Insight Focus

- The latest WASDE report projected all-time high US production, weighing on prices.

- Meanwhile, the wheat market has weakened both in Europe and the US.

- Adverse weather could support prices in the future.

US corn production is now at an all-time high, putting pressure on prices.https://downloads.usda.library.cornell.edu/usda-esmis/files/xg94hp534/vd66xk611/4m90gh16q/grst0124.pdf The situation was exacerbated by the January WASDE report, which projected greater production and higher ending stocks. We should expect the market to adapt to all the fundamental data published last week, and with confirmation of ample supply, the risk should be to the downside.

However, for now, we are increasing our Chicago corn forecast for the 2023/24 September/August crop to a range of USD 4.15 to USD 4.4/bushel compared with a range of USD 3.9 to USD 4.15/bushel previously. The lower prices we were expecting during harvesting did not materialize thanks to farmers being able to hold on to stocks. The average price since September 1 is running at USD 4.73/bushel.

On the weather front, northern Europe has been receiving excessive rains since mid-December, which we think will have a negative impact on wheat production. This week, freezing temperatures are expected in northern Europe, resulting in frost. After excessive rain, this could potentially produce winterkill. Cold temperatures and snowfall are also expected in the US.

High Corn Stocks Pressure Prices

Since our last report on December 18, Chicago corn has been trending lower and the March futures contract closed the gap on January 8 with the expiry of the December future at USD 4.56/bushel. This was somewhat expected given the bumper old crop in the US. Friday’s closing was USD 4.47 USD/bushel, pressed lower after the publication of the January WASDE report.

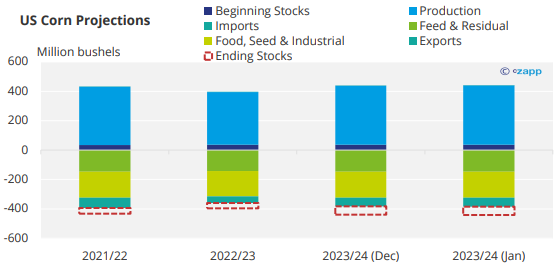

The January WASDE report surprised the market with higher corn carry of 31 million bushels. But interestingly, while 2021/22 ending stocks were left unchanged, acreage was reduced. There was also lower feed and residual demand.

Similarly, in the 2022/23 figures, there was a small reduction in acreage – and therefore in production — compensated by lower demand, which left ending stocks unchanged.

For the 2023/24 period, modifications resulted in 31 million more bushels of ending stocks. Harvested acres were reduced by the anticipated amount of 0.6 million acres but this was more than compensated by higher yields. These were increased to 177.3 bushels per acre, an increase of 2.4 bushels per acre, taking production 108 million bushel higher to 15.34 billion bushels — an all-time record.

Demand projections were increased by 75 million bushels due to higher feed and ethanol demand, resulting in the higher ending stocks of 2.16 billion bushels compared with 2.13 billion bushels previously.

Source: WASDE

All in all, the increase is minimal, with stock to use moving to 14.8% from 14.7%. However, because the revisions took the market by surprise, they resulted in a price fall of 4% after the WASDE report was published last Friday.

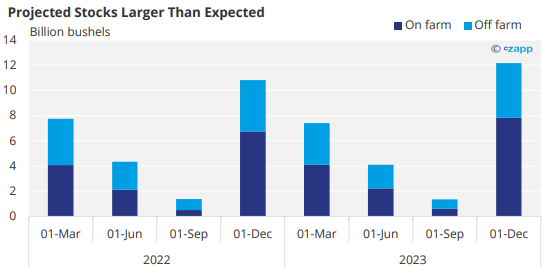

More pressure came from the quarterly stocks report with 12.2 billion bushels of stocks reported as of December 1, which marks an increase of 13% year on year. Of this amount, 7.8 billion bushels were on farm stocks – a 16% year over year increase. The market was expecting slightly smaller stocks of just 12 billion bushels.

Source: USDA

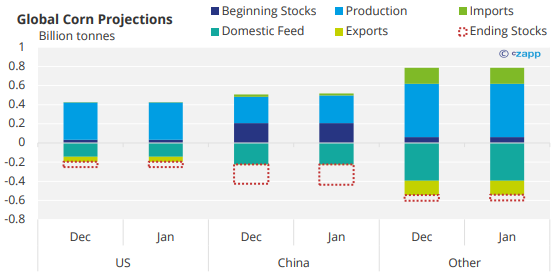

In the WASDE report, world corn stocks were revised upwards by 10 million tonnes to 325,2 million tonnes, most of which comes from higher Chinese production, which rose by 12 million tonnes to 288.8 million tonnes. Higher US production added 3 million tonnes.

Source: WASDE

Brazilian production was reduced by 2 million tonnes to 127 million tonnes, which is still much higher than Brazilian National Supply Company Conab’s projection of 117.6 million tonnes. Conab lowered its corn production forecast to 117.6 million tonnes from 118.5 million tonnes. This level is 131.9 million tonnes lower than last year’s production largely due to dryer than normal weather. The 10-million-tonne discrepancy between these projections should be more or less priced in by the market already.

Argentinian production was left unchanged at 55 million tonnes. This is lower than the Rosario Stock Exchange (BCR’s) forecast of 59 million tonnes. In Argentina, BCR increased its corn production forecast to 59 million tonnes, which is a record and significantly higher than the 36 million tonnes produced last year.

Argentinian corn is currently 84.6% planted, just ahead of last year’s 83%. The condition remains at 36% good or excellent. Meanwhile, Brazil’s summer corn crop is now 4.2% harvested compared with 1% for the same period last year. Safrinha planting is behind last year at 84.3% complete compared with 90.1%.

Brazil Soybean Production Rises

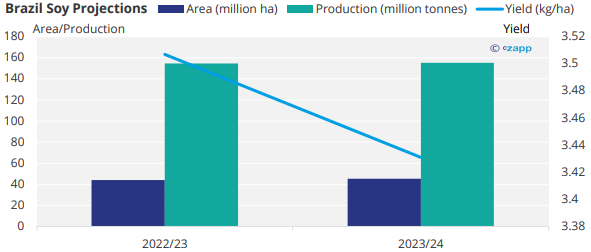

Brazil’s soybean production was in the crosshairs last week with reported 2022/23 production of 154.6 million tonnes — a huge year on year increase of 23%. The new 2023/24 harvest has now started and is now 0.6% complete. Conab lowered the production estimate to 155.3 million tonnes from 160.3 million tonnes.

Source: Conab

Argentina’s BCR also raised soybean production to 52 million tonnes thanks to more favourable weather.

European Weather Could Support Wheat

On the wheat front, the European market has fallen by 2.7% while the US market had a milder fall of just 1.7% since our previous report mid-December.

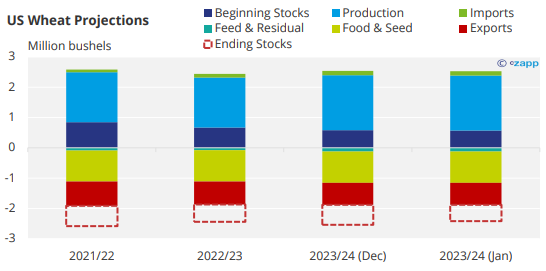

The January WASDE projections reduced US wheat ending stocks by 11 million bushels to 648 million bushels due to changes in feed and residual demand for the 2021/22 crop. Feed and residual demand was reduced by 24 million bushels for 2021/22 but increased by 12 million bushels in 2022/23, resulting in a lower carry in 2023/24.

There were no changes in production and consumption figures and wheat ending stocks are now 648 million bushels compared with last month’s projections of 659 million tonnes.

Source: WASDE

But price pressure came from quarterly stocks showing 1.41 billion bushels of wheat, an 8% year on year increase. Of these stocks, 395 million bushels were on farm stocks, a 9% year on year increase.

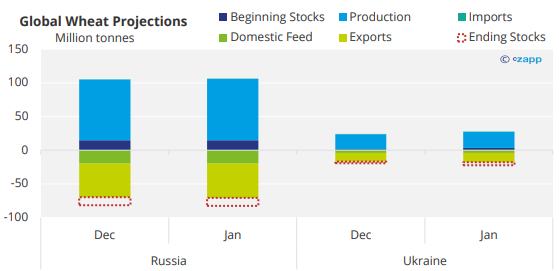

WASDE increased world ending stocks by 2 million tonnes to 260 million tonnes, which all came from increases in Russian and Ukrainian production. It is now expected Russia and Ukraine will each boost production by 1 million tonnes to 91 million tonnes and 23.4 million tonnes, respectively.

Source: WASDE

Further price pressure came from rumours that China cancelled several US wheat cargoes. Besides WASDE, the International Grains Council (IGC) hiked its global grains production forecast to 2.3 billion tonnes in 2023/24 – a total increase of 11 million tonnes. Corn was up by 7 million tonnes to 1.23 billion tonnes, while wheat production was up by 1 million tonnes to 788 million tonnes.

Despite high production creating a bear market, weather could create support for prices. European wheat is suffering from excess rains, especially in mid Europe. Key producer Germany has received excess rains, which should have a negative impact not only in quality but also in replanting needed. On top that, temperatures have fallen suddenly causing severe frost, which could result in winterkill. We suspect EU wheat production will be lower than what the market is expecting.

Brazil has been experiencing dryer than normal weather, which has already been reflected in the corn and soybean production downgrades made by Conab. But ample rains are forecasted this week, which will benefit soil moisture.