Price Action

Market Commentary

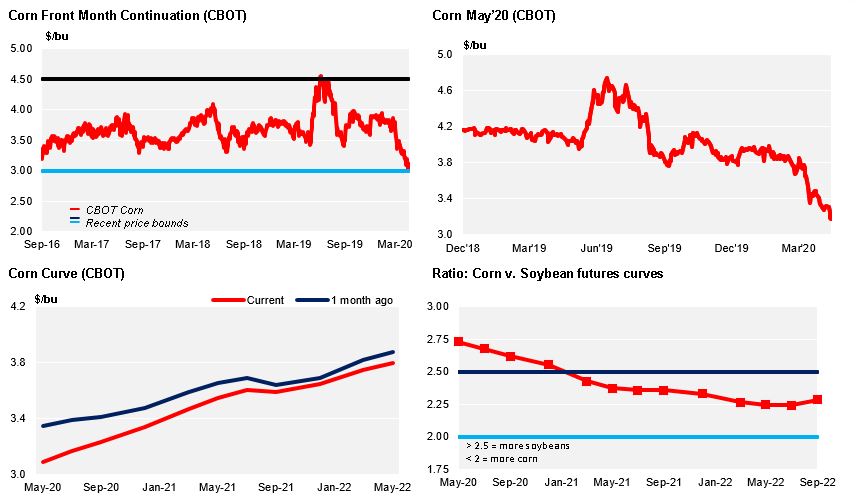

Despite and end of the week rally in Chicago Corn, the losses from last Monday dragged by Crude Oil left weekly losses for Corn both in Chicago and Europe, while Brazil made gains. Wheat fell in the US and Europe.

The week was volatile with a low of 3,002 USD/bu and a high of 3,156 for Corn in Chicago.

The start of the week was negative due to Crude plummeting and a huge advance in US Corn planting. But the rest of the week was positive also helped by a rally in Crude, a positive export sales report on Thursday and rumors of Chinese buying interest. The latter despite Trump threatening China with new tariffs due to Covid. The combination of all ended in weekly losses for Corn in Chicago and in Europe.

US Corn planting made huge progress last week reaching 27% vs. 7% the previous week vs. 12% last year and vs. 20% of the five year avg.

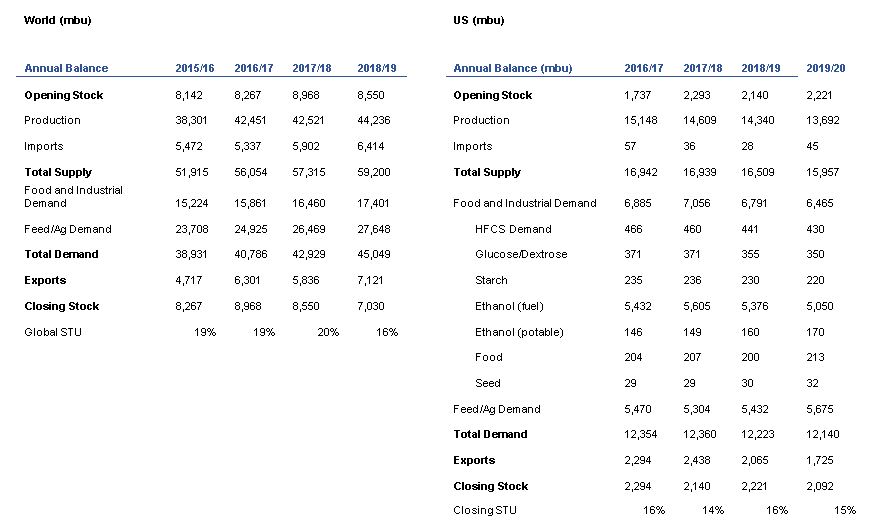

The IGC lowered global Corn production by 1 mill ton to 1157 mill ton in the new 20/21 crop but still well above the 1119 mill to of the last crop. Despite this production growth they are forecasting lower ending stocks.

The UE confirmed the implementation of the import levy of 5,27 Eur/ton for Corn, Sorghum and Rye.

French Corn planting is running at a good pace with 70% completed.

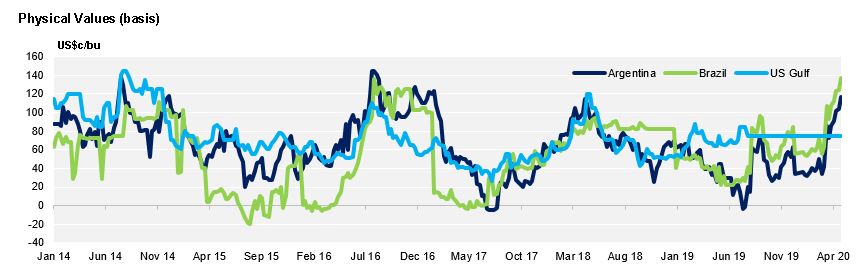

The dry April in South America has left the Parana River with low water and barges are not moving something that has pushed Argentinian premiums up influencing prices in Brazil as well.

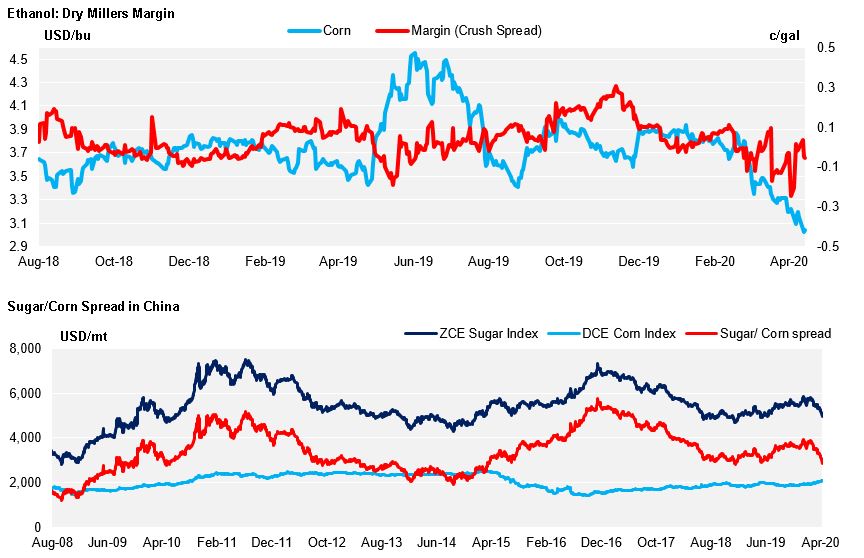

Harvest in Brazil is already 81% completed but that same dry weather should have a negative impact to the rest of the Safrinha (second Corn crop) and yields are expected to fall with an impact of some 2 mil ton. The cut should not be a problem as demand has also fallen, especially for Ethanol use.

Wheat had also a negative week both in the US and Europe. The fall was more pronounced in Europe as rains have returned after a very dry month of April with almost no rain since mid-March.

French Wheat continues to show poor condition falling again to 57% good to excellent vs. 79% las year. Although Germany does not track crop conditions, the farmers associations are showing great concern about the lack of rain and its impact in yields. Despite rains having returned last week is does not seem to be enough to offset the very dry April northern Europe has suffered.

But despite the dry Weather and the poor Wheat condition in France, the MARS bulleting left Wheat yield projection basically unchanged from last month’s report at 5,65 ton/ha (-0,2%).

Russia allocated all its 7 mill ton Wheat export quota last week.

The IGC did lower their global Wheat production forecast in 20/21 by 4 mill ton to 764 mill ton still well above last years’ 762 mill ton. The revision was due to lower production in the areas hit by a mild winter and a dry April: EU and Black Sea area.

We have a negative view on Crude Oil for the next couple of months and demand for Ethanol will continue to suffer thus expect Corn in Chicago to remain rangebound with no reason for the market to trade higher.

Supply

WASDE Projections

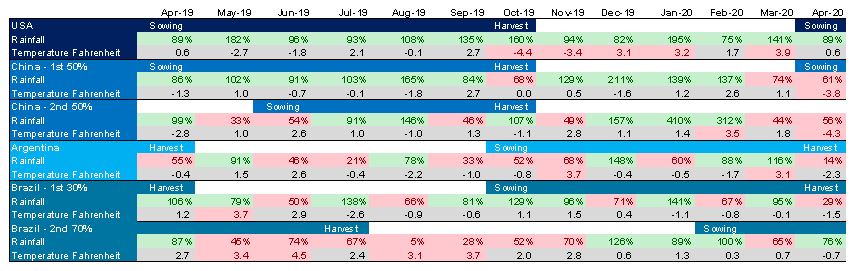

Weather in Main Corn Growing Regions

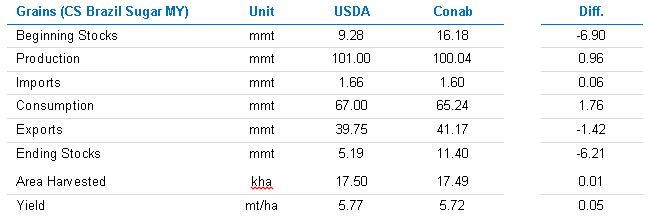

Brazil Balance

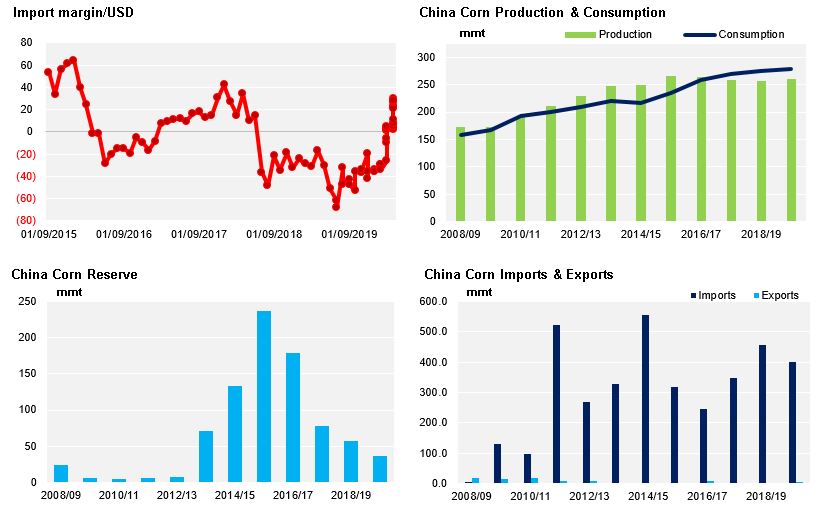

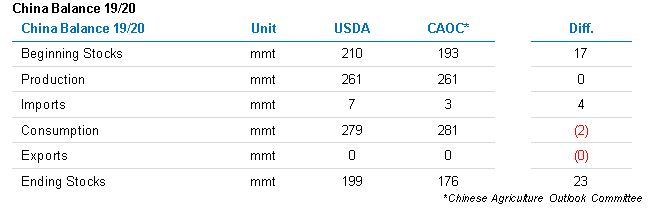

China

Demand

EU