Insight Focus

- This year’s US beet harvest will be lower than hoped.

- Mexico will therefore export more sugar to the US than previous years.

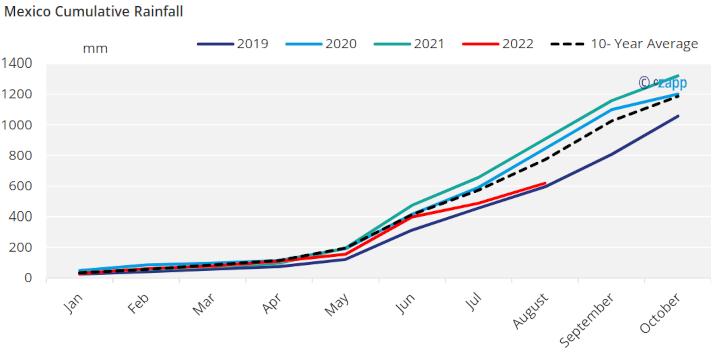

- Rain in September and October will determine the success of the Mexican sugar harvest.

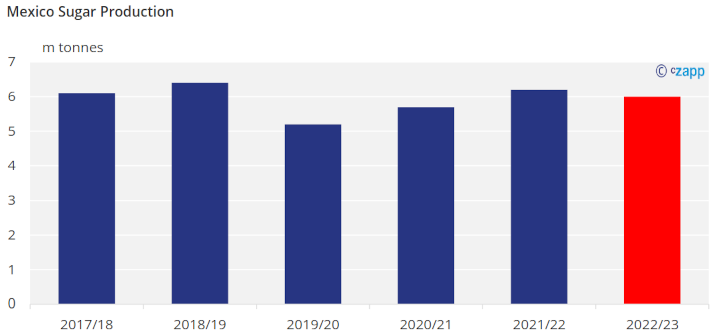

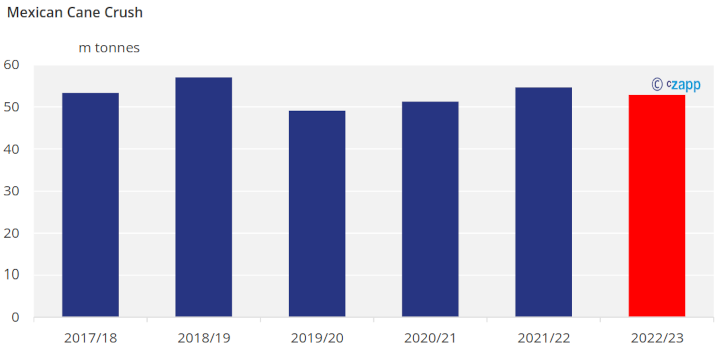

We think Mexico will produce aproximately 6m tonnes of sugar in the 2022/23 season.

- This is 200k tonnes less than last season due to the the current dry conditions in Mexico affecting yields.

- However this remains a good crop for Mexico, ensuring adequate supply for the domestic market and export flows.

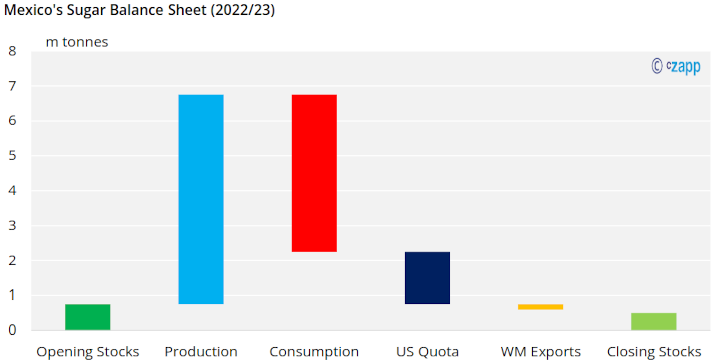

What does this mean for the Mexican balance Sheet?

- 4.5 million metric tonnes of sugar for domestic consumption.

- 1.5 million metric tonnes of sugar for export to the United States.

- 150,000 metric tonnes of sugar for export for the world market.

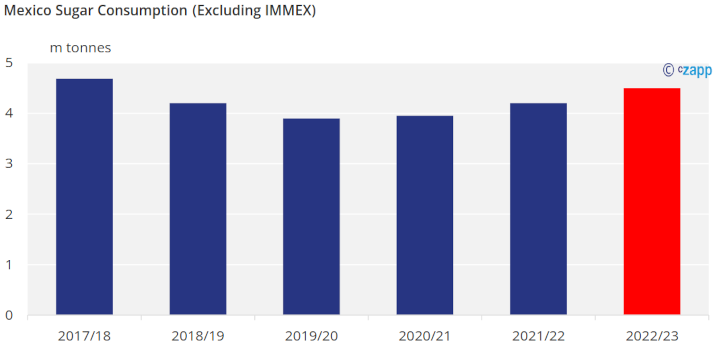

Mexico sugar consumption decreased between the 2017/18 and the 2019/20 harvest. Yet, following the global pandemic, sugar consumption has increased yearly in Mexico.

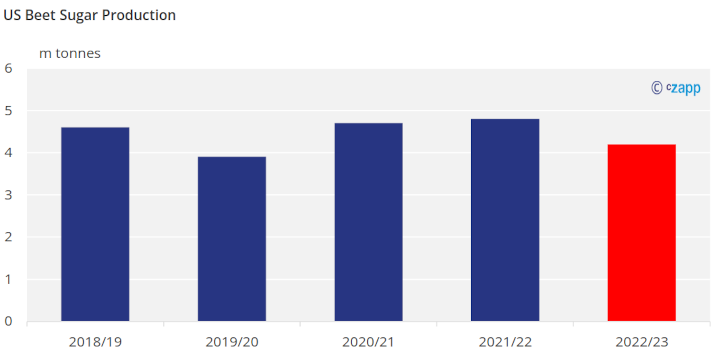

Poor US weather causes shortage of sugar beets

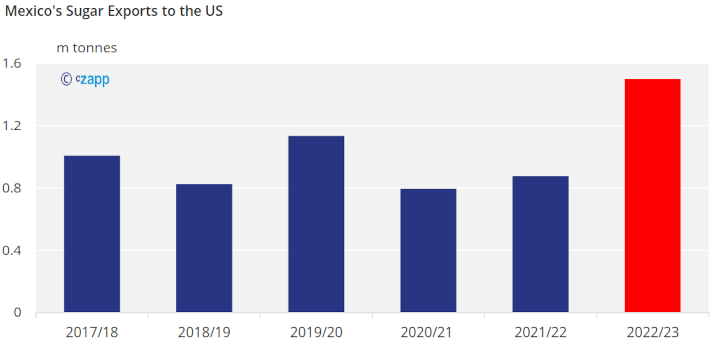

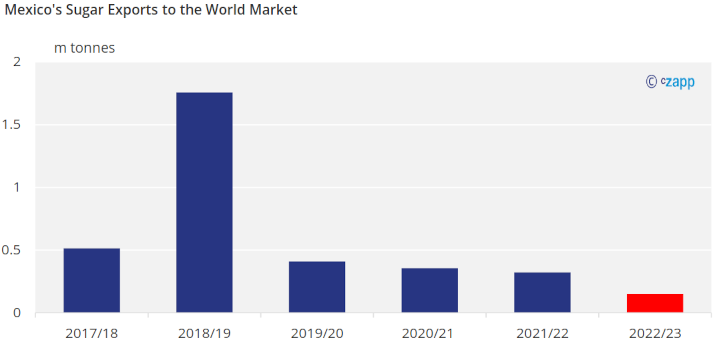

The other notable change for Mexico is the increase in the forecast quota to the USA. We think Mexican sugar exports to the USA could reach 1.5m tonnes, compared to 878k tonnes in the previous season.

The main reason for the increase in quota is the delayed planting of American sugar beets in various northern states due to cold weather and excessive moisture. The US Department of Agriculture reduced the projected 2022/23 US sugar supply by 275,000 tons as a result of the poor weather.

Mexico’s sugar export to the world varies vastly year to year depending on how much sugar they are allowed to export into the United States.

This large increase will mean Mexico is unlikely to have much sugar for the world market.

Current expectations are for 150k tonnes only.

Mexico Drought

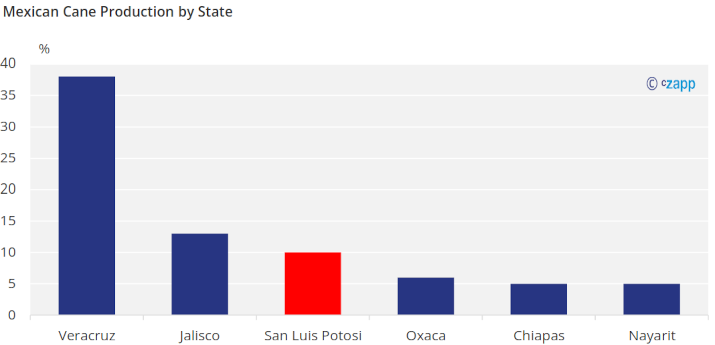

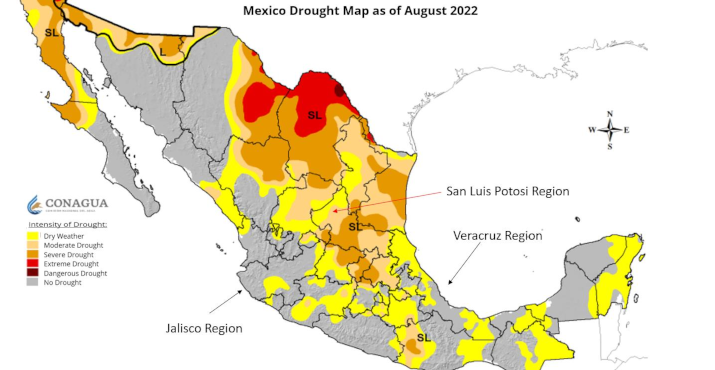

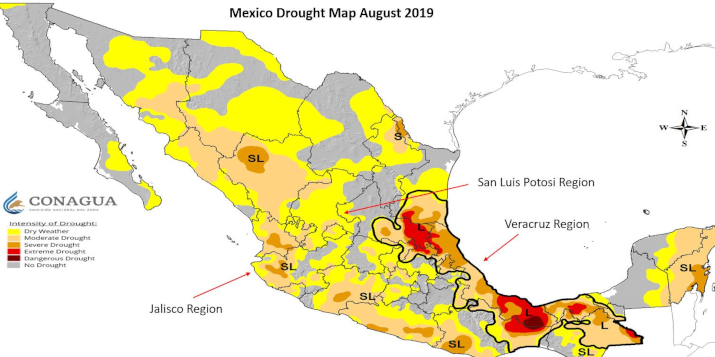

Most of Mexico is currently experiencing a drought. The drought should not affect cane production since the two biggest sugar producing regions, Veracruz and Jalisco, seem to be unaffected.

The production in San Luis Potosi will most likely be the only area affected.

Bearish Scenario: Drought continues and spreads

If the drought continues onto the wet months of October and September, this year’s harvest could suffer more than expected due to the drought. The impact won’t be as widespread as the disastrous 2019-20 drought, however. So far this season the rainfall has been below the 10 year average but not yet below 2019 levels.

60% of the cane in Mexico is not irrigated so the lack of rain in key regions can be devasting. In 2019 the mexican industry lost 8m tonnes of cane year on year.

Significantly though, the lack of rainfall at the time was across the east coast, including Veracruz and San Luis Potosi.

We do not expect this crop to suffer as much damage, but a continued dryness will have a negative impact on the cane development, reducing cane availability and yields.

Other Insights That May Be of Interest…

PET Supply Chains Groan Under Global Heatwaves

From ‘Climate What?’ to Taking Steps against Climate Change

Investors, Regulators Drive Carbon Labelling Agenda

Explainers That May Be of Interest…