Insight Focus

- European PET spot prices continued to tumble, as further price reductions expected.

- PET resin producers face losses, squeezed by high costs and cheap imports.

- Producers lower rates and shut lines until the end of the year to stop losses.

European PET Spot Prices Continue to Tumble

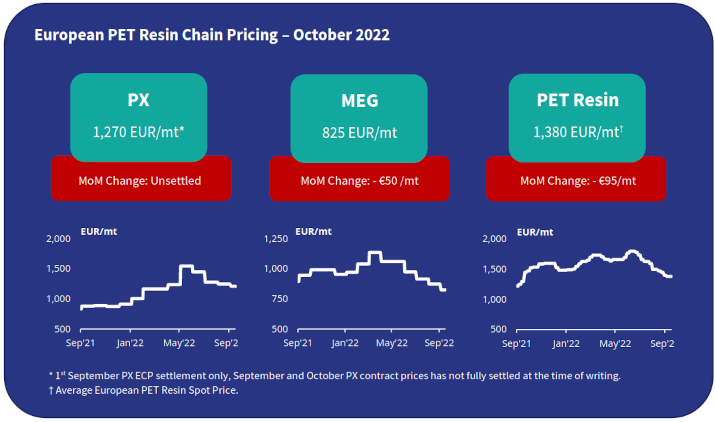

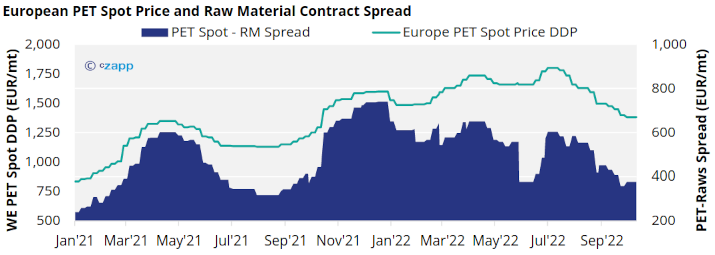

European spot prices for virgin resin have continued to fall, and typically ranged between EUR 1360 to EUR 1400/tonne, averaging EUR 1380/tonne mid-October. This represents an average EUR 95/tonne decrease from September, and a tumultuous decline of around EUR 450/tonne in just three-months.

Of course, prices were also heard either side of this range, depending on location and individual producer.

Higher offers in the low 1400s, were presented depending on destination. However, few buyers seem willing to accept prices above EUR 1400/tonne at the present time.

On the lower end, some spot deals were concluded at EUR 1350-1360/tonne, with talked levels from some producers as low as EUR 1320/tonne. Although this price level is likely for local delivery than a broader market indication at the present time.

Unsettled Raw Material Settlements Causing Havoc for PET

As European producers’ lower prices to generate sales and fend off imports, many are also doing so unaware of their true production costs on spot sales.

The European PET market continues to be plagued with delayed raw material contract settlements and pricing volatility, creating uncertainty, and damaging demand for domestic resin.

Whilst both the September and October’s monoethylene glycol (MEG) ECPs are now fully settled, producers have only seen an initial September paraxylene (PX) ECP agreement understood to be at EUR 1270/tonne.

Now mid-way through October, European PET producers lack full PX ECP settlements for September and October.

Expectations are for September to be fully settled lower, however, predicted levels seem unlikely to change current market dynamics or add any competitiveness to domestic material.

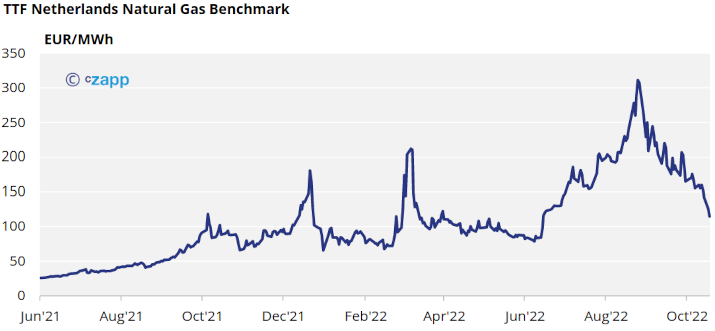

Lower Gas Prices Could Bring Reprieve

European gas prices have now fallen to their lowest level since June, now at a comparative level to last December’s peak but below that seen in March following the Russian invasion of Ukraine.

A combination of factors has helped lower prices, including EU price cap talks, milder weather, and a large increase in LNG imports boosting storage levels to around 92% capacity.

Lower gas prices, as well as a lower forward curve, will come as a relief to European producers who has been squeezed by rising costs.

That said, there remains a large disconnect between Asian and European energy costs, with cheap Russian gas fuelling the aggressive import competition the European industry is facing.

Although gas prices have fallen, average cash cost of production is now estimated to be on par with current spot prices, meaning some European producers will already be in a loss-making position.

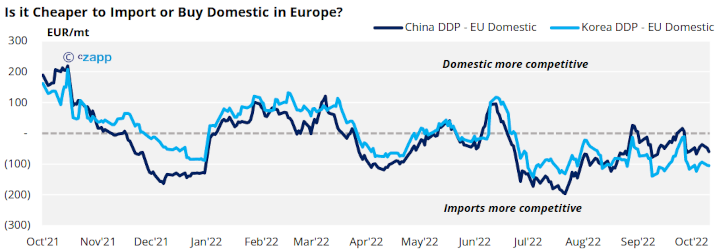

Is it cheaper to import?

At the time of writing, China PET resin export price averaged around USD 970/tonne, down around USD 90/tonne over the past month.

Whilst European spot prices have fallen, there remains a considerable delta between containerised Asian imports and domestic European PET resin on a delivered basis, averaging around EUR 98/tonne.

Prices below USD 1100/tonne CIF are now being heard on the market, because of lower ocean freight and steady decline in Asian export prices.

Market Outlook & Concluding Thoughts

- With European PET margins squeezed by high costs and aggressively priced imports, many producers are contemplating shutdowns and extended maintenance periods.

- At least two producers, JBF and Neo Group, have already announced shutdowns on lines extended until the end of 2023 or beyond, others have lowered operating rates to around 70%.

- Indorama Ventures has also declared force majeure on PET out of its Rotterdam plant. Both production lines at the site are shut down due to an “unplanned production disruptions”.

- Whilst production cuts may help to reduce spot resin availability in the short-term, buyers seeking supply security in Q1’23 may move to imports, worsening near-term prospects for European producers.

- Speaking to several producers, a potential EU investigation into anti-dumping on PET resin from certain Asian countries seems to be an ever-more-likely prospect.

Other Insights That May Be of Interest…

PET Resin Trade Flows: Brazil seeks to Export More PET to North America

Plastics and Sustainability Trends in August 2022

European PET Resin in Major Downward Correction

US PET resin Imports Hit New Highs as Volumes from Oman Leap

What Europe’s Deepening Energy Crisis Means for PET Resin