Insight Focus

- Wheat rallied this week on the back of short covering and strong US exports sales.

- Corn experienced milder gains in Chicago and closed the week negative in Europe.

- US corn price action will depend on who folds first — the large spec short versus farmers holding on to stocks.

The week started negatively for corn and wheat in all geographies, but prices turned around by mid-week and rallied, led by short covering in wheat and strong US exports for both corn and wheat. The week ended slightly positive for US corn but negative for European corn. Wheat closed the week with expressive gains both in the US and Europe.

The driver last week was wheat pulling corn higher. Corn fundamentals helped after strong US export numbers were published last Thursday. This coincided with a turnaround in corn prices and triggered some short covering.

US, European Wheat Outlooks Diverge

Wheat started on the defensive last Monday, but it quickly turned around in what appeared to be a short covering rally after the late COT publication showed a huge increase of spec shorts. The buying was further fuelled by strong US exports sales coming in higher than expected with a huge 263% increase week on week. But it was also fuelled by the MARS bulletin from the European Commission, which said excessive rain during October and November disrupted planting and the condition of winter cereals. The bulletin highlighted issues in France in particular, which is significant since the country is a major wheat producer.

The wheat outlook is set to diverge in major markets this week. On one hand, the condition of the US wheat crop will likely improve this week again due to favourable weather conditions and ample rains last week. Dry and warm days are expected in the US, which should lead to snow melting, providing moisture to wheat areas and resumption of corn harvesting.

But on the other hand, French and German wheat planting is very much delayed, which will lead to late development, and the condition is worsening due to excess rains. Europe is forecast to have low temperatures including snowfall.

Given that European wheat production is much larger than the US, a potential downgrade in European production will weigh more on the market than a potential upgrade of US production. Despite the MARS bulletin, the European Commission increased its wheat production forecast slightly to 126.58 million tonnes, but the amount was immaterial to the market.

Rains are forecast in centre east Brazil, which was suffering from dry conditions, and the south is expected to receive stormy weather once more risking the already damaged planted areas. Centre west Brazil is also expected to receive rains.

After last week’s rally, we could see a pullback this week. We think most of the rally last week was driven by spec funds covering shorts, but fundamentals continue to show the market should be well supplied.

The Russian Agriculture minister said the country is considering a full export ban on wheat and other grains if local stocks fall below 10 million tonnes, although that appears to be far from the case. Wheat stocks were 64 million tonnes as of October 1. The Ministry also announced that wheat production this year is 94.7 million tonnes so far and will reach 95 million tonnes, which is the second largest crop after the 105 million tonnes produced last year. Russian winter wheat planting has now finished.

US winter wheat is now fully planted, and its condition improved 2 percentage points to 50% good or excellent versus just 33% last year. This marks the best crop condition of the last three years. The wheat area under drought conditions fell three points over the week to 38%.

Planting in Ukraine is now complete. French wheat is 83% planted, behind the 99% recorded at the same time last year. The condition was 80% good or excellent, 3 points lower week on week and down significantly on the 98% recorded last year.

Only European wheat could surprise with a potential downward revision to production forecasts given the very delayed planting pace and poor condition.

US Corn Stuck Between Sellers and Specs

In the US, the tug of war will continue this week between spec funds holding large short positions and the farmers who are refusing to sell corn stockpiles in an attempt to bolster prices. US corn was 96% harvested versus 99% last year and compared with the five-year average of 95%. About 44% of the area is experiencing drought, up two points from the previous week.

The European Commission revised its corn production forecast slightly higher to 60.2 million tonnes versus 60.1 million tonnes. This number should be very close to reality with harvesting almost finished and 13% higher year on year.

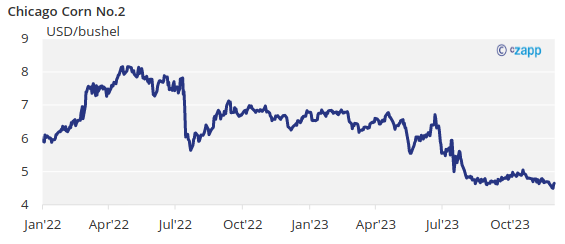

There is no change to our forecast for the new 2023/24 crop for Chicago corn in a range of between USD 3.90/bushel and USD 4.15/bushel but with an upside bias. The average price since September 1 is running at USD 4.77/bushel.

Russian corn is 73% harvested, unchanged from last week. Ukrainian corn is 85% harvested. French corn is now fully (99%) harvested. In Brazil, the first corn crop is 83% planted versus 88% last year. The Brazilian summer corn crop is 55% planted compared with 68.6% last year. The corn condition in Argentina is 26% good or excellent.