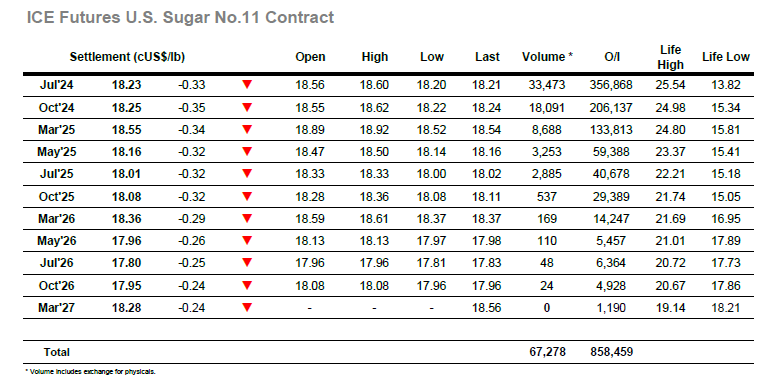

There was no fresh news to get interested about this morning, and with most traders continuing to stand back the volume throughout the morning was paltry. Prices had continued to drift within the same tight band and having picked away from an 18.42 low Jul’24 reached noon at 18.55, precisely the same level as 24 hours previously. The pattern maintained through into early afternoon, though having drifted back to the morning lows the market did encounter some day trader selling which set the price down towards 18.30. There was no significant spread interest either as Jul/Oct’24 maintained at a small discount, and so on still low activity the market levelled out again, only now in the 18.30’s. This maintained until the final hour when there was another small drop down to the 18.20’s, by no means critical movement but edging ever closer back towards the support just below 18c. The day ended only just ahead of the lows with Jul’24 valued at 18.23, maintaining the rangebound pattern for another day.

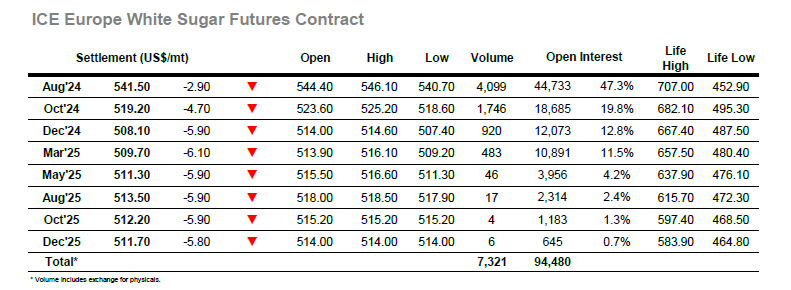

Resuming at unchanged, Aug’24 quickly slipped back to the lower $540’s and remained weaker through the next hour as buyers proved tricky to locate. Moving on there was a modicum of pricing interest appearing and this sent outright values back to a small credit before noon, though the quantities changing hands were such that no real momentum was generated. Prices continued to meander along sideways for a period during which time No.11 stared to slip, and because the flat price showed little inclination to follow suit this led the Aug/Jul’24 arbitrage to widen back to $139.00. Gradually the market did slip back down through the range, although the impact remained mild in comparison to No.11 and the price remained above the morning low until the final stages. The call played out near to the lows with Aug’24 settling at $541.50, while there remained an air of stability for Aug/Oct’24 at $22.30 and Aug/Jul’24 at $139.50. Overall today’s performance changes little and leaves the market squarely to the centre of the recent $527.70 / $555.00 band with continuing “sideways” trading likely.