Insight Focus

- If SAF production can be scaled up, it will create a major new demand driver for corn ethanol.

- But US authorities are lagging behind in finalising guidelines.

- A Brazilian company has been given the green light to produce SAF from corn ethanol.

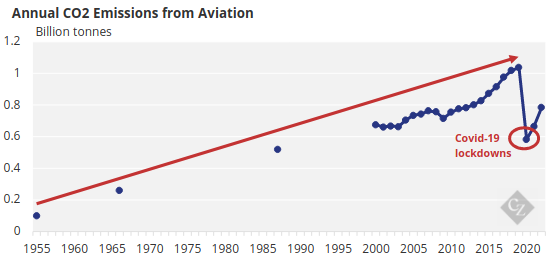

A growing market for Sustainable Aviation Fuels (SAF) could play a significant role in generating a secure market for corn and ethanol in the years to come.

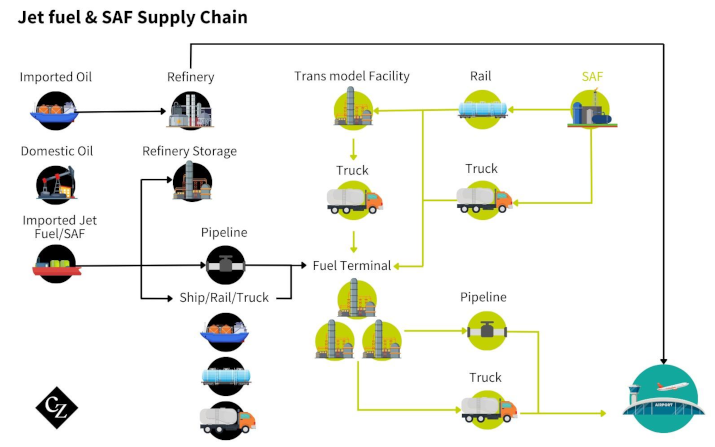

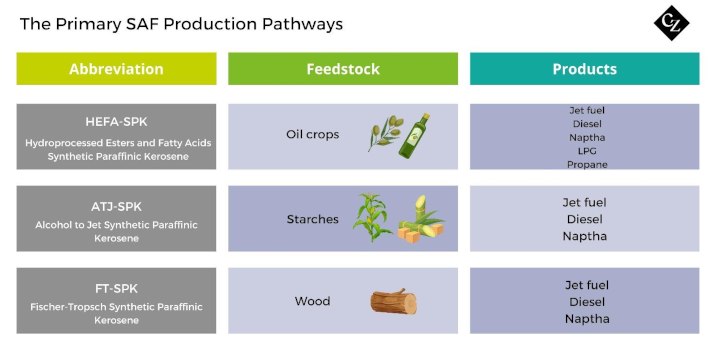

SAFs are liquid hydrocarbons made from non-petroleum sources including ethanol. SAFs currently represent less than 1% of the jet fuel market, but they do not require major modifications to current jet engines or fueling infrastructure.

Over the past several decades, biorefiners and aviation interests have been focused on the use of biodiesel as a means of lowering the carbon footprint of jet propulsion. The ethanol industry wants to grab a bigger share of the action.

“We are creating a new industry and now is the time,” Lee Blank of Summit Carbon Solutions said at the recent National Ethanol Conference in San Diego, California. Any expansion of ethanol into the potentially huge aviation fuel sector will likely result in big opportunities for corn and ethanol.

“The SAF market really is going to drive this area over the next few decades, and we have to be aggressive if we’re going to get it,” Blank said.

Airlines Support SAF

Delta Air Lines said recently that “SAF is the most promising lever known today to accelerate the airline industry on a path to net zero carbon emissions by 2050.”

Irish carrier Ryanair said this month that it will take an additional 500 tonnes of SAF in 2024 from the Austrian based energy firm OMV. UK airline Jet2 said it will use a blend of SAF at Bristol Airport in 2025, a year ahead of the UK government’s SAF mandate.

In Spain, local airline Volotea said on March 13 that it has completed its first flight with 50% SAF fuel supplied by Spanish oil company Repsol.

No Updates on GREET Model

In order to allow ethanol producers and the U.S. agriculture sector to participate in the SAF market, the Greenhouse Gases, Regulated Emissions, and Energy Use in Transportation (GREET) Model must first be finalised by the US EPA.

This model is a tool that examines the lifecycle impacts of vehicle technologies, fuels, products, and energy systems and has been under consideration since 2019.

For any given system, GREET can calculate total energy consumption (renewable and non-renewable), emissions of air pollutants, emissions of greenhouse gases, and water consumption. According to the EPA, “GREET analysis clarifies the energy and environmental benefits of biofuels, bioproducts and biopower, and pinpoints opportunities to mitigate barriers to their sustainable deployment.”

US officials are now working on modifications to the GREET model for SAFs. The model is important for determining eligibility for the US Inflation Reduction Act’s SAF tax credit.

Delays Frustrate Ethanol Industry

The ethanol industry is frustrated by the delays in finalising the model. Renewable Fuels Association President and CEO Geoff Cooper said that while the association is pleased to hear progress is being made on the modified GREET model, it is disappointed by an additional delay of modifications that were to be finalized by March 1.

“RFA is calling on the interagency Working Group to complete this process as quickly as possible while maintaining scientific integrity and honouring the commitment to incorporate a broad range of carbon reduction strategies,” he says. “To meet the Biden administration’s SAF goals, the marketplace needs certainty and clarity.”

Cooper added that “grain-based ethanol is, hands down, the most abundant and most cost-competitive source for large-scale SAF production. With nearly 200 ethanol biorefineries spread across the country, a well-established transportation and storage network, and the capacity to produce almost 18 billion gallons of low-carbon renewable fuel, the puzzle pieces are already in place to ramp up ethanol-to-jet fuel production.”

Cooper also said that the US ethanol industry is “hopeful that they will be able to participate in this remarkable opportunity to decarbonize the aviation sector.”

“It’s probably, maybe, could be, the next ‘ah ha’ moment for ethanol and corn demand,” Dan Keitzer, an Iowa farmer and district director of the Iowa Corn Growers Association, told news sources recently. The US government wants the airline industry to use 3 billion gallons of SAF annually by 2030.

SAF Advances in Brazil

Meanwhile, Brazilian corn-based ethanol producer FS announced that it has received certification that its corn-based ethanol complies with international requirements to produce SAF. The International Sustainability Carbon Certification (ISCC) Corsia applies to its Lucas do Rio Verde unit, in Mato Grosso state.

ISCC is the leading international biomass and bioenergy certification scheme, focusing on land use sustainability along with greenhouse gas (GHG) traceability and verification.

Besides the general ISCC Corsia, news sources said FS was also granted an add-on certification of low use change (LUC) risk thanks to its ongoing partnership with second-crop corn supplier GF group. It certifies that the biofuel does not generate GHG emissions related to indirect land use change (ILUC), which can occur when pasture or agricultural land previously destined for food and feed markets is diverted to biofuel production.