Insight Focus

- China imported 21% less cassava in 2023 than it did in 2022.

- High prices made it less competitive as animal feed or a feedstock for ethanol.

- What might this decline mean for China (and Thailand’s) sugar and ethanol industries?

China is a major regional cassava buyer. The cassava is used as a feedstock to make ethanol or as animal feed. Both options help to reduce China’s dependence on imported grains.

Most of China’s cassava imports come from Thailand, and the scale of recent Chinese demand has driven prices ever-higher. This has led to excellent returns for Thai farmers, who have been planting cassava at the expense of sugar cane. But it’s been bad news for Thailand’s ethanol industry, who also use cassava as a feedstock.

China’s cassava demand is therefore critical to a number of food and energy industries in the region… and there are signs this demand may now be falling.

Chinese Cassava Production Stagnates

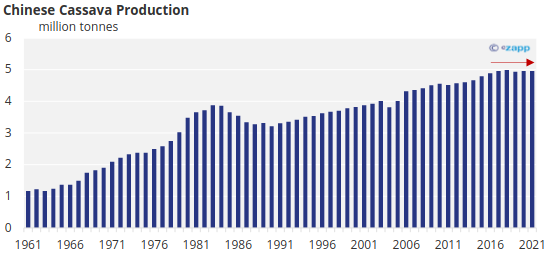

Cassava is produced in southern China, and produSource: NBSCction has stagnated in recent years, at about 5 million tonnes.

Source: FAO, Czapp

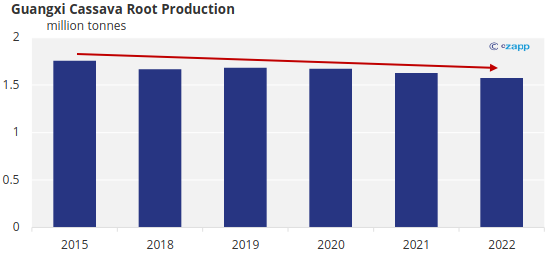

Acreage in Guangxi, the largest cassava producing area, has even shrunk slightly in recent years due to the increase in construction. This has been caused by urbanization and higher returns of competitive crops.

Source: Guangxi Statistics Bureau

In any case, 5 million tonnes of cassava root is far from enough to meet China’s needs. China requires cassava for direct consumption in the form of food, cassava pearl and vermicelli, as well as for processing into starch, ethanol, feed and fertilizer.

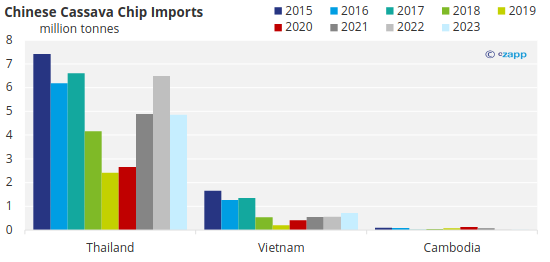

Therefore, China needs to import cassava products. Thailand and Vietnam became the most natural choices, especially as Thailand is the world’s largest exporter of cassava products.

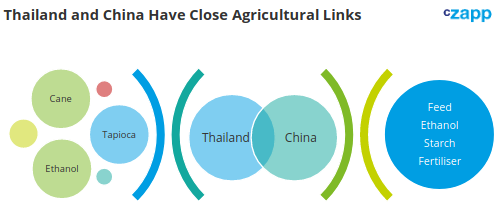

China’s Ties with Thailand

In addition to a strong sugar relationship, China also has close ties with Thailand in cassava trade. China is the largest importer of cassava chip, importing 5.6 million tonnes in 2023. Of these, 87% come from Thailand.

Sugarcane and cassava are the fiercest competitors for arable land resources in Thailand. Both crops are fuels for ethanol, so changes in Chinese cassava demand will affect Thailand’s cassava, sugarcane and ethanol output.

Imported Cassava Chip Is Used for Ethanol, Feed, Starch Processing

Fresh cassava is often processed into dried cassava and tapioca starch for preservation and transportation. Compared to fresh cassava, dried cassava contains only about 13% water, making it easy to preserve. China is a net importer of dried cassava, with 30% used for feed and 70% for alcohol production, starch processing, fertilizers and other uses.

Cassava Chip is Used For:

- Edible and industrial ethanol

- Fuel ethanol

- Starch processing

- Animal feed

- Fertilizer (cassava pulp)

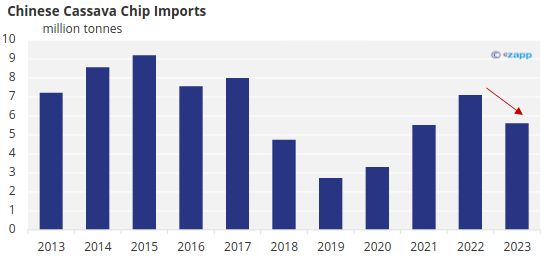

Chinese imports of cassava chips fluctuate wildly, ranging from 2.74 million tonnes in 2019 to 9.2 million tonnes in 2015. In 2023, China imported a total of 5.6 million tonnes of cassava chips, a decrease of 21% from the previous year.

Import demand for dried cassava depends both on relative prices with corn for feed use, and also the processing profit of ethanol.

Cassava-Based Ethanol Competitiveness Declines

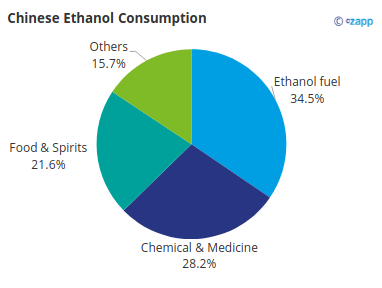

China’s ethanol consumption is very different from Brazil and India, with fuel ethanol accounting for just 34.5% of total consumption, and most of the rest for food and industrial purposes. In addition, almost all ethanol is fermented, although production capacity for synthetic ethanol is growing.

Cassava is one of the three major feedstocks used to produce ethanol, along with corn and molasses. In 2023, 3.6 million tonnes of cassava chips were used to produce edible and industrial ethanol, down 33% from the previous year. The decline is mainly due to the fact that the cost competitiveness of cassava ethanol is not as high as that of corn ethanol.

- In the revised version of the Terminology of Baijiu Industry from June 1, 2022, cassava was removed from the list of ingredients for Baijiu.

- Import parity of cassava-based ethanol is negative due to high cassava chip prices, and the operating rate of these ethanol factories has decreased.

Today, the FOB price of Thai cassava chip has fallen back to USD 245/tonne. The corresponding cost of cassava-based ethanol is about CNY 6,500/tonne (USD 915/tonne), which is CNY 150/tonne lower than the market price.

China’s Feed Demand for Cassava Chip Could Fall

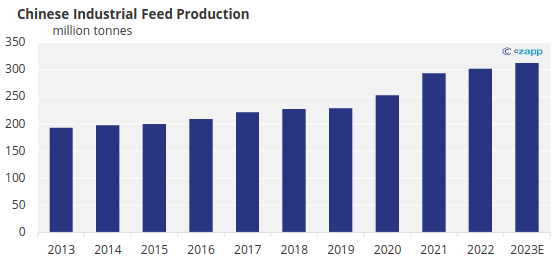

About 30% of dried cassava in China is used for feed production. In the first quarter of 2023, the demand for cassava chip for feed use was strong. This could be due to the increase in animal feed production.

As of the end of September 2023, the total output of industrial feed in the country was 232.64 million tonnes, a year-on-year increase of 5.3%. Among them, pig feed accounted for 46%, which increased by 10.3% year-on-year.

But against the backdrop of losses in pig farming, China’s Ministry of Agriculture said at a press conference in January that China would guide farmers to reduce pig production capacity while strengthening regulation of the industry. Feed demand may be at risk of declining.

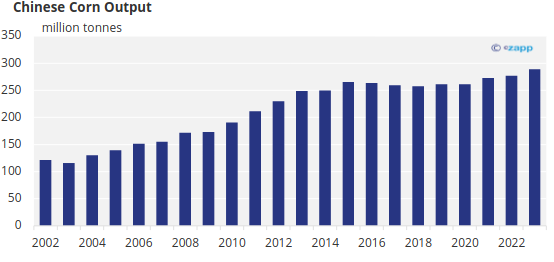

However, in 2023, China’s corn once again ushered in a bumper harvest, reaching 289 million tonnes, a year-on-year increase of 4.2%. At the same meeting, the Ministry of Agriculture announced it would expand the planting of genetically modified soybeans and corn. There is still room for growth in China’s grain output in the future.

Source: NBSC

Lower Availability of Thai Cassava Chips

The decline in corn prices and the strength of casSource: NBSCsava prices have weakened the competitiveness of cassava chips.

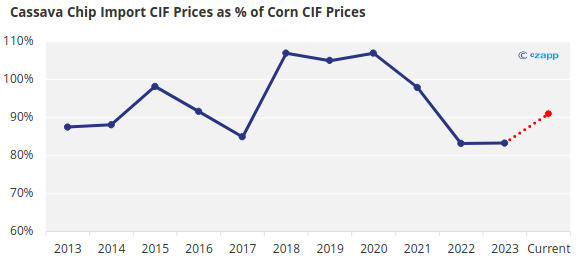

In 2023, the average CIF price of imported cassava chips was USD 277/tonne. The price parity with imported corn is about 83%, and the rate has now risen to about 90%. This means the cassava chip price has become higher relative to the corn price.

Source: China Customs

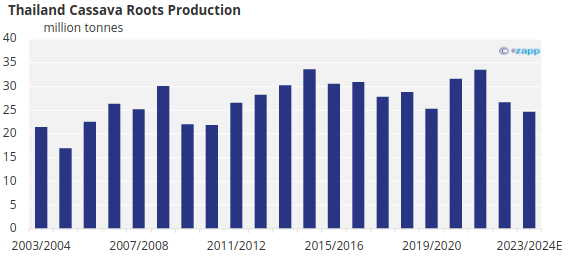

For 2024, we think Thailand’s cassava production will decline further due to last year’s unfavorable weather. This has led to a decrease in the availability of cassava chips and therefore supported prices.

Currently, we think China’s cassava chip imports in 2024 are likely to decline further.