positive but the equity returns are S&P-500-like over the last two years (I think about these years as the beginning of the RD era for the US soybean processing industry) so not a lot of BETA production (there was “a lot” from ADM, now “none” from BG).

Still, while the BETA has evaporated, both management teams remain extremely optimistic for the future and I characterized their emotional states as “giddy” when I presented to an agricultural conference in Omaha on Friday. And why not? You would be giddy too with excellent margins and the ability to pay down debt and multi-quarter visibility to continued profitable outcomes.

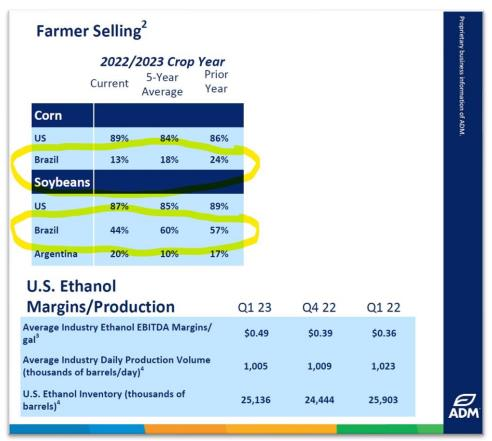

A recent benefit to global oilseed processing margins for both companies (and soon to become an element for margin expansion for US soy processing margins as discussed in last week’s note) is the relentless selling of soybeans and now corn into the global export markets by Brazilian soybean and corn farmers and warehousemen. Has the selling peaked? ADM’s published details in its earnings presentation would suggest relative to the 5-year average and a year ago there is a lot more selling to come.

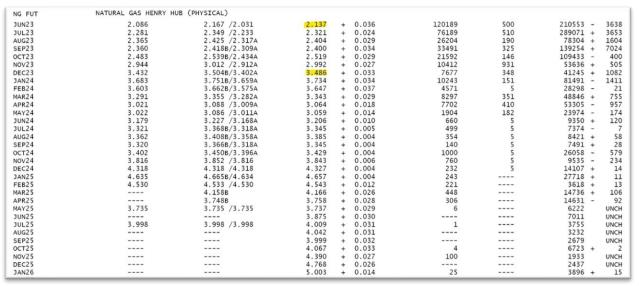

One margin component barely mentioned during the calls is the cost of energy (BG noted the reduced cost for their European operations) and I am a bit lost as to why it gets so little discussion amongst largescale consumers like BG and ADM. The price collapse of natural gas versus year ago and the enormous carry (contango for you Houston readers) in the natural gas market means cheap energy for the foreseeable and I would have never guessed that when the Russian/Ukrainian conflagration erupted.

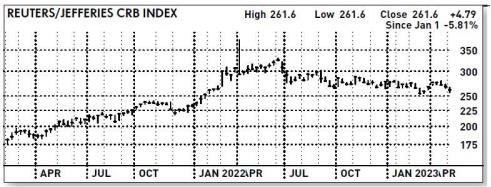

The widely watched CRB index remains in a quiet downtrend with crude oil prices sitting on the index like a wet blanket. Grain and oilseeds prices will have to overcome the general indifference for commodity length from the trader class.

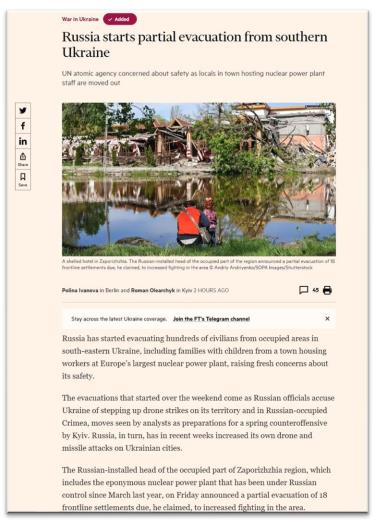

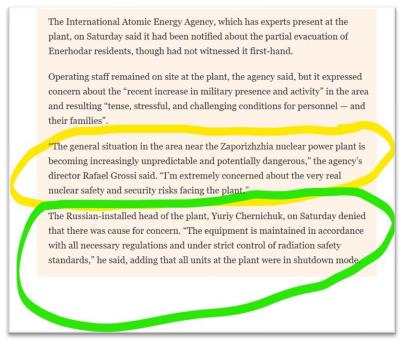

Disturbing news this weekend that may keep grain and oilseed traders playing close attention: the potential for nuclear contamination to spread across the soils of the “breadbasket” of Ukraine and Russia which would have disastrous implications for grain supplies for many years.

Yikes! Who is giving us the straight story? Dunno.

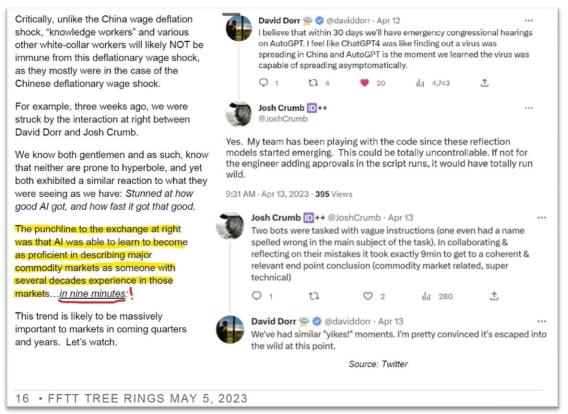

And finally, it looks like my 35 years in the business can now be learned in 9 minutes. Another yikes to that. See Luke Gromen’s presentation from his weekly Forest For The Trees below:

Keep an eye on BO N/Z spread and the flat price of vegetable oils (soy, rapeseed/canola, sunflower, and palm) as I believe an impending rally will inspire bulls across the grain and oilseed markets, watch the Ukrainian nuclear plant situation, pray for world peace, and have a great trading week.