Insight Focus

- PTA and MEG reopen marginally higher following Chinese New Year.

- China PET resin export prices soften through the weak, sub-900 range coming back into view.

- How will low operating rates and margins impact schedule for upcoming capacity additions?

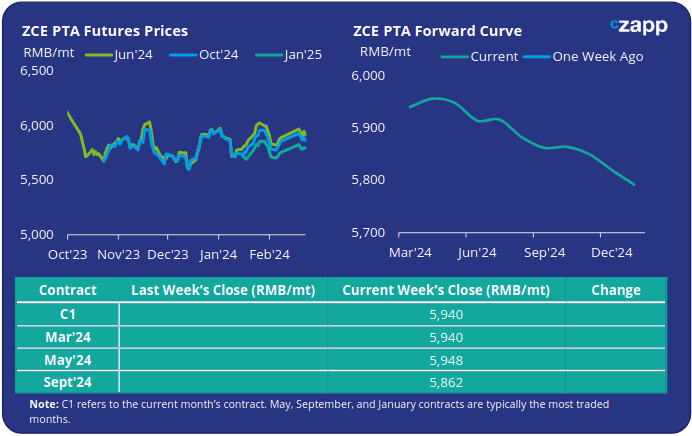

PTA Futures and Forward Curve

PTA Futures prices opened higher following the Chinese New Year holiday on higher upstream costs but eased partially through the week.

PTA availability has lengthened with a delayed recovery to downstream polyester production, with some factories not expected to fully restart until after the Lantern Festival (24th Feb).

Restocking ahead of the holiday also means end-polyester demand is lacklustre, all of which has slowed PTA offtake, resulting in some inventory accumulation.

Planned PTA maintenance operations in March were expected to counterbalance any inventory accumulation. However, some delays are possible due to the recent margin recovery.

However, gradually resumption in polyester production should constrain any further significant inventory expansion.

The PX-Naphtha and PTA-PX spreads both remained stable compared to pre-holiday; the PTA-PX CFR spread averaged around USD 94/tonne last week.

The PTA forward curve remains relatively flat until May then backwardated through the remainder of the year. The May’24 contract is at a RMB 8/tonne premium over the current month’s contract; Sept’24 is at a RMB 78/tonne discount.

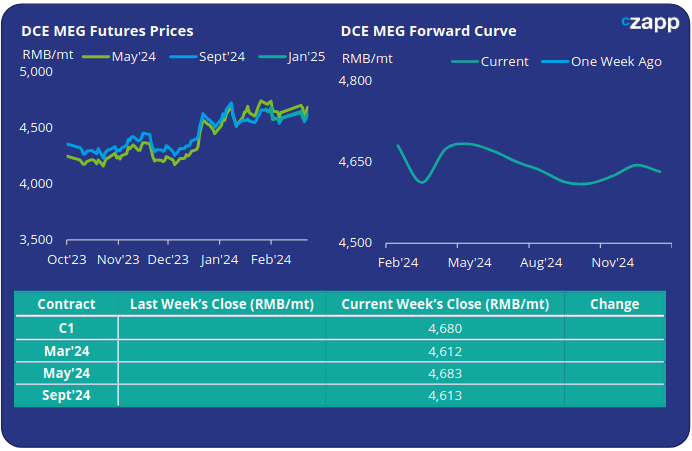

MEG Futures and Forward Curve

MEG Futures also reopened marginally higher, up by 1% since the pre-holiday period.

Main East China port inventories were very slightly down by 0.15% by Friday last week versus levels on 9th Feb, to around 777k tonnes. Although daily offtake slowed around the holiday this marks the first Spring Festival without an MEG inventory build.

Offtake is expected to pick up again as polyester production fully recovers back to the high operating rates seen before the break. Maintenance turnarounds will also improve the supply/demand balance into March.

The MEG forward curve is in-flux, although overall is relatively flat through H1, before moving into backwardation. The May’24 contract currently has just a RMB 3/tonne premium over the current month; Sept’24 is at a RMB 67/tonne discount.

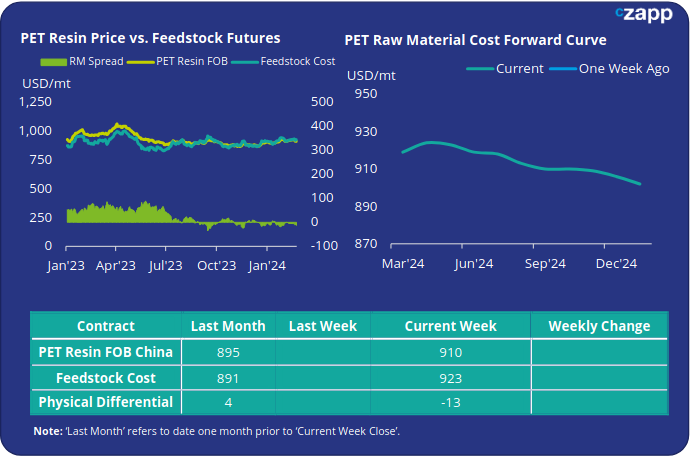

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices had moved down by the end of last week, having shown initial strength immediately after markets came back from holiday. Export prices averaged USD 910/tonne last Friday, a decrease of USD 5/tonne from the 8th Feb.

The weekly PET resin physical differential against raw material future costs decreased USD 8/tonne last week to average minus USD 9/tonne. By Friday, the daily spread had slide further in negative territory to minus USD 13/tonne.

The raw material cost forward curve remains relatively flat in the short-term, before moving into backwardation from April onwards.

The current May’24 costs were USD 4-5/tonne higher than the current month; Sept’24 was running at a consistent USD 13-15/tonne discount to May.

Concluding Thoughts

Post-holiday, tighter PTA availability has eased with a delayed recovery to downstream polyester production, with some factories not expected to fully restart until after the Lantern Festival (24th Feb).

Restocking ahead of the holiday also means end-polyester demand is lacklustre, all of which has slowed PTA offtake, resulting in some inventory accumulation.

Planned PTA maintenance operations in March were expected to counterbalance any inventory accumulation. However, some delays are possible due to the recent margin recovery.

However, gradually resumption in polyester production should constrain any further significant inventory expansion.

The PX-Naphtha and PTA-PX spreads both remained stable compared to pre-holiday; the PTA-PX CFR spread averaged around USD 94/tonne last week.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.