530 words / 3 minute reading time

Price Action

Comments:

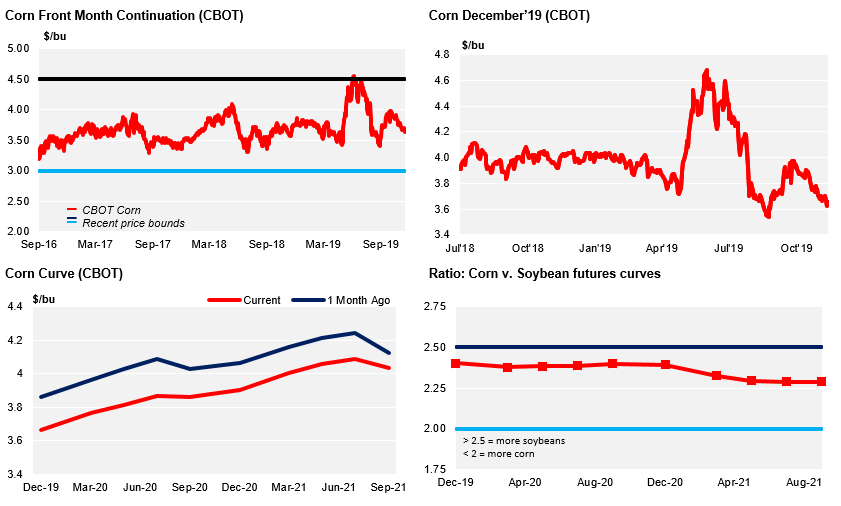

Chicago Corn closed up last week thanks to a positive Friday but the week was very much flat. The rally last Friday was simply following wheat where we had some short covering after the European production forecast for 2020 was revised down by the European Commission. Despite last week’s positive closing, Chicago corn is in a downtrend that started in mid-October. We had wheat rallying last week but soybeans plummeting with corn stuck pretty much in the middle with a lack of fundamental news.

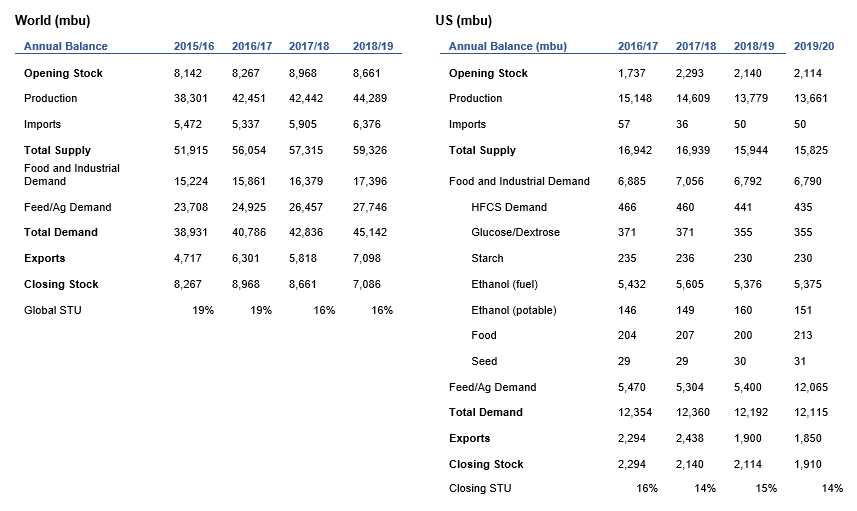

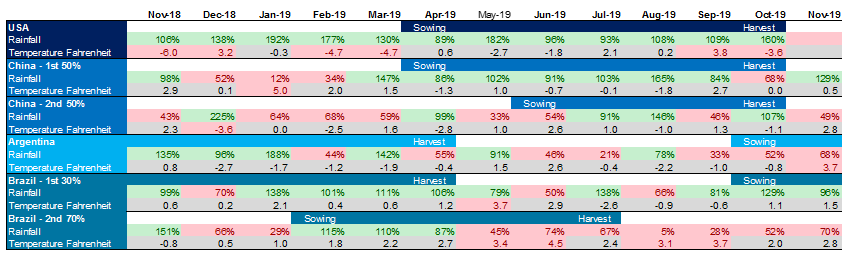

Corn harvesting in the US is usually finished by the end of November. This year has been different. Both planting and harvesting have been delayed by bad weather. Harvesting is running at 84% complete vs. 93% last year and vs. 96% of the four year avg. Harvesting will continue probably through the end of the year. We have a new WASDE next week and with harvesting still very much delayed we may have to wait for the January report to have a final accurate number for Corn production. We continue to see downside risk to yield and harvested acres.

European corn was higher week on week, despite the European Commission increasing their production forecast to 67,3m ton vs. 66,7m before which is up from 65m of the USDA and 64m of Strategie Grains. The higher production number was neutral for the market as the European Commission projection is above the consensus. The French harvest continues to be delayed at 92% complete or only 4 pts up from last week and vs. 100% last year. Ukrainian harvest is 98,7% completed with 74,3m ton harvested vs. 70m last year.

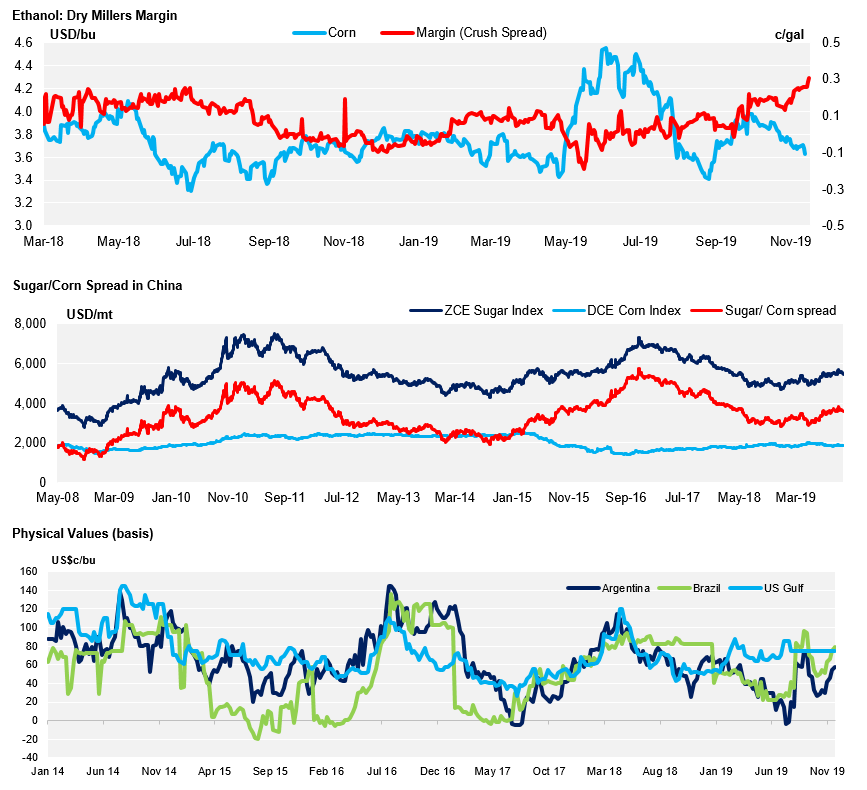

Brazilian prices were up another 3% week on week despite poor export data; high local demand is displacing exports. The November export number should close around 3,7m ton vs. 6,1m exported in October. Corn ethanol production is playing a part as ethanol stats as of 1H November showed corn ethanol production already surpassing last year’s production for the whole year. The late planting in Soybeans will also have an impact in corn planting for the safrinha, especially in Parana, as the corn planting window is short after soybeans are harvested. The major problem, however, is that traders sold a large export program and were not counting with the surge in local demand thanks to higher pork exports to China triggered by the swine fever. This all points to very tight stocks by May 2020. Another supportive factor is a potential corn export tax in Argentina as the industry has fears this will happen after the change of government.

European wheat rallied last week after the November MARS bulletin showed lower wheat planted area as a result of a wet and cold November. Planting activities have been disrupted in Germany, France, UK and other major growing countries. The European Commission later in the week forecasted wheat production at 147,9m tonnes or 220k tonnes lower than the previous forecast. In Russia, the agriculture Ministry reduced their forecast to 75m ton from 78m before and vs. 74m of the USDA. French wheat conditions fell again to 75% good to excellent, from 78% last week, and we had 84% just three weeks ago.

Supply

WASDE Projections

Weather in Main Corn Growing Regions

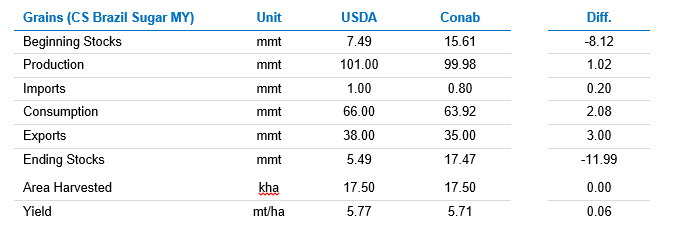

Brazil Balance

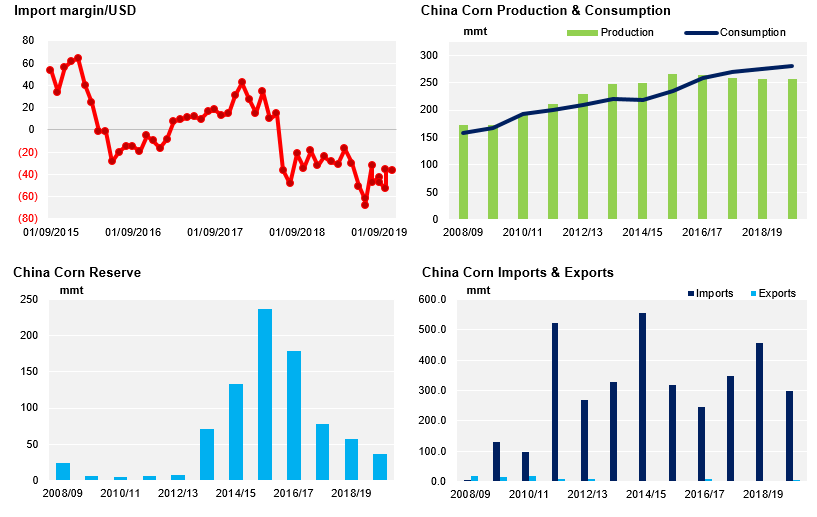

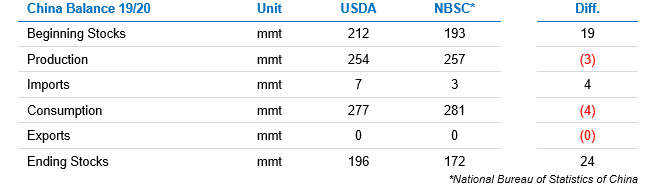

China

China Balance 19/20

Demand

EU