- The sugar market is starting to feel slightly more positive again.

- The producer short position has dropped substantially, which indicates that someone is buying back.

- The longer-term bull view remains intact for later in 2022.

Watch the Producer Short

- Everyone always obsesses about what the speculators are doing: last week, we wrote about speculators fleeing the market.

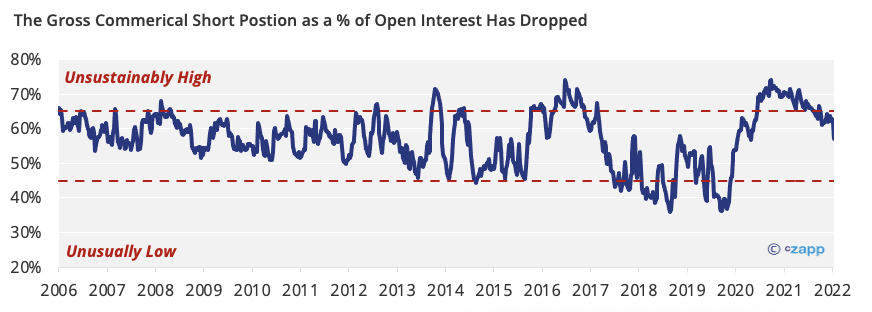

- But we think that the producer (commercial) short position is the one to watch in the coming weeks.

- The commercial short position is now at its lowest since 2019.

- It dropped dramatically in the first week of January, which may indicate that some producers have been buying back their hedges.

- In a rising market, if producers need to buy back, this is often a non-discretionary trade, such as responding to poor crop performance.

- In such an event, sugar prices could move quickly higher and trigger a further chain of buying.

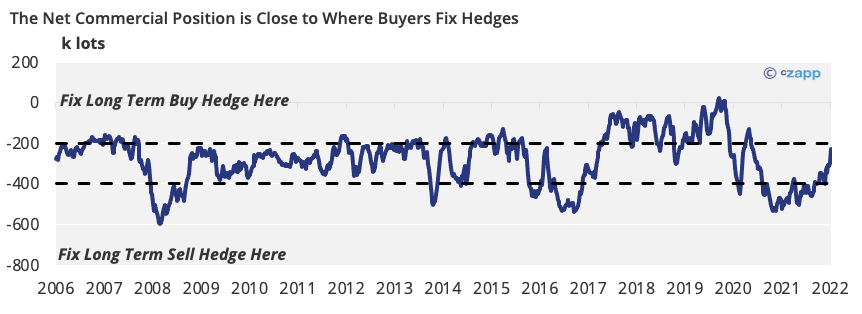

- The net commercial position would climb further – it’s already close to a level where, in the past, end-users have decided to fix as much as they can for the longer term.

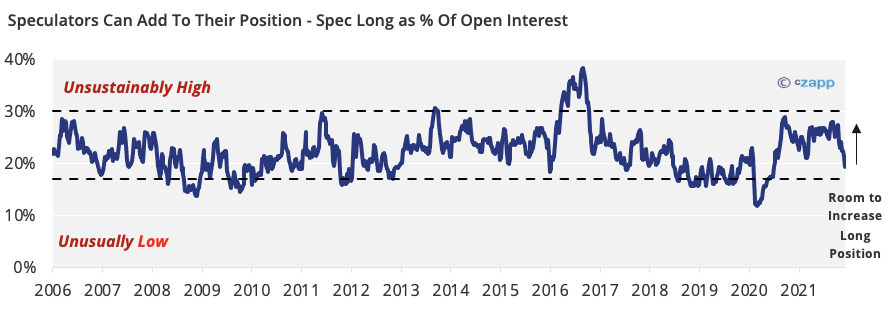

- We must also remember that speculators now hold a much smaller long position than they have over the last 12 months.

- This makes it much easier for them to aggressively buy the market should upwards momentum return.

- Conversely, it’s now become more difficult by historical standards for them to cut their long much further.

- They can increase their short position, but we think the positive longer-term fundamentals should prevent a significant speculator short position from building up.

- All of this means the market could easily regain and test the top of its 18.50-20c range, given the right trigger events.

- Until this, we think prices will remain subdued with a stronger Dollar, which, as we wrote last week, is generally negative for commodities.

- However, there may be signs that the USD has stopped strengthening, which we’ll also have to watch out for in the coming weeks.

Source: Refinitiv Eikon

Risks of Producer Buybacks?

- In the short term, we’re unlikely to see a large volume of producer buybacks.

- But it’s possible we see some short-term activity from mills in Australia and Central America.

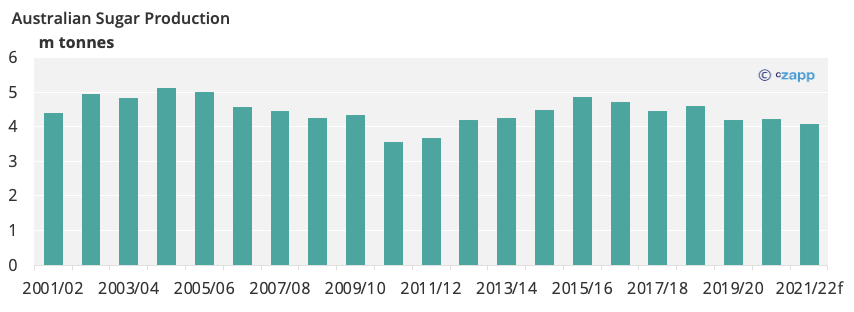

- Sugar production in Australia is just about finished.

- The impact of heavy rain on the cane crop has not been as bad as first thought, but sugar production should still hit a 10-year low.

- It’s possible some mills may need to buy back small volumes in the coming weeks.

- Some Central American mills may also need to buy back hedges if there’s any disruption to the end of their campaigns.

- We think they’re 95% priced, mainly against the K’22 contract, which leaves little room for anything to go wrong.

- We’ve heard that mills in Guatemala could struggle to harvest all their cane due to issues securing labour.

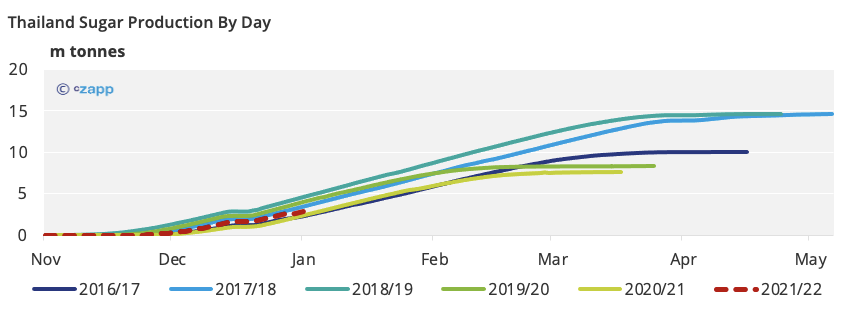

- Whereas we think that producers in Thailand won’t need to buy back.

- They have about a third of their pricing left (1.4m tonnes) and crushing is progressing as anticipated.

- Both cane and sugar yields are also performing well.

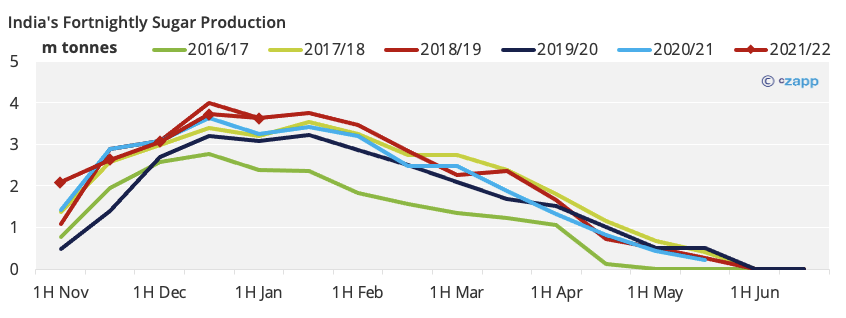

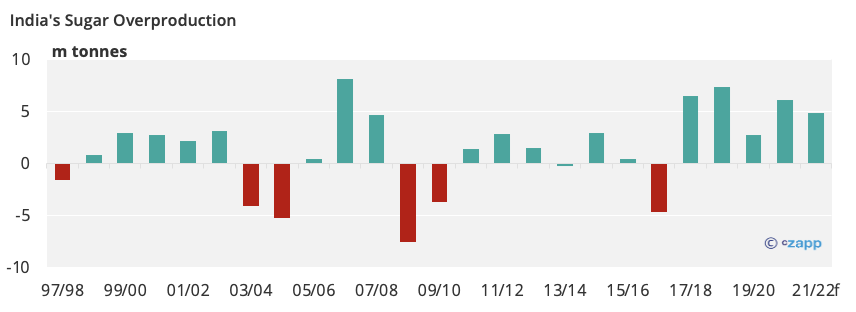

- The Indian crop continues to be the best on record, which again makes it unlikely that there’ll be any pressure on Indian sales.

- Indian mills have also only contracted about 3.5m tonnes of sugar exports for this season; we think they could export another 3.5m tonnes if world market prices trade back towards 20c.

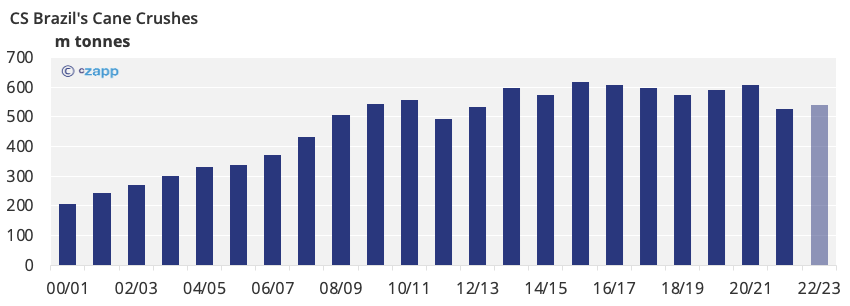

- Looking further ahead, it’s also possible that mills in CS Brazil may be forced to buy back if there’s not enough rainfall ahead of the season starting in April.

- In key sugarcane states, rainfall has been below average through January, but more rain is forecast in February.

- We think CS Brazil will crush 540m tonnes, but the cane is more sensitive to dry weather following over a year of dry conditions.

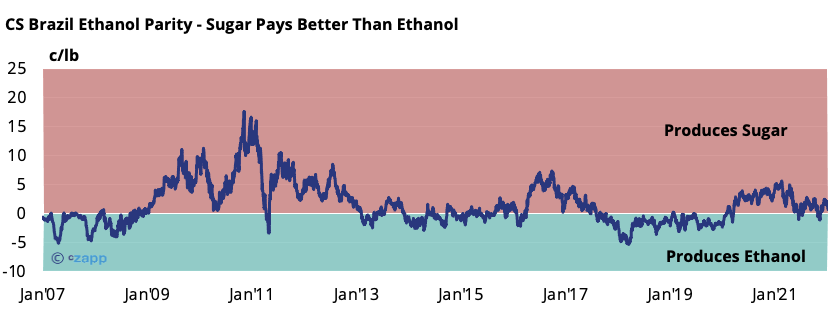

- There’s also the possibility that CS Brazilian mills choose to buy back sugar hedges to increase their ethanol production.

- We’re mindful of this but think sugar prices would have to fall significantly further and/or ethanol prices strengthen before it becomes a serious consideration.

- Elsewhere in the sugar market, the white premium is coming alive and has exceeded 100 USD/mt.

- This should be supportive of raw sugar demand as many of the world’s re-export refiners should be able to operate profitably.

Longer Term: The World Needs More Sugar

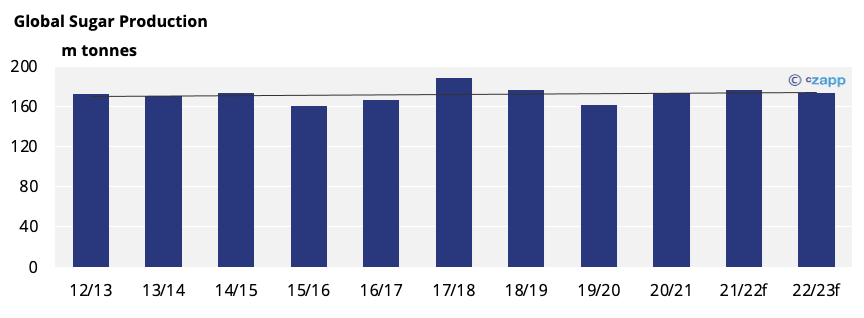

- Global sugar production has barely expanded in the past decade thanks to low investment/falling prices.

- This means there’s no other production coming on stream to balance India’s withdrawal from the market.

- In the longer term, sugar prices need to be high enough to reverse this, especially as India’s ethanol programme grows.

- We’ve written a series exploring which countries could expand their cane or beet acreage in the coming years.

- For the past decade, India’s smothered the market with cheap subsidised sugar.

- However, India’s excess sucrose is now being diverted into ethanol, so the market will lose its price-insensitive supplier of last resort.

- In normal years, this loss won’t be noticed, but in years where the weather affects sugar output in other major producing countries, there will be no safety net and prices will strengthen.

How to Manage Your Market Risk

- Anyone seeking to hedge for 2022 should be guided by the recent price action.

- Buyers should now aim for sub-17 c/lb, while producers should aim for 20 c/lb and above.

- For 2H’22 and beyond, we’re trying to keep an open mind, but fear prices could strengthen.

- This suggests buyers should accelerate their hedging, while producers can be a little more patient.

- Given the lack of Thai and European refined supply for 2022, we think the white premium should trade at a level which incentivises toll (re-export) refiners to operate at high throughput.

- We therefore think the white premium should trade between 80-100 USD/mt, with regional physical values enabling refiners to hit their profitability targets; current white premiums for 2022 are starting to feel fair value.

If you have any questions, please get in touch with us at Jack@czapp.com

Other Insights That May Be of Interest…

The World Needs More Sugar…Who Can Help?

The World Needs More Sugar…Can India Help?

The World Needs More Sugar…Can Brazil Help?

The World Needs More Sugar…Can Thailand Help?

Explainers That May Be of Interest…

Thailand’s White Sugar Industry