Insight Focus

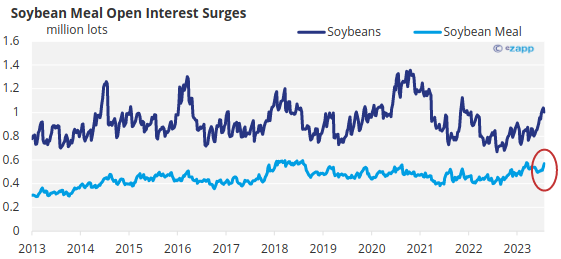

- The soybean meal futures market experienced a sharp rally and increase in open interest this Friday.

- This, alongside confidence from major oilseed processors, points to a bull market.

- Fundamentals are underpinned by the underestimated impacts of the Argentine elections.

All Signs Point to Bull Market

There was an expansion in open interest during Friday’s explosive rally in soybean meal and soybean meal calendar spreads.

This is normally considered a bullish sign by professionals as it indicates the buying was led by new longs who had to pay higher and higher prices to secure their long positions.

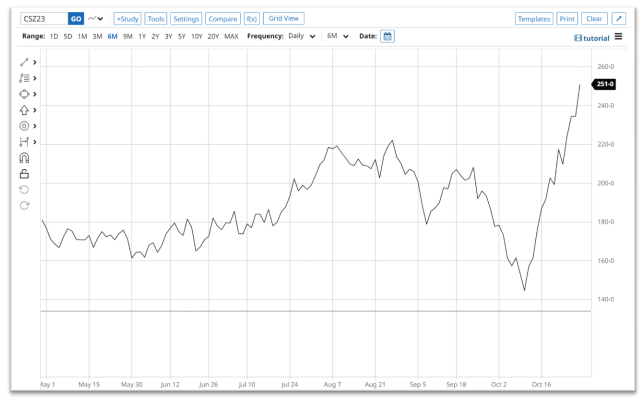

On Friday, the Chicago Mercantile Exchange’s (CME) December 2023 soybean meal contract traded at the highest level in the life of the contract, so the “new” longs now own some relatively high-priced meal.

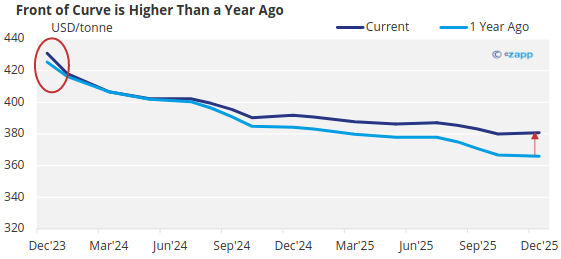

The current front part of the curve is now higher than a year ago and the inverse in the curve has strengthened.

This is also a bullish sign as the market inverts and spot prices move higher than deferred prices further down the curve.

An inverted futures curve in any commodity market sends the same message to buyers: buy it later. It means there is not enough available supply today, and a delayed purchase will likely yield a cheaper price.

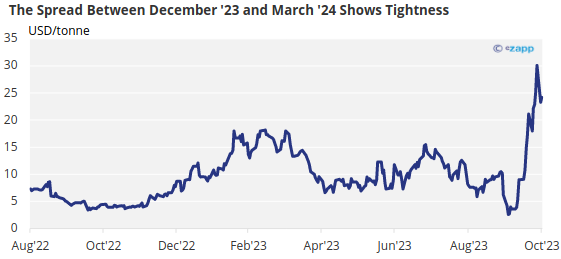

The below chart features the current December 2023 soybean meal futures contract versus the March 2024 contract. The spread tells the story of current US soybean meal supply availability: it’s tight.

Soybean Executives Predict Sustainable Margins

Nearby soybean crush margins are soaring due to pressure on the nearby soybean prices. The harvest is due and there is a long tail of the old Brazilian soybean crop still available for global customers and moving into traditional US export markets.

Let’s not forget about the full-scale panic occurring in the soybean meal markets, both domestically and globally. Just two weeks ago the National Oilseeds Processing Association (NOPA) reported a record crush rate for the month of September. This is fresh in everyone’s mind as it is the latest data point about US soy processing crush rates, released just two weeks ago.

This weekend I listened to the management teams of global oilseed processing behemoths Archer Daniels Midland and Bunge take question after question about soybean crush margins during the Q&A portions of their respective earnings calls. Most of the enquiries questioned whether the executives were concerned about recent weakness in soybean crush margins.

Both management teams sketched bullish pictures for margins. They discussed the structural changes to the supply and demand balances for soybean meal given global population growth and Argentine production headwinds. They also explained that the forecast is excellent for soybean oil margins due to high demand for renewable diesel but also due to expanding food demand.

Quite frankly, the management teams were not guardedly optimistic: they were downright bullish for US crush margins and were vindicated by the explosive rally in margins at the end of the week. The December 2023 CME’s soybean crush margin is shown below.

All Roads Lead to Argentina

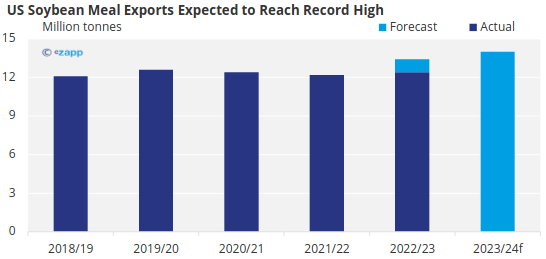

So, why are the analysts so concerned about the domestic US crush dynamics when the record NOPA soybean processing rates cannot build up enough supply to prevent a soybean meal supply panic. Bulls are clearly stampeding into the market.

One word sums it up: Argentina. They are overlooking the collapse of the historic leader for providing soybean meal to the world and the implications for US soybean meal demand to replace Argentine production. See the chart and notes below courtesy of the USDA’s Foreign Agricultural Service.

Source: USDA

With an Argentine runoff election looming over the global soybean meal markets for the next two weeks, the volatility in meal futures and physical prices and the subsequent impact to crush margins likely remains elevated.

The US farmer has completed the majority of this year’s soybean harvest. The US soybean processor has plenty of new crop soybeans to crush and now has even more economic incentive than ever for the fourth quarter to operate plants at the nameplate capacity or above.

Still, the soybean meal futures curve remains inverted, and the physical price is moving higher. Simultaneously, the futures market is moving higher and the CME’s delivery window is nearly empty.

ADM’s chief financial officer, Vikram Luthar, finished the earnings call with this summary about the future for crushing margins.

Renewable diesel is the future margin enhancer. In today’s market, it is all about the soybean meal (and Argentina). But the structure has changed and the US soybean processor is in a very favourable position.