Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

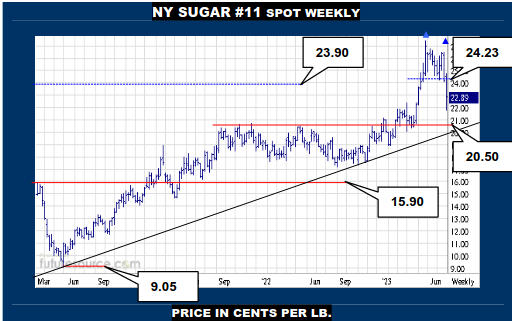

NEW YORK SUGAR #11 WEEKLY

The Jun nosedive from the 26’s resolved a more than 3₵ high Q2 double top (spot) en route and NY quickly gouged on into the 21’s. While 21.00 is technically the projection of that top, it would only be logical to cater for a little overspill to then test the first main weekly support shelf at 20.50 before envisaging far better cushioning that could thus help to guard the ’20’s uptrend itself (19.90). Meantime taking some corrective air Friday but would need to rebound over the top border (24.23) and mid band (24.48) to pull off a much faster and more enduring retrieval.

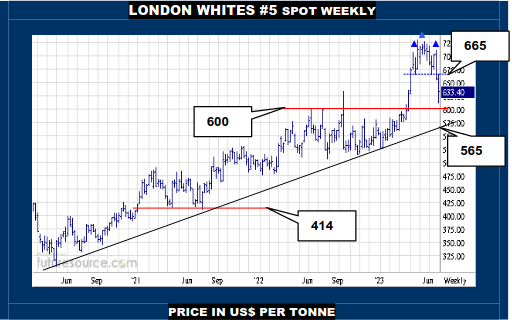

LONDON WHITES #5 WEEKLY

London has meanwhile been toppled from a $65 high Q2 H&S (spot) and has promptly traveled much of the way on down from there towards the derived 600 target. Of course, that 600 goal also happens to be the first main rung of weekly support and so, while catering for prods into the 590’s, there should be a greater sense of buffering then that once again gives the ‘20’s uptrend (565) a decent chance at survival. Even so, further probing south threatens in the interim and only a reflex over the 665 top rim and mid band (668.6) would imply a hastier catch.

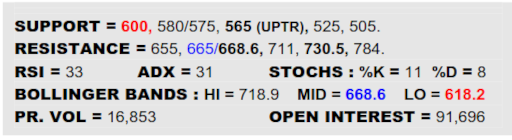

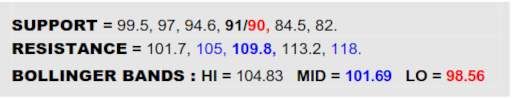

BLOOMBERG COMMODITY INDEX WEEKLY

Just when the macro seems to be waning, yet another little shaft of light hits the tunnel as the Dollar was blocked by its nearby top rim at 103.4 this week, giving the B-Berg a nudge back up Friday. Even so, this must soon carry the mid band (101.7) to give more reassurance and swivel the sights onto 105 again with a mind to the ’23 action developing more along the lines of a base, a subsequent emergence over 109.8 reshuffling to a much more pro-commodity outlook. Alas, if the Dollar still found a way clear of 103.4 to leave the 105 figure well overhead here, it would be premature to rule out further retrenchment to much bigger 91/90 support, the latter a Fib retracement of the early ‘20’s advance.

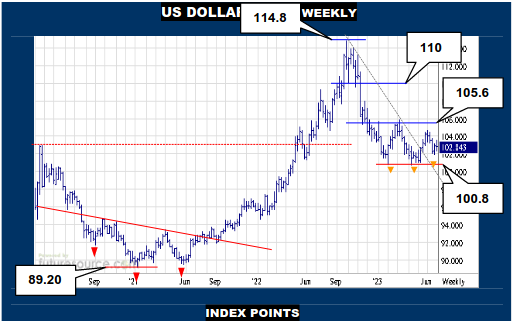

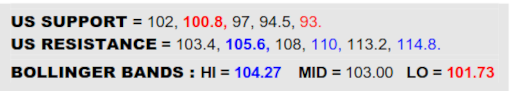

US DOLLAR INDEX WEEKLY

Jun had been shaping up quite well for the Dollar as it retrieved a dip near 102 to comfortably preserve the prior downtrend escape but Fridays’ refusal at the immediate daily top rim of 103.4 sets things back a bit. If able to swiftly rectify this and punch through, so the basing vibe of ’23 would grow and an ultimate emergence over 105.6 would complete an inverse H&S type of pattern that would infer belief in a further round of Fed rate hikes to drive back up to 110. The balance is wavering meantime though with that 103.4 stumble and the 100.8 troughs cannot be deemed immune to further attack with the risk of cracking a new aperture down to the 93’s.

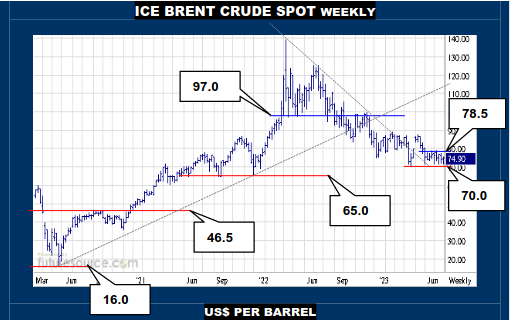

ICE BRENT CRUDE OIL SPOT WEEKLY

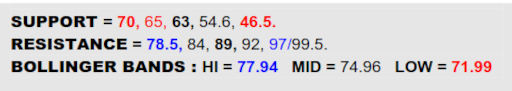

A lingering stalemate in a key component of the B-Berg index as Brent has sustained the previous shedding of the ’22 downtrend but still really needs to prove the turn higher by busting free of the 78’s resistance. If it could do that, there would be growing hope for the B-Berg to overhaul 105 and higher rungs of the ladder here at 89 and then 97 would look attainable. Alas it has been two months of cagey nip and tuck to preserve the bolstering vibe of exiting the downtrend but, while 78.5 keeps the lid on, so the 70 prop isn’t that far underneath and would presumably be much more vulnerable if the Dollar pierced the mid 105’s to finish its base, in which case the rebellion could go down in flames.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.