Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

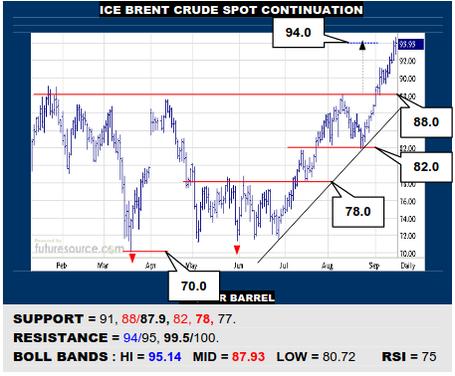

ICE BRENT CRUDE OIL SPOT

Championing the B-Berg’s cause, Brent forged all of ’23 into a large inverse H&S as it vaulted 88 and has kept going since. However, while generally eying passage to triple digits now, it must be noted that an immediate Aug base projection to 94 has just been met so corrective stresses could increase temporarily if unable to quickly traverse the 94’s.

NYMEX NATURAL GAS 2ND CONTINUATION

A bid to rally again faltered in the tiny early Sep gap (3.09-3.10) and Nat Gas has slipped back again. Thus wary of a nearby bear flag so be ready for a break of 2.90 and the mid band (2.874) to test the 2.80 ledge. If able to dig in and hold there, a new leg higher could begin. If 2.80 gave way as well though, make room on back to the 2.47 shelf.

COMEX GOLD 2ND CONTINUATION

Rambly non-committal action from Gold is still paying respect to the 1900 vicinity so the prior H&S top no longer looks as punishing as it did originally. However, to breathe new life here will still take conquest of the 1961 neckline pivot while also seeing the Dollar peel back through the 104’s. Otherwise keep watching 1885 as a trapdoor down to 1809.

LME COPPER 3-MONTHS

Keeping its distance from the 8120 support, Copper has steadily dialed in the sights on the ’23 downtrend (8530) again. It still looks a tough task though without some measurable decay of the Dollar out of the 104’s and will need cementing via conquest of 8600. Stumbling in the 8500’s would meantime warn to keep eying 8120 as a new H&S tripwire.

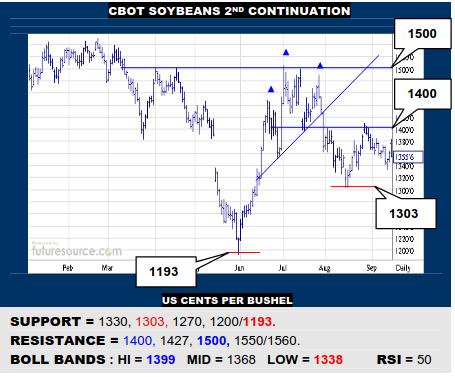

CBOT SOYBEANS 2ND CONTINUATION

The mid-year H&S kept the lid on during a late Aug test of the 1400 rim but the dip in Sep has been fairly tame and of no concern to the 1303 support. A bit of a lull all in all therefore but always minding that 1400 threshold, a break beyond setting sights on 1500 for a major base possibility while only breaking 1303 would inflict greater damage.

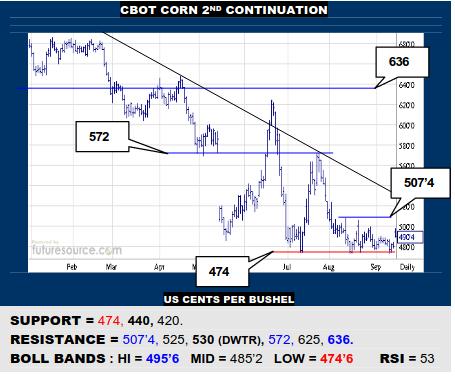

CBOT CORN 2ND CONTINUATION

The 474 support has continued to tough it out but Corn must still react back off here and pop 507’4 to persuade that it was turning the tide to bring the downtrend within striking distance (530) for the possibility of more substantive change. Otherwise still eying 474 closely as a break might yet precipitate a delve on down into the 440-420 monthly support.

NY SUGAR #11 SPOT CONTINUATION

A quick glimpse over the prior April peak of 27.41 couldn’t be secured Friday so Sugar still needs some work to shore up a second flag escape and raise sights onto the inverse H&S projection at 28.50. Meantime keep tabs on the 25.90 divide between the two flags as the mid band (25.53) steadily draws towards it to make it all the more pivotal.

NY COFFEE 2ND CONTINUATION

A much better week for Coffee as it rebounded from a second look at 147.2 to shed its mid-year downtrend and peg a provisional new 10₵ double bottom. Rumblings of a more committed rebellion then that infers scope to the 167’s and maybe further if the Dollar reversed back across the 104’s. Hard to make an impression on the 170’s otherwise.

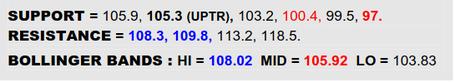

BLOOMBERG COMMODITY INDEX

The game of chicken between the B-Berg and Dollar is nearing critical mass as the 108.3 hurdle (stage one) is in play here while the Dollar is mere pips shy of a major divide at 105.6. A decisive thrust over 108.3 for the commodity index would nicely balance up the years’ basing action, making for a far better inverse H&S that would technically measure almost to 120. Nevertheless, there would still then be the well marked 109.8 barrier that would also need crossing to really give the new base reassurance and luster and making that entire transition really does seem to ask that the Dollar miss the mark at 105.6. Alas, if the greenback kept going, mind the mid band (105.9) and uptrend (105.3) here.

US DOLLAR INDEX

Crossing 104.5 appeared to be stage one of a comparable base building process by the Dollar to that of the B-Berg and it appears to have since added a Sep bull flag to stoke the fire for a strike at the secondary 105.6 escape hatch. Getting out beyond the 105’s would underscore the ’23 basing action and put the US currency in clear skies with little to hinder it until 110. Just for the moment the latest steps up in Sep haven’t lured RSI with them though so a marginal state of divergence exists but that could be quickly cured by entry to the 106’s. A vague glimmer of hope for the commodity sector then but needing to see a diversion through the mid band (104.3) to signal a first true disruption here.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.