Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

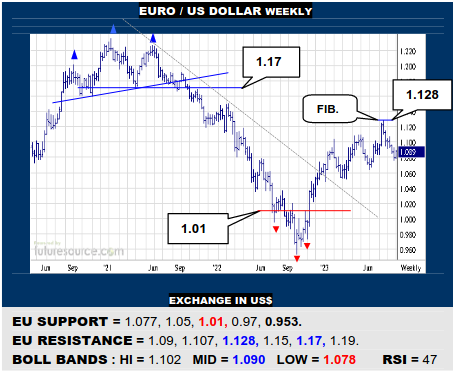

EURO / US DOLLAR WEEKLY

Broadly disconcerting in how the EU failed precisely at the 1.128 Fib retracement of the ‘21/’22 decline but it is trying to muster a nearby revival if it could pop the mid band (1.09), an inside week also a viable prospect. Making room to the low 1.10’s short term then but ultimately still leery of the bigger underlying space from 1.077 down to 1.01.

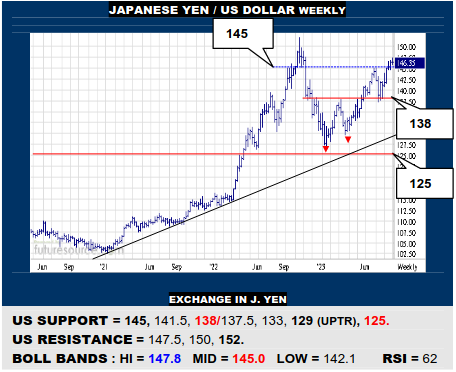

JAPANESE YEN / US DOLLAR WEEKLY

With aid from the arriving mid band, the US has sustained its break over 145 so the door remains ajar on up towards 152 still, even if the indicators aren’t exactly chewing at the bit. Only a decisive twist back under 145 would snap the mid band and undercut the footing to threaten another retreat to test the key base shelf at 138 again.

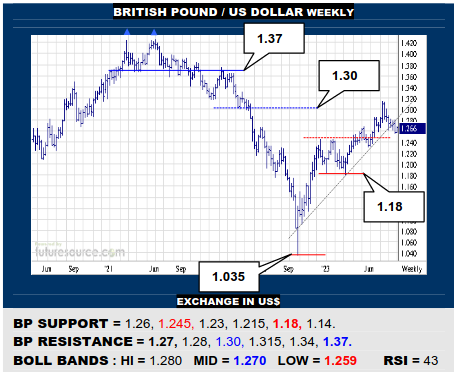

BRITISH POUND / US DOLLAR WEEKLY

The BP has snatched back a brief glimpse over the edge of a summer H&S but must vault the mid band (1.27) to secure it and so present a new shot into the 1.30’s. If denied by the mid band, beware any next gouge under 1.26 resolving the H&S to hammer on below 1.245 and emphasize an uptrend derailment that could then lead down to 1.18.

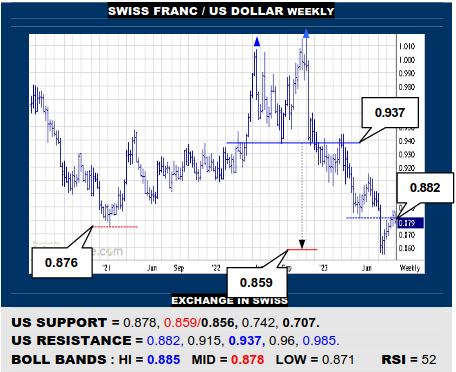

SWISS FRANC / US DOLLAR WEEKLY

A fleeting stab over 0.882 resistance must be secured by the arriving 0.878 mid band to score a more persuasive turn higher for the US after meeting a 0.859 double top projection in Jly to then aim for the 0.91’s. If instead the mid band succumbed, a Q3 correction would appear to crest and 0.856 would mark a door way on down to 0.75.

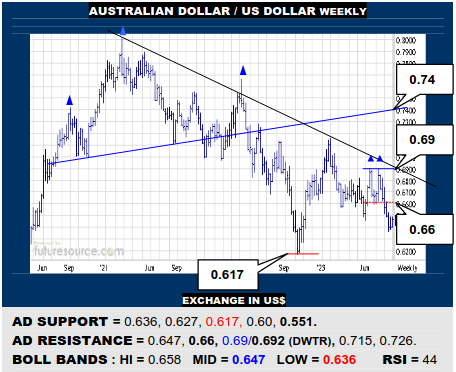

AUSTRALIAN DOLLAR / US DOLLAR WEEKLY

Clearing the mid band (0.647) could spark a correction for the AD but it would have to then defeat the 0.66 rim of the mid-year dual top to have more impact where the main downtrend peaks at 0.69 might be feasible. While denied by 0.66, be ready for a new lash lower to attack 0.617 and potentially trigger another stretch down to the 0.55’s.

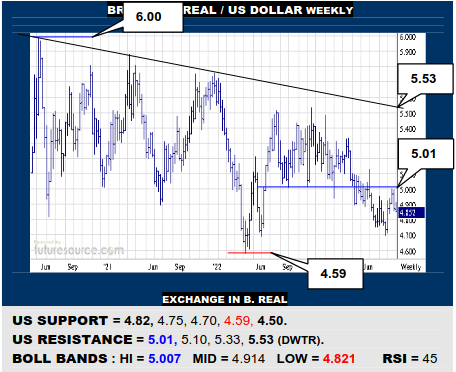

BRAZILIAN REAL / US DOLLAR WEEKLY

Heavier clutter from pre-Q2 above 5.01 thwarted the Aug rebound and it is assuming a toppier shape where breaking 4.82 would warn of a further leg down towards the 4.50’s to meet the decade long uptrend (4.50). The US must grip above 4.82 to rekindle its recovery bid and dispatch 5.01 to make a more enduring impact towards the 5.30’s.

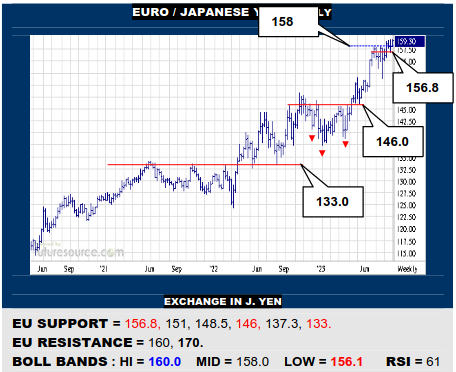

EURO / JAPANESE YEN WEEKLY

The EU has popped prior 158 resistance and, barring a brief mid band fraying, has sustained the getaway so, aside from a psychological 160 hurdle, there is a path showing up to 170. Awkward wrangly action does still insist on minding the nearby 156.8 trough closely however, any slip below capable of quickly tipping the balance back to 151.

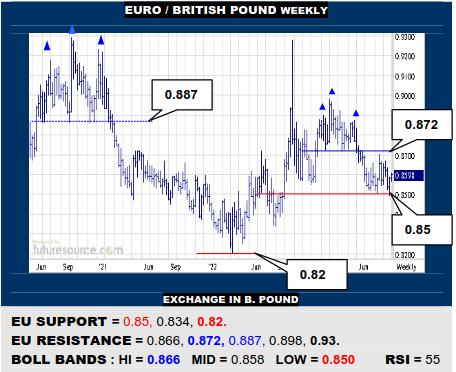

EURO / BRITISH POUND WEEKLY

Support has evolved through summer at 0.85 but the EU will still have to bust clear of the previous H&S border at 0.872 to score a lasting turn north that might then have reach to the 0.90’s. Meantime still having to mind 0.85 as its ultimate demise could bring 0.82 back into play, marking a tripwire to complete a massive 7-year top.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.