Insight Focus

- PTA and MEG Futures retreat on slow downstream demand and abundant supply.

- China PET resin export prices trend downwards on lower costs and oversupply.

- Several PET resin lines to restart after maintenance; Yisheng adds new 350k tonne line.

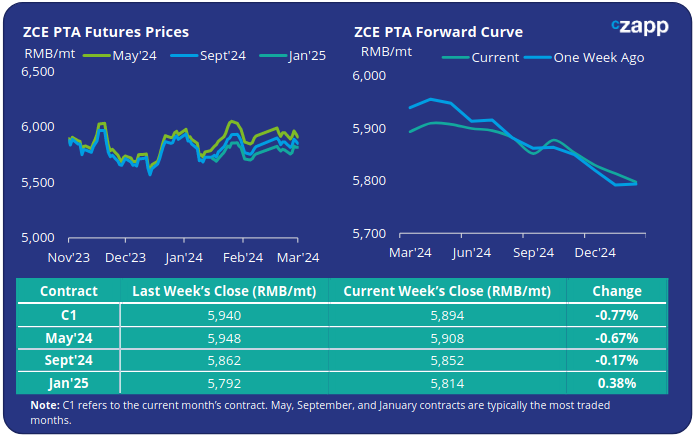

PTA Futures and Forward Curve

Crude oil prices ended the with a modest gain of around 2.5% up from last Friday’s close on expectations that OPEC+ will extend its production cap deal, tightening supply further.

Although PTA availability is relatively abundant, expectations are for polyester operating rates to gradually recover in early March supporting demand and the transfer of stocks to the downstream.

Planned PTA maintenance operations in March are expected to also counterbalance any inventory accumulation. Additional maintenance turnarounds may entail if margins are further compressed.

Whilst in the short-term, the PTA forward curve remains relatively flat, beyond the May the curve is modestly backwardated through the remainder of the year.

The PTA-PX spreads remained stable, averaging around USD 94/tonne last week.

The May’24 contract is at a RMB 14/tonne premium over the current month’s contract; Sept’24 is at a RMB 80/tonne discount.

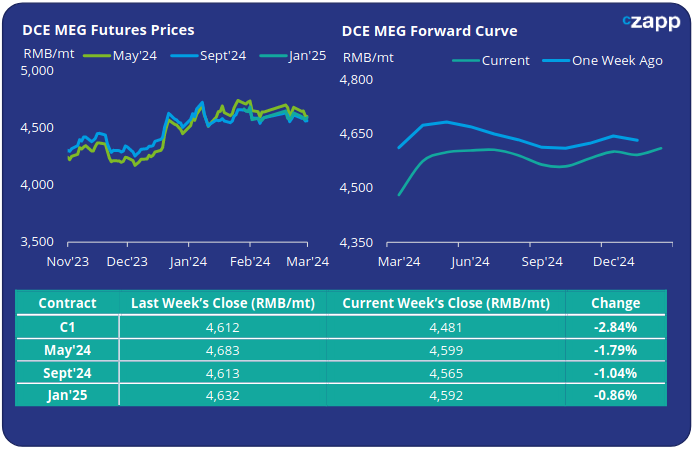

MEG Futures and Forward Curve

MEG Futures continued their post-CNY slump, as prices weakened through last week, with the main May’24 contract shedding a further 1.8%.

Although main East China port inventories reduced by 1.47% by last Friday, to around 766k tonnes and daily offtake have plummeted, domestic production has risen amid sluggish post-CNY demand.

Downstream demand is expected to recover modestly into March as operating rates are lifted, supporting MEG demand.

However, following relatively mute import activity, planned restarts at several Saudi Arabian plants in March, means import arrivals will gradually recover over the coming months.

The MEG forward curve shows near-term strength into May, becoming relatively flat thereafter. The May’24 contract currently has a RMB 118/tonne premium over the current month, with Sept’24 then at a RMB 34/tonne discount to May’24.

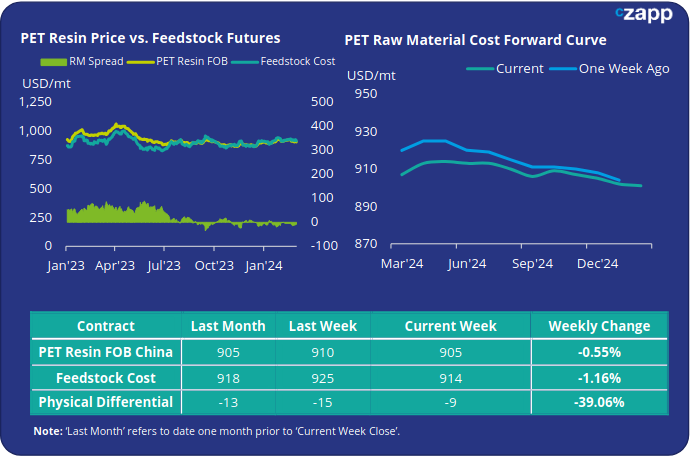

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices continued to soften through last week, easing by an additional USD 5/tonne to average USD 905/tonne last Friday.

The weekly PET resin physical differential against raw material future costs remained relatively flat versus last week averaging minus USD 11/tonne. By Friday, the daily spread was minus USD 9/tonne.

The raw material cost forward curve has flattened in the near-term, meaning forward costs are now projected to be relatively consistent through much of the next-12 months.

The current May’24 costs were USD 7/tonne higher than the current month; Sept’24 was running at a consistent USD 8/tonne discount to May, broadly on par to current levels.

Concluding Thoughts

PET resin export prices have come under pressure since the return from CNY, falling back to levels seen at the beginning of January.

Whilst some of the weakness is reflective of falling feedstock costs, processing spreads have also retreated, constrained by structural oversupply, higher stock levels, and slow demand recovery post-holidays.

Producers nevertheless have a large back book of orders to work through in March, a period that typically sees intensive domestic and export deliveries. Some producers are increasingly sold-out for March, moving new orders into April shipment.

However, whilst PET resin demand will strengthen into peak season, operating rates are expected to be lifted as lines restart, some following lengthy maintenance shutdowns.

The market is also seeing the beginnings of another wave of new capacity, with Yisheng starting the first of its two new 350k tonne lines during Spring Festival, the second of which is scheduled to come on-stream at the end of March.

The threat of additional new capacity although largely concentrated in H2 will weigh on sentiment, even as demand recovers.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.