Insight Focus

- PTA and MEG Futures decline as oversupply in both markets weigh on sentiment.

- China PET resin export prices slowly ease, although raw material spreads improve.

- Near-term weakness in raw material curve creates new contango in forward prices.

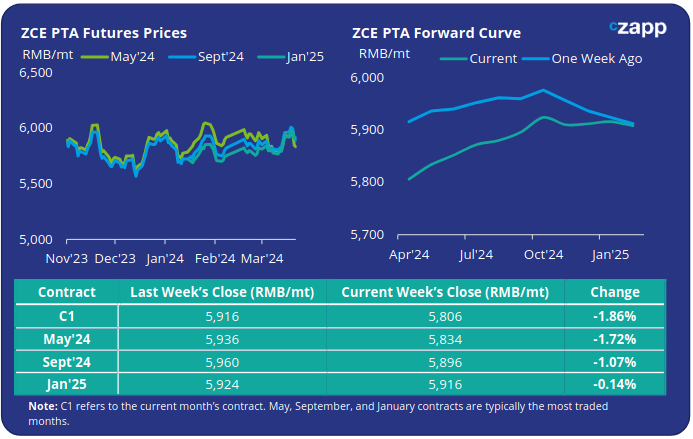

PTA Futures and Forward Curve

PTA Futures dropped by nearly 2% last week, giving back much of the gain seen the previous week, threat of additional oversupply overrode underlying crude strength.

Oil prices also parred some gains through the week, on the prospect of a ceasefire in the Middle East and a stronger US dollar. Nevertheless, Brent oil prices were able to hold onto around a 1% gain on Friday versus the previous week’s close.

PTA margins remain compressed, and with the addition of FCFC new 1.5Mt PTA plant and Yizheng’s 3Mt due to start operation, PTA oversupply looks to keep fundamentals weak in the short-term.

PX-N spread averaged slightly higher last week, whilst the PTA-PX spot CFR spread remained stable at around USD 82/tonne.

However, potential maintenance turnarounds late March/early April, as well as new polyester capacities may gradually help ease inventory levels supporting margin recovery. Until then, PTA price movement will largely be dictated by upstream costs.

The fall in near-term PTA values means the forward curve now shows more of an upward recovery through the year.

May’24 contract has a RMB 28/tonne premium over the current month’s contract; Sept’24 has risen to a RMB 90/tonne premium over current month.

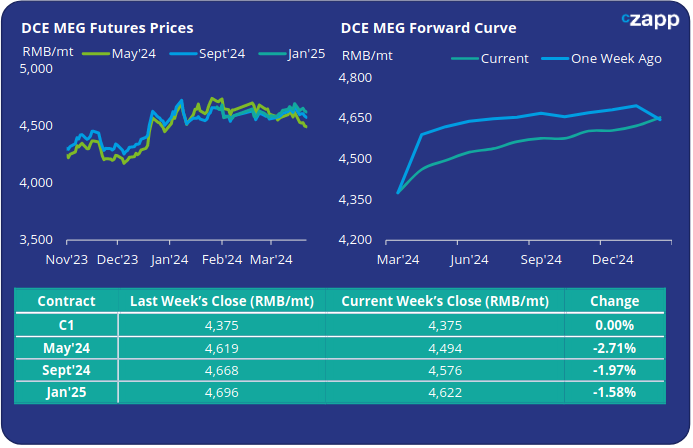

MEG Futures and Forward Curve

The main May’24 MEG futures contract fell sharply last week by around 2.7%, following higher inventories and India’s latest restriction on Chinese fabrics.

East China main port inventories continued to rise last week, increasing to over 833k tonnes by Friday, up around 4.8% from the previous week.

With deep sea arrivals increasing, inventory levels are expected to build further, pressuring market sentiment, compounded by additional MEG plant restarts in Saudi Arabia and Taiwan.

Easing domestic production, resulting from planned turnarounds, may counterbalance some of the inventory pressure from imports.

In terms of demand, whilst polyester operating rates currently remain elevated polyester inventories are rising with slow offtake. India’s latest move to impose a minimum import price on imports of Chinese fabrics could also weigh on Chinese downstream polyester fibre demand.

The forward curve remains in contango. The May’24 contract premium over the current month decreased to RMB 119/tonne; Sept’24 has a RMB 201/tonne premium to the current month.

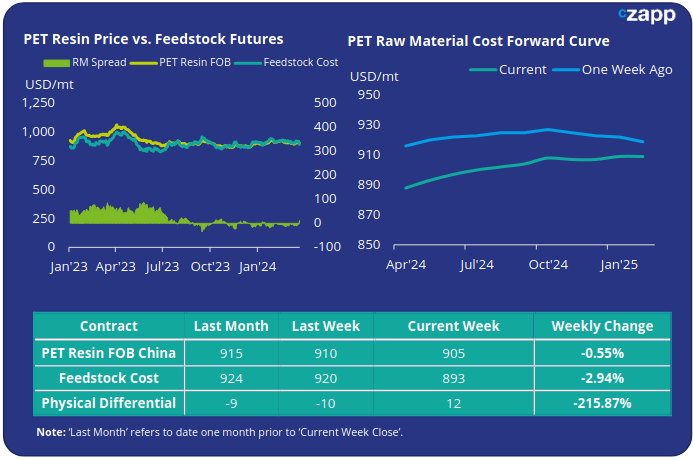

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices softened slightly last week, with prices averaging USD 905/tonne on Friday, USD 5/tonne down on the previous week. And prices on the lower end falling back into the 890s.

The weekly PET resin physical differential against raw material future costs increased by USD 8/tonne, to average minus USD 2/tonne for the week.

However, with the fall in raw materials by Friday, the daily spread had turned positive to USD 11/tonne. Can Chinese producers hold onto to this recovery going into next week?

The raw material cost forward curve has moved in a slight contango because of the near-term correction in raw material prices, The Sept’24 contract has around a USD 15/tonne premium over the current month.

Concluding Thoughts

PET resin export prices largely followed raw materials lower last week. However, returning peak season demand could see margins move higher over the coming weeks.

Spot raw material spreads moved higher through last week. Although, given recent crude volatility, a longer period of improved PET physical differentials would be needed to confirm the trend.

Domestic downstream demand continues to pick up, with beverage manufacturers increasing operating rates; easing shipping rates are gaining added buyer interest on the export side.

However, supply is still ample for April shipment, and although some suppliers have begun to sell out certain grades, plenty of options and availability remains.

Chinese PET resin exports are also increasingly facing new trade barriers, as new anti-dumping investigations are launched.

Following recent announcements from Mexico, and South Korea, the Indian government also aims to review trade tariffs against Wankai New Materials, following a surge in PET resin exports to India last year.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.