Insight Focus

- PTA Futures follow rising crude prices higher, despite ample supply narrowing margins.

- China PET resin export prices lifted by feedstock costs; fundamentals remain weakened.

- Raw material forward curve keeps flat, pricing dominated by crude in near-term.

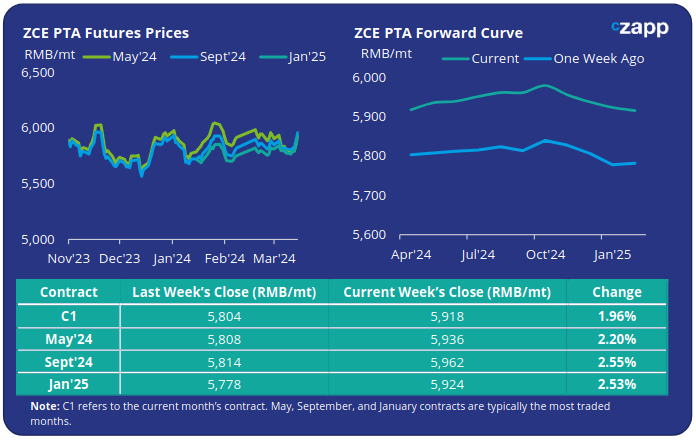

PTA Futures and Forward Curve

PTA Futures swung sharply upwards by over 2% towards the end of last week, as upstream costs leapt on higher crude.

Brent crude traded through USD 85/bbl last Thursday, the highest since November, as the International Energy Agency warned of a supply deficit throughout the year.

However, the divergence between IEA and OPEC demand numbers is the largest in 16 years, meaning that whilst Morgan Stanley predicted potential sharp prices rises, oil price uncertainty is at peak levels.

Continued recovery of polyester operating rates supports PTA demand. However, downstream inventory accumulation and high PTA supply liquidity create headwinds, with fewer PTA plants having undergone maintenance in March than expected.

PX-N spread narrowed by around USD 5/tonne last week, whilst the PTA-PX spot CFR spread also dropped abruptly to just USD 82/tonne.

The forward curve turned flat last week, has now moved into slight contango through to Q4’24, from a previously flat outlook.

May’24 contract has a RMB 18/tonne premium over the current month’s contract; Sept’24 has risen to a RMB 26/tonne premium to May.

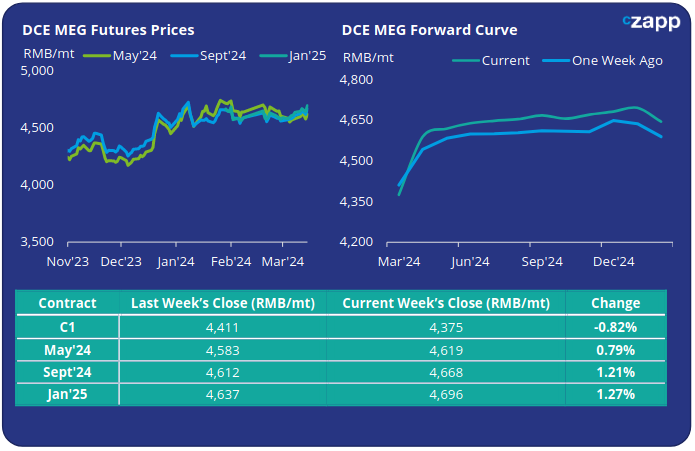

MEG Futures and Forward Curve

The main May’24 MEG futures contract increased only modestly last week, by less than 1%, as increased arrivals dampened sentiment.

Main East China port inventories jumped 12.5% last week, to 796k tonnes, the first considerable rise for some time.

Whilst fundamentals are supported from the demand side, by increasing polyester polymerisation rates, rising domestic supply and increased imports weigh on market sentiment.

Expectations are for prices to keep rangebound, as improving demand plays off against increasing deep sea cargoes. Plant outages, scheduled and unplanned, will play a key swing role going forward.

The May’24 contract premium over the current month has increased to RMB 244/tonne, before the forward curve flattens out; Sept’24 has a RMB 49/tonne premium to May’24.

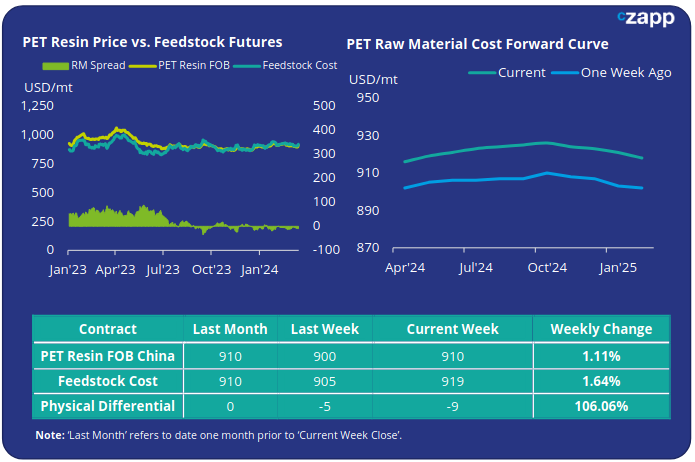

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices firmed last week, with sub-900 offers evaporating from the market. By Friday, the China PET resin export price averaged USD 910/tonne, a USD 10/tonne increase on the previous week.

The weekly PET resin physical differential against raw material future costs decreased by USD 5/tonne, to average minus USD 10/tonne for the week. By Friday, the daily spread had remained at minus USD 9/tonne.

The raw material cost forward curve remains relatively flat, with the Sept’24 contract having a small USD 9/tonne premium over the current month.

Concluding Thoughts

PET resin export prices found strength once again, following a recent downward trend. However, much of the uplift came via higher feedstock costs, rather than increased overall demand.

Despite apparent increased domestic demand, with buyers restocking ahead of peak season, the export market remains lukewarm.

Although some producers have sold out production for March, others still have volume available for prompt shipment/late March.

PET resin bottle grade operating rates have steadily increased since Spring Festival, increasing availability and keeping the sales pressure on producers.

New capacity additions also keep market sentiment weak; Xinjiang Tunhe announced the launch of its new 100kta PET bottle grade line. Yisheng is also expected to start the second 350kta line at the end of March.

Chinese PET resin exports are increasingly facing new trade barriers, as new anti-dumping investigations are launched.

Following recent announcements from Mexico, and South Korea, the Indian government also aims to review trade tariffs against Wankai New Materials, following a surge in PET resin exports to India last year.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.