Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

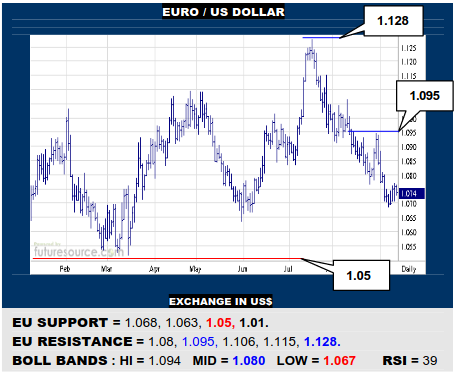

EURO / US DOLLAR

Some respite for the EU early in Sep but only minor progress that has yet to trouble the mid band (1.08) and is thus giving off a distinctly bear flag vibe currently. Duly eying 1.068 as the trigger down from this flag to test the next main rung at 1.05. Only hurdling the mid band into the 1.08’s would infer further relief to take a swipe at 1.095.

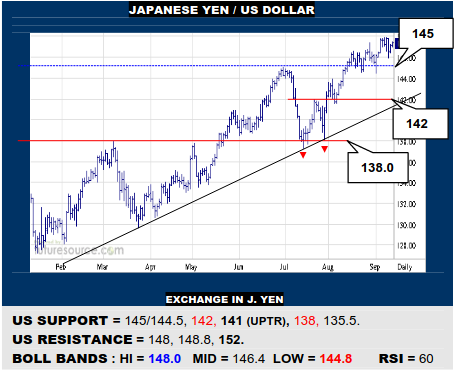

JAPANESE YEN / US DOLLAR

The upper Bollinger band (148) has been restraining the US climb but it has stayed out beyond the prior 145 escape hatch so the path on to the ’22 high at 152 could yet be pried open again. Only reeling back through the 145/144.5 support would be seriously disruptive and thus a warning of testing the 142/141 base and uptrend bracing.

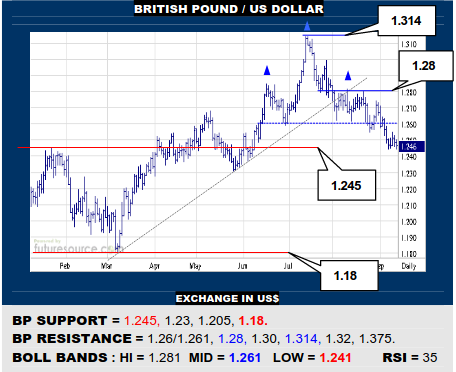

BRITISH POUND / US DOLLAR

The BP has provisionally curbed the drop away from a mid-year H&S at the 1.245 shelf but nearby congestion aboard there echoes of a bear flag threat so be ready for the immediate prop to crack and release ongoing losses towards 1.20. Must otherwise react back over the 1.26 top border at the very least to shake off this malaise.

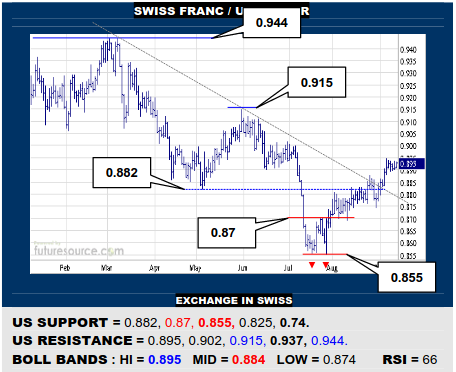

SWISS FRANC / US DOLLAR

Not the most energetic Q3 recovery but the US lately overhauled the downtrend hailing from the 1’s and current congestion has the gist of a brewing bull flag. Hence still mulling a path to the 0.91’s and piercing 0.915 would even put the 0.937 weekly double top in view. Only veering back under 0.882 would threaten a delve to 0.87 instead.

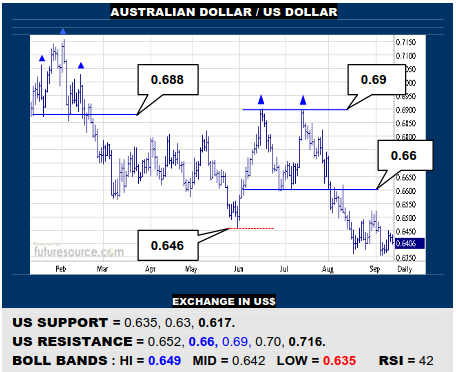

AUSTRALIAN DOLLAR / US DOLLAR

The AD has dug in its heels at 0.635 again lately and frayed the mid band but will ultimately need to pop 0.652 to really show clearer signs of stabilizing via a small new dual bottom that could then challenge the 0.66 double top rim. Not enough rebellion to yet convince of diverting from the path that otherwise still seems gradually headed for 0.617.

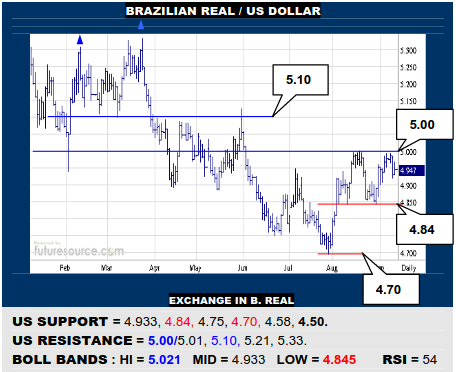

BRAZILIAN REAL / US DOLLAR

So far, a second refusal for the US at the 5.00 frontier, which remains a pivotal divide to round out the Q3 recovery into a more reliable base that could raise sights towards the 5.30’s. Meantime barely balancing on the mid band (4.933) and a cleaner break of that would tip back towards 4.84, where a small dual top could resume the fall to 4.50.

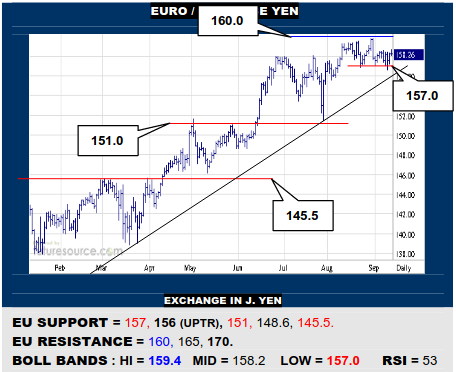

EURO / JAPANESE YEN

The EU has lost the scent a little at 160 but so far is still finding a solid prop at 157. This and the uptrend now pulling in ever closer (156) will be key to maintaining the offensive if a breakthrough towards 170 is to be achieved. Alternatively, loss of the trend would build a new Q3 top and warn of probably retracing to test the 151 area once more.

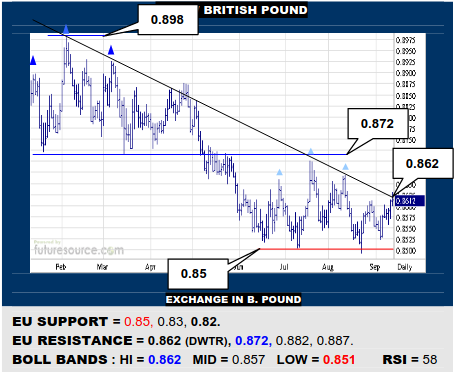

EURO / BRITISH POUND

The EU has grappled away from recent 0.85 defenses to engage the ’23 downtrend (0.862). If able to bust free, look for a further foray to try to cross the pivotal 0.872 divide and dilute the prior H&S while simultaneously installing a new mid-year base. Alas, if curbed by the trend, so a third strike at 0.85 could open passage on down to 0.82.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.