Insight Focus

- PTA futures buoyed by higher upstream costs, steadily improving fundamentals.

- China PET resin export prices rise slowly, restrained by oversupply and upcoming new capacity.

- Raw material forward curve shows only slight USD 10/tonne premium through to Sept.

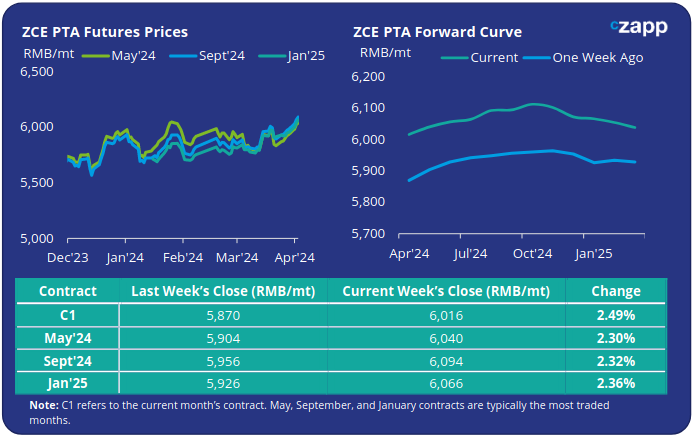

PTA Futures and Forward Curve

PTA Futures increased a further 2.5% last week, rising with higher crude and PX costs, before the week’s early close on Wednesday due to the two-day national holiday.

Crude oil prices have surged over the last week, with Brent Futures increasing 5% from USD 86.59/bbl on April 1st to USD 90.95/bbl on Friday.

Oil prices rocketed following a drone attack on one of Russia’s largest oil refineries and escalating geopolitical tensions in the Middle East, driving downstream petrochemical prices higher.

PX-N spread has also continued to swell on improved fundamentals and plant turnarounds, whilst the PTA-PX spot CFR spread has broadly remained flat and compressed since mid-March.

Although PTA supply/demand fundamentals have improved with increasing polyester operating rates and PTA plant turnarounds, high inventory levels continue to constrain further price rises.

However, a gradual easing of ease inventory levels is expected through April potentially supporting margin recovery.

May’24 contract has a RMB 34/tonne premium over the current month; Sept’24 has a RMB 78/tonne premium over current month.

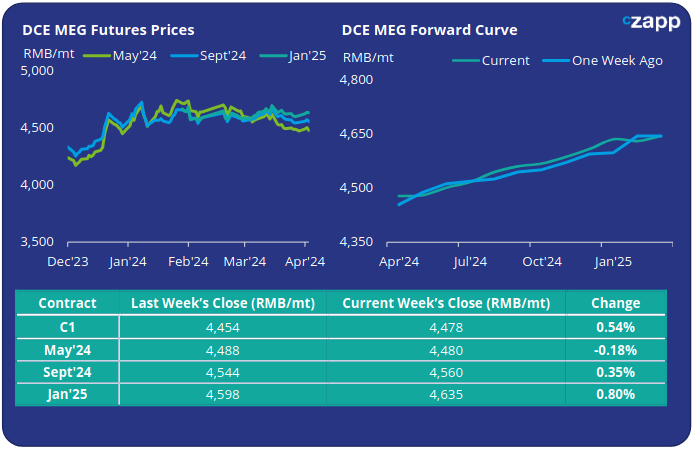

MEG Futures and Forward Curve

The main May’24 MEG futures contract softened slightly last week, whilst other contract months saw minimal percentage gains despite a slowdown in import arrivals.

East China main port inventories decreased last week to around 778k tonnes by Wednesday (before the national holiday 4-5th April), down around 7.43% from the previous week.

Despite the drop, import arrivals are expected to rise over the coming weeks, as supply continues to increase from the Middle East and the US.

Whilst domestic supply has reduced over the last few weeks due to seasonal turnarounds, some coal-based plants are expected to come-back online shortly, adding pressure on MEG prices.

In terms of demand, whilst polyester operating rates have increased supporting MEG demand, downstream polyester inventories have risen with slow offtake.

The forward curve remains in contango, although the premium shown by the Sept’24 contract over the current month has fallen to just RMB 82/tonne.

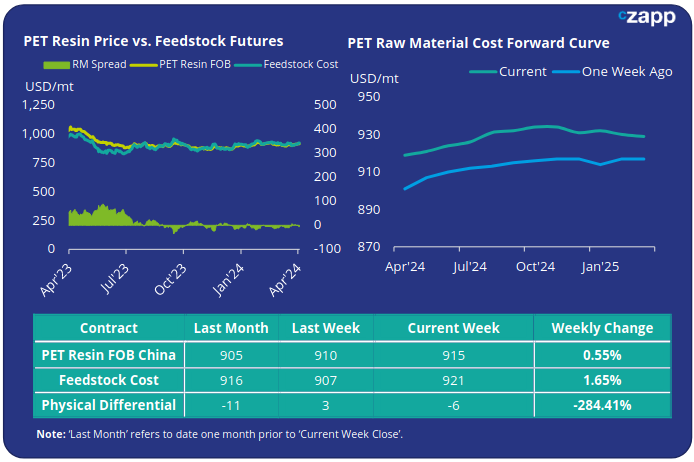

PET Resin Export – Raw Material Spread and Forward Curve

Despite the latest crude rally, Chinese PET resin export prices experienced only minimal increases last week, ahead of the Tomb-Sweeping Day holiday.

Export prices averaged USD 915/tonne on Wednesday, up just USD 5/tonne on the previous week.

The weekly PET resin physical differential against raw material future costs fell back by USD 5/tonne, to average minus USD 6/tonne for the week.

Over the last fortnight, the improvement in physical differential seen before Easter has reversed with levels falling back into the previous range.

The raw material cost forward curve continues to be in slight contango; Sept’24 contract has around a USD 10/tonne premium over the current month.

Concluding Thoughts

Due to the short trading week and the subsequent crude rally, the question is ‘Will prices now correct upwards on Monday?’

Some other Asian PET resin producers indicated early on that their prices will rise off-the-back of higher costs.

However, whilst Chinese PET resin export prices have drifted marginally higher, any further sharp rises will likely face stiff resistance from buyers.

Even with seasonal improvement in both domestic and export demand, recent capacity increases from Yisheng (700 kta) and Xinjiang Tunhe (100kta), in addition to further new capacity in April and May, keeps pressure on the physical differential.

Steadily increasing operating rates are also finely balanced against any demand improvement, keeping the raw material differential pinned down.

However, downside potential for margins is also relatively low, with producers running healthy stock levels of less than 15 days on average; at least one major export claims to be sold out April and May.

Elsewhere, supply is still ample for prompt shipment and expectations are for PET resin export prices to track raw material costs closely with further margin recovery limited.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.