Insight Focus

- Kenya is currently the third largest macadamia kernel exporter.

- The Kenyan government has recently provided more support for macadamia farming.

- Production issues in South Africa could strengthen Kenya’s value proposition.

Macadamia Nut Basics

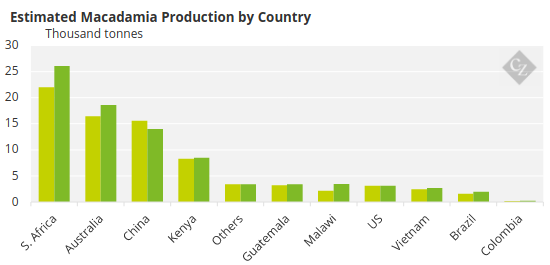

Macadamia trees originate from Australia, specifically southern Queensland and northern New South Wales, though macadamia’s first commercial scale plantation was in Hawaii. But since then, Australia has been overtaken by South Africa as the leading macadamia producer. Australia and South Africa now account for 50% of total world production, followed by Kenya and China.

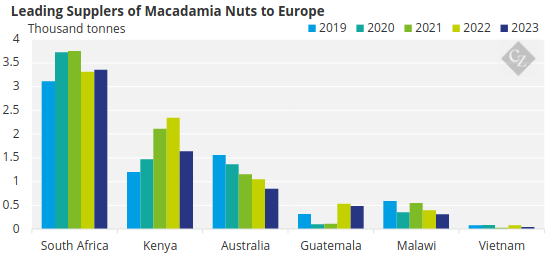

Source: CBI

Macadamia has a butter-like flavour and creamy-texture and is rich in nutrients and beneficial compounds. Although it has a comparatively high fat content of 76%, these are mainly monounsaturated fats, which have been found to help reduce risk of heart disease and type 2 diabetes. It also has a high fibre content.

The trees take between seven and 10 years to yield commercial quantities of nuts, but they are then productive for several decades. This makes it an excellent stable, long-term crop because it generally doesn’t respond to market fluctuations in demand.

Macadamia as a Kenyan High Value Export Crop

About 90-95% of the macadamia kernels produced in Kenya are specifically for export. Key destinations are the US, EU, Japan, China, Hong Kong and Canada. Demand had declined in 2020 due to the pandemic, though exports have recovered in line with the global economy.

Macadamia is particularly expensive to produce. Aside from taking up to a decade to begin yielding fruit, it also has the hardest nutshell, which is five times harder to crack than a hazelnut and requires specialist processing facilities. The process is also delicate — kernels can be damaged if shelled poorly. Farmers risk harvesting early as they can’t see inside a sample of nuts to check for ripeness.

Kenya Emerges as Challenger to South Africa

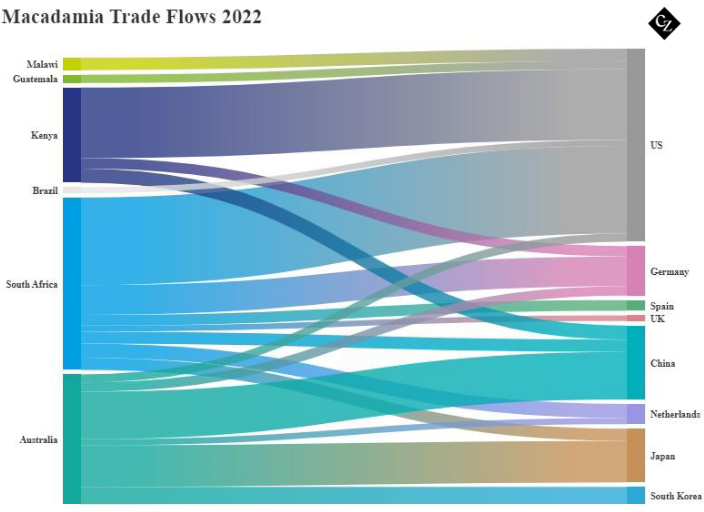

Let’s look at the biggest macadamia exporters. First is South Africa, followed by Australia and Kenya. But Australia’s macadamia exports mainly go to Asia and some to the US due to more favourable logistics.

Data source: Tridge

Europe meanwhile is estimated to consume around 6,100 tonnes of macadamia a year – which represents about 8% of global production. There is fast growth in these numbers, particularly in Germany, according to CBI.

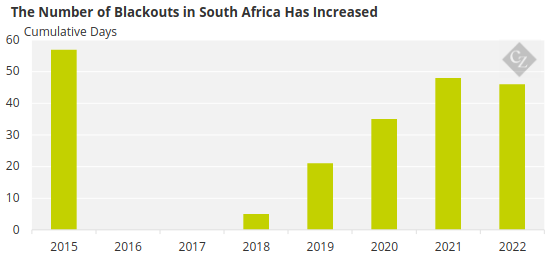

This means the most logical suppliers for the European market are South Africa and Kenya. Although South Africa is currently the biggest exporter of macadamia kernels globally, its economic and infrastructure challenges are providing market and price point opportunities to Kenya. It has been well-publicised that South Africa’s national utility company Eskom has experienced increasing numbers of blackouts, impacting the agricultural and industrial sectors.

Source: Farmers Weekly

Not only this, but Kenyan agricultural policy is becoming more favourable for macadamia producers. The Kenyan government recently lifted an export ban on raw macadamia kernels. This policy was implemented in 2009 and was designed to provide local farmers with an opportunity to develop their local industry.

This was done by introducing new processors, intensifying the competition locally and subsequently increasing crop production volume. The ban benefitted both farmers and the government, but over time, supply increased and the price that could be achieved by farmers fell.

This has been enough to incentivise higher production. Less than a year after the ban was lifted, the anticipated annual harvest of Kenyan macadamia has grown from 41,500 tonnes to 45,000 tonnes in 2024.

Renewed EU FTA Boosts Exports

The EU mainly imports macadamia from Africa, which should continue following the December 2023 renewal of a preferential trade agreement, the Economic Partnership (EPA). This means duty-free imports of several agricultural products, including macadamia nuts.

This is a golden opportunity for Kenya to gain sustained access to the EU’s single market, while providing a platform to support Kenya’s economic development.

For example, Kenya can take advantage of Germany’s appetite for macadamia kernels. Germany is the largest European importer (and re-exporter to neighbouring countries) of shelled macadamia. In 2022, Germany imported approximately 3,300 tonnes.

The trade deal also signals that Kenya is ready to produce and export high-quality products to Europe. For example, Kenya Nut Company (KNC) have established themselves within the macadamia kernel market and produce high quality products.

Kenya’s climate is considered excellent for macadamia production so future investment in the sector, given recent changes within policy, are likely.

Concluding Thoughts:

- The Kenyan pre-crop is looking positive with a higher estimated crop yield for 2024.

- Growing demand for healthy snacks has increased the demand for macadamia.

- The EU is a major macadamia consumption market, importing around 8% of global production

- With the lift of the export ban and the preferential trade into the EU, Kenya is on track to increase exports to the EU and other markets.

- This, along with some structural issues in South Africa, could help it become Europe’s largest macadamia supplier.