Insight Focus

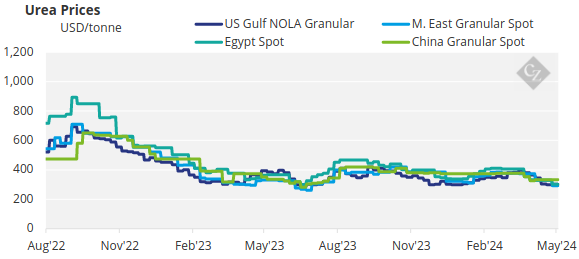

Urea prices still struggling to find a floor and the outlook is bearish. Processed phosphate prices are under enormous pressure on increased supplies from China.

High Domestic Urea Prices Hold Back Chinese Exports

The international urea market is still struggling to find a floor with few buyers around. Those looking are indicating progressively lower prices knowing there is sufficient volumes of urea available. Middle Eastern producers are unsuccessfully trying to maintain prices at around the USD 280-285/tonne FOB mark.

However, a June physical cargo of 40,000 tonnes from SIUCI in Oman was reported sold at USD 275/tonne FOB. Some remarked that with the Chinese urea supplies expected to come into the market in June, this could well be an excellent price.

However, at current, Chinese domestic values are higher than those of the international market price on an FOB equivalent consideration so it will be interesting to see what Chinese producers and traders will do. History has shown that Chinese sellers have been pragmatic so it could be expected that they will match international levels, putting even more pressure on international prices.

Brazilian demand has ebbed out and offers from sanctioned countries are at USD 290/tonne CFR without much interest. European demand is subdued mostly because of bad weather.

The only bright producer news over the past few days was the tender in Indonesia, which saw around 180,000 tonnes sold at USD 305.68/tonne FOB with a few of the cargoes destined for Australia. This is on the back of Malaysia having some production problems and with BFI of Brunei apparently sold out until the end of May.

The outlook for the international urea price remains bearish with no sign that India could come to the rescue with a tender due to its high domestic stocks.

Processed Phosphate Prices Weaken

Processed phosphate prices are following urea prices. DAP prices in India are coming down every day with lots of Chinese availability looking to find a home. Although Chinese producers tried in vain to maintain a floor price of USD 535/tonne FOB, current FOB levels are reflecting sub-USD 500/tonne with Indian offers surfacing at around the USD 515/tonne CFR mark.

It will be interesting to see how low the Chinese DAP price will go with USD 475/tonne FOB considered to be an average break-even price. However, some producers with their own phosphate rock supplies have break-even prices closer to USD 400/tonne.

This week, the US Department of Commerce raised the countervailing duty (CVD) on imports from Morocco while DAP/MAP prices elsewhere continued to decline steadily. The CVD levied against Moroccan producer OCP has been increased to 14.2% from 2.12% as part of a preliminary determination on April 29, reversing a prior cut from November 2023. The news nearly paralysed the US barge market, with participants hesitant to take a position due to uncertainty surrounding short-term pricing.

By May 2, DAP and MAP prices at New Orleans had rebounded somewhat despite thin liquidity. The key takeaway from this week’s CVD news is that supply from Morocco and Russia to the US is expected to remain absent for the foreseeable future. With US supply set to remain tight, the price premium over other markets is likely to reemerge, particularly as prices elsewhere fall on the back of greater export availability from China.

In other significant market news, Mosaic and Ma’aden this week announced a share purchase agreement whereby the former will sell its stake in the Ma’aden Wa’ad Al Shamal Phosphate Company joint venture to the latter in exchange for shares valued at roughly USD 1.5 billion. Mosaic said the transaction will provide it with a “transparent value” for its investment in Ma’aden.

The outlook for the processed phosphate market is bearish on the back of Chinese supplies entering all markets, including Brazil where aggressive MAP 11-52 CFR pricing has spread rapidly.

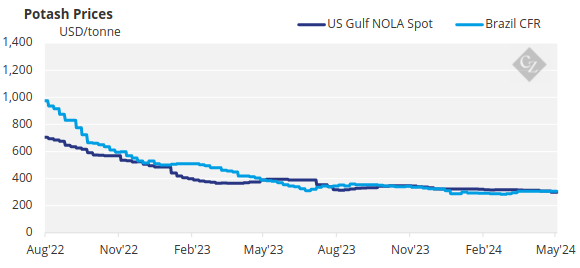

BHP-Anglo American Deal Dominates Potash

The international potash market remains unchanged from last week. Brazilian potash prices are holding whilst in the rest of the world, price pressure remains. BHP’s attempt to acquire Anglo American has met with resistance and it will be interesting to see if BHP will raise the stakes to tempt Anglo American shareholders to agree to a transaction.

Ammonia Market Split East to West

The ammonia market is split in pricing between East and West of Suez with the latter fearing a supply squeeze with the maintenance of the Ma’aden plant in Saudi Arabia. This has resulted in higher prices, although transactions have been for smaller cargoes.

The Mosaic and Yara May settlement price saw USD 25/tonne shaved off the previous price and the new price is set at USD 450/tonne CFR. This development is said to be inspired by downward pressure on ammonia prices West of Suez, where ample supplies have been available.

The outlook is that prices in the West are unlikely to garner much support moving into the latter stages of Q2, and while prices in the Far East appear to have registered some support in recent weeks, the prospect of this tailwind lasting beyond June appears unlikely.