Insight Focus

- The urea market is slowly coming alive despite a disappointing India tender.

- Increased Indian subsidies could allow for DAP imports at international prices.

- Both the potash and ammonia markets are sluggish.

India Urea Prices Too Low for Middle East Producers

The long-anticipated India urea tender resulted in a disappointing 647,000 tonnes purchased compared with the rumoured 1-million-tonne target, which could mean that India may return with another tender sometime in the first quarter.

Prices of USD 329.40/tonne CFR East Coast India and USD 316.80/tonne CFR West Coast India were deemed too low by Middle Eastern producers so a major chunk — around 400,000 tonnes — originated from Russian prilled urea producers. These producers were able to achieve a netback of around USD 250/tonne FOB.

Netbacks for Middle Eastern producers were in the range of USD 295/tonne FOB and USD 310/tonne FOB, so they have looked elsewhere for higher returns, with the US market providing better results.

This week we also saw Egyptian urea prices increase USD 39/tonne on the back of 120,000 tonnes of short covering for Turkey as well as smaller volumes to Europe.

Although Brazil is coming to a seasonal end of its buying, it is expected that both Australia and Thailand will emerge to fulfil inventories for the start of their main season in April onwards. The outlook for urea prices is therefore positive for the coming few months with the US market rumoured to require imports of around 1 million tonnes for its spring application.

With China expected to be out of the market until March, this will add further support to increased prices. In Malaysia, the 561,000 tonne per year Gurun plant will go down for maintenance on February 1 for around 45-60 days.

Pupuk Indonesia held tenders this week and granular urea was sold in the low USD 320s/tonne FOB and prilled urea at USD 324/tonne FOB. BFI of Brunei also held a tender closing on January 11 for 30,000 tonnes with January shipment but so far no results have been forthcoming.

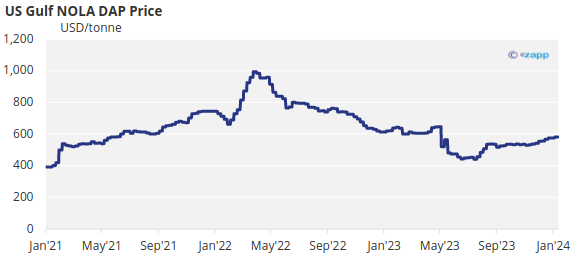

China Absence Supports Processed Phosphate

Participants in the processed phosphate market are all looking towards the Indian government to increase the nutrient-based subsidy for DAP in order to allow for imports at international prices.

The current benchmark price for Indian DAP is USD 595/tonne CFR, which gives importers a loss of around USD 100/tonne at current subsidy rates. Tight availability is persisting in the market with China not offering any product due to export restrictions imposed by the government.

The outlook for processed phosphate prices will therefore be higher in the short term but will most likely drop once Chinese products become available in March or April once the domestic season is over.

Demand for MAP in Brazil has been sluggish due to worsening affordability resulting from low soybean prices. It is being reported that inland MAP prices are equivalent to around USD 500-510/tonne CFR, although the current benchmark price is USD 560-565/tonne CFR.

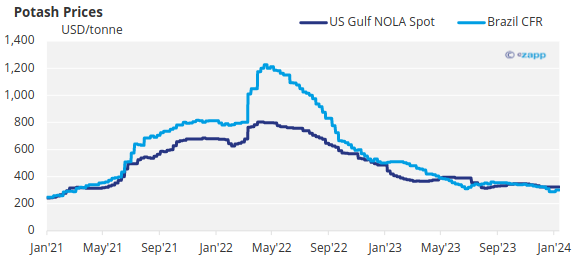

Potash Supply Chases Demand

The international potash market is subdued with average prices in Brazil dropping another USD 8/tonne this week with CFR prices reported at between USD 305-310/tonne CFR. Prices in the US Midwest and NOLA also came under pressure.

Prices in Southeast Asia were holding this week despite a resurgence of crude palm oil (CPO) prices. Chinese contract negotiations for 2024 appear to be far off with the Chinese showing little — if any –interest to engage.

The outlook for potash prices is negative with too much potash chasing little demand.

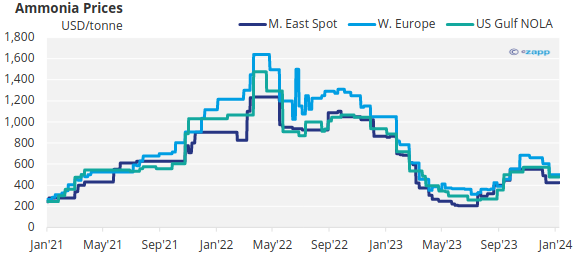

Indonesian Ammonia Deal Pushes Market Down

Ammonia prices took a beating this week with Indonesian ammonia sold to China at USD 370/tonne CFR, which is reported to be close to USD 100/tonne FOB less than a deal done last week. As a result of this, India is now looking to secure ammonia at USD 350/tonne CFR — something Middle Eastern producers are reluctant to agree to at this stage.

That being said, they may have to reconsider looking at price developments elsewhere. The reason for the price pressure is a combination of too much supply chasing few buyers with the latter holding out for even more price reductions.