Insight Focus

- PET production and resin supply are disrupted by port congestion across Europe.

- Some buyers are seeking alternative sources as heavy snow hits key supply regions.

- PET resin spot prices have stabilised in February and should firm on supply constraints.

Logistical Delays Tighten Europe’s PET Supply

- The European PET market is heating up again.

- Resin producers are reporting a greater level of enquires at a time when logistical delays and disruptions are being felt across the region.

- Port congestion is high across Europe, from Liverpool to Genoa, and driver availability is low.

- Shipping operators are even diverting vessels to circumvent ports with the greatest delays.

- Port delays are not only disrupting imports, but increasingly the intra-European movement of raw materials.

- Some PET producers have attempted to move more via trucks but volumes, particularly for the raw material PTA, are simply too large to make any real impact.

- Ultimately, raw material deliveries aren’t reaching planned levels and so several producers have reported lower operating rates and have missed production days due to raw material constraints.

- Affected by both logistical delays and domestic production constraints, PET buyers are also coming back into the spot market seeking both resin and preforms for immediate use.

Buyers Face Low Stocks as Snow Hits

- At the end of January, heavy snow across large parts of Greece and Turkey disrupted air and road traffic in both countries.

- Combined with the ongoing European energy crisis, most PET resin producers in Turkey have significantly reduced operating rates in recent weeks.

- Buyers in Southeast Europe and the surrounding Mediterranean, which rely on large volumes of Turkish PET resin, are actively seeking alternative sources.

- Unfortunately, most are facing the reality that stocks are still relatively low, yet to recover fully from a difficult 2021.

- Many European PET producers are reportedly sold out until the end of April, amid a heavily contracted market.

Energy Costs Remain High as Additional Port Charges Add Pressure

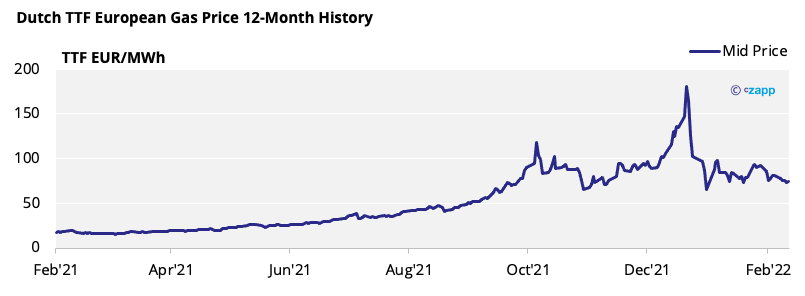

- European gas prices remain at high levels, up an eyewatering 323% year-on-year.

- Whilst energy costs should ease as Europe exits the colder months, the ongoing Russia-Ukraine situation will likely add a geopolitical risk premium to energy prices.

- As a result, energy costs for European PET producers should remain elevated year-on-year, at least in the near-term.

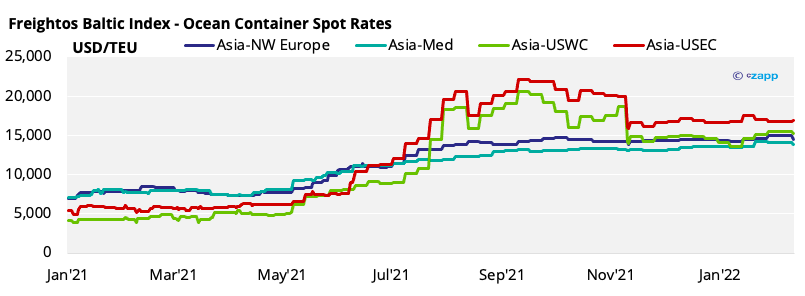

- Freight costs, on the other hand, show no signs of immediate easing.

- Any recovery in container shipping will take time, and even then, it’s not expected to go back to where it once was.

- In addition to high ocean rates, a spike in transhipment waiting times has led to an increase in port handling costs by 20-25% in Southern Europe.

- UK rates are around double what they were two years ago.

- Some ports are also restricting export quantities and introducing new terminal congestion surcharges, as was seen at Genoa, Italy last month.

- Unlike in Q4, when European PET producers introduced surcharges on existing contracts due to escalating energy costs, most have now factored additional variables into new 2022 contracts.

- As a result, most producer margins will see a certain degree of protection, with additional costs simply being passed onto the buyer, by increasing contract prices.

PET Resin Spot Prices Stabilise and Should Firm on Supply Constraints

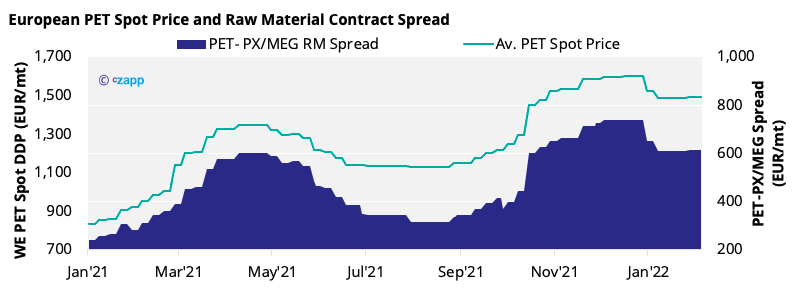

- In February, PET spot prices averaged around 1,490 EUR/mt mid-month, a modest increase of 5 EUR/mt from January levels.

- Spot prices were stable-to-firm in H1 February after being revised down in January, supported by finely balanced fundamentals.

- Spot prices as low as 1,450 EUR/mt were also heard earlier the month for local delivery in Northwest Europe.

- However, prices closer to 1,500 EUR/mt were assessed to be more representative of the current market, with upward pressure now taking hold.

- Prices in Southern and Southeast Europe held stable at around 1,500-1,520 EUR/mt, higher than some Northern European markets, amid a decrease in peripheral supply from Turkey and delayed imports.

- January’s PX European Contract Price (ECP) settled at 915 EUR/mt for the month, up 45 EUR/mt from December.

- MEG ECP settled for February at 970 EUR/mt, representing a 15 EUR/mt increase from January.

Market Outlook & Concluding Thoughts

- The European PET market should experience prolonged schedule disruptions.

- Certain locations could continue to run below full capacity due to feedstock constraints.

- Buyers awaiting PET resin imports may also face delays; large volumes of these imports were booked in Q4’21 for delivery in March onwards.

- A difficult European logistics environment will support resin prices as demand starts to pick up as we enter the spring buying season.

- Even with the arrival of new breakbulk vessels, domestic resin demand should remain at good levels, balanced against supply.

Other Insights That May Be of Interest…

China’s Record PET Orders Threatened by Logistical Chaos

Europe’s PET Supply Worries Ease as Omicron Hits Consumer Demand

European PET Prices Jump with Supply Shortages

Chinese PET Exports Rebound Following Logistical Mayhem

European PET Surcharges Shock Market Amid Record Price Hikes