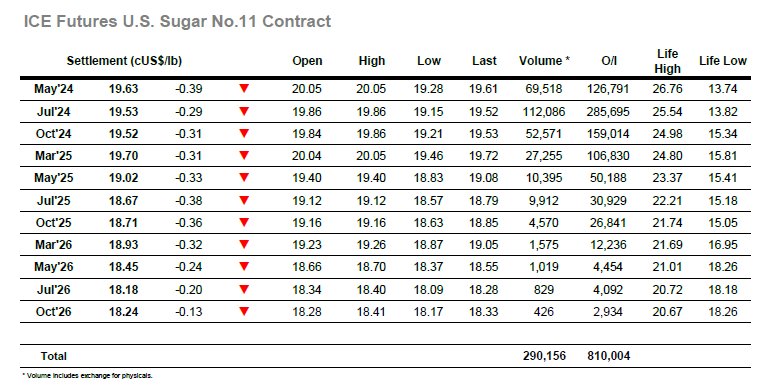

The market immediately moved lower to test and break the 19.68 support level, and while there was a token effort to pull back above it was a brief respite until the selling kicked back in to continue the lower path. It was one way traffic throughout the rest of the morning as Jul’24 descended to 19.23 against selling from all sectors, and while the market showed some attempt at holding as short covering appeared ahead of the US morning it was soon trading lower still. Jul’24 reached 19.15 and May’24 was at 19.28 before a more sizable bounce emerged, representing the lowest levels seen at the top of the board since January 2023. It was not just the flat price coming under pressure with the front month spreads again taking a hit, May/Jul’24 dropping to a low at 0.09 points while Jul/Oct’24 moved to a discount at -0.07 points. These spread losses were not erased significantly despite Jul’24 moving back up to the 19.50s later in the afternoon, a concerning sign for those looking for a bounce though another day of strong selling / liquidation suggests that there are few remaining in the spec sector. There was an effort to push the price back over 19.68 as we neared the close, however it was unsuccessful as a plethora of new selling arrived ahead of the call. This left Jul’24 closing at 19.53 to maintain the technical weakness, and while the picture is undeniably oversold it is hard to see where the trigger for any significant recovery lies at the present time.

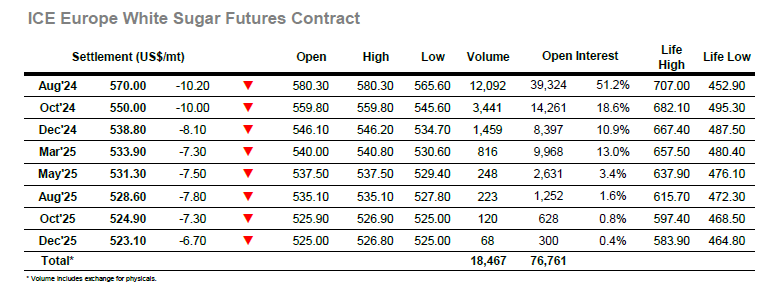

Technical weakness was driving the picture for sugar this morning and prices plunged from the start to quickly trade beneath $573.70 support and register the lowest prices seen for the Aug’24 contract this year. Good volumes were changing hands as an assortment of consumer buying was filled in, but though this prevented further losses for a period it proved to be a mere stop gap in the decline. By late morning, the weight of selling had a significant impact with another shove lower, this time sending Aug’24 to $565.60, $0.10c below the Dec’23 low and creating a double bottom for the chart. Such a mark generated some short covering from day traders though the market didn’t rally by very far and prices continued to hover at the bottom of the range into the afternoon. Eventually some more meaningful covering appeared and with it some consumer buying followed higher and took prices back up through $570.00. We remained away from the lows for the duration, though the action of both spreads and arbs suggested that the market was still vulnerable as Aug/Oct’24 traded in the $19.00 area while Aug/Jul’24 dropped back to $139.00. The struggle for the premium particularly suggested that the delivery was not viewed constructively and will be keenly viewed in the coming days. Selling returned during the final 15 minutes to stem the recovery and lead Jul’24 to a close at $570.00, another poor showing which leaves hopes of recovery resting on the double bottom holding firm.

• The May’24 expiry produced a tender of 6,279 lots (313,950mt) with full details show below.