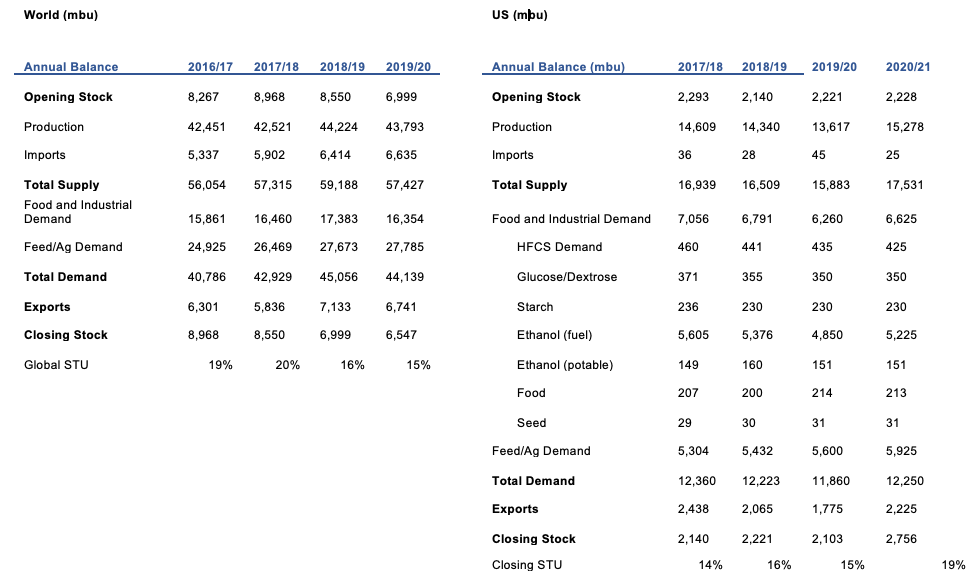

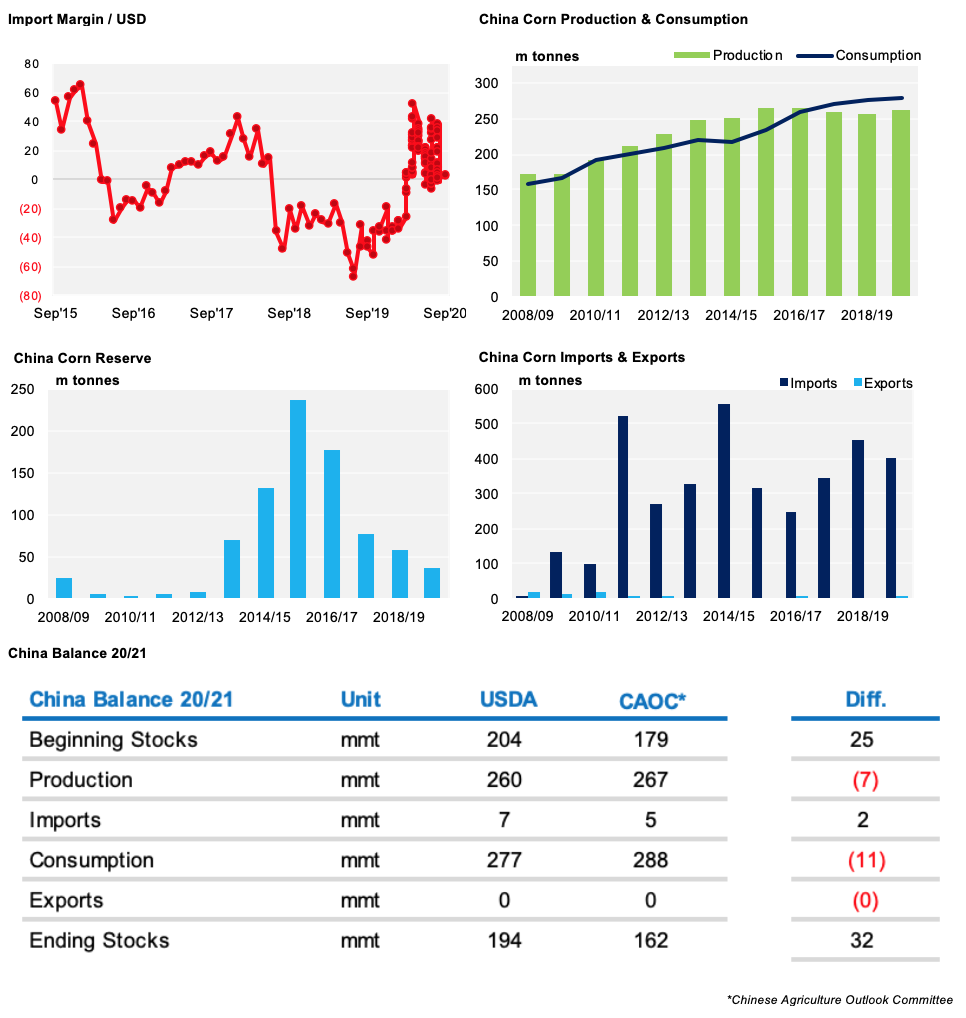

- China may need to import around 10m tonnes of corn next season.

- Its corn purchases were strong last week, but this couldn’t save the market from falling.

- China should continue to play a major role in price behaviour as it continues to buy grains to fulfill the Phase One Trade Agreement and its needs.

Forecast

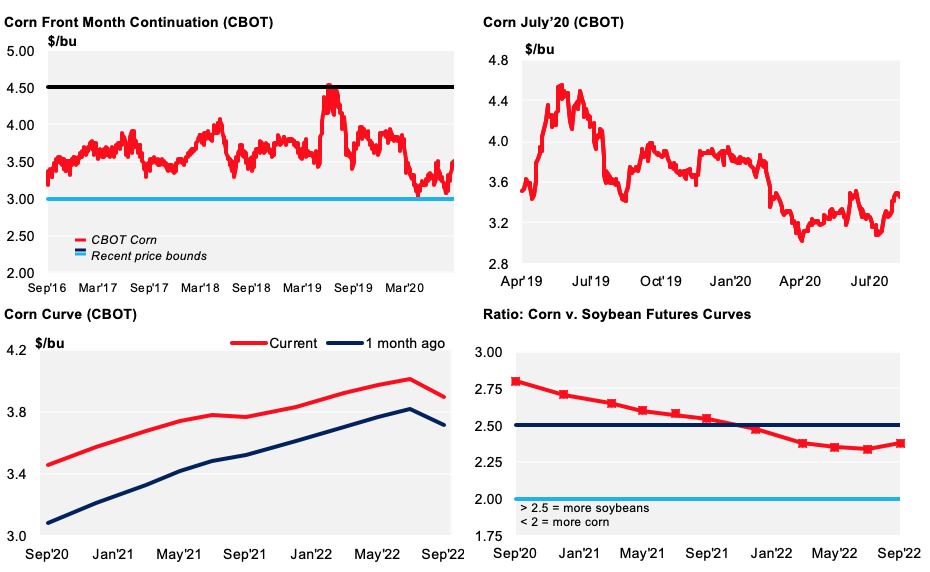

The 2019/20 average Chicago Corn finished at 3.54 USD/bu compared to the 3.50 we had projected. We think the 2020/21 average price will be in the range of 3.25 to 3.75 USD/bu.

Market Commentary

Soybeans in Chicago rallied 2% last week as Chinese buying intensified; poor crop conditions also played a part. This pulled Corn and Wheat up which finally closed almost unchanged due to losses during the second half of last week. European and Brazilian Corn fell.

Corn corrected its initial gains after the three-week rally. This was helped by rains giving some relief to the recent dry weather.

The US’ Corn condition fell again last week by 2%. It’s’ now ranked at 62% good to excellent.

Chinese Corn purchases were big last week, but this couldn’t save the market from falling. A Chinese broker said in a Black Sea conference that China is short of 50m tonnes of Corn and needs to import around 10m tonnes in 2020/21. This goes against the USDA’s prediction that China will import 7m tonnes next season. This number is big and will be bullish if it materialises.

France’s Corn condition worsened dropped by 1% last week, now at 61% good to excellent as dry weather continues to have a negative impact.

The Ukrainian Grain Association lowered its Corn forecast by 1.1m tonnes to 35.3m tonnes meaning it’s now almost flat from last year and down from the early estimates of around 40m tonnes.

Wheat closed the week slightly positive in Chicago with higher gains in Europe (all below 1%) as physical demand was reduced due to high prices. However, Chinese buying was strong like it was for Beans and Corn. The stronger dollar probably weighed in the small gains in Chicago.

Further buying from China and the September WASDE will be the keys this week.

We think we will see lower Corn yields in this week’s WASDE, towards the 178 bpa region. The average guesses will be published today or tomorrow, so we will soon see what the market is expecting too.

China will continue to play a major role in price behavior as it continues to buy grains to fulfill the Phase One Trade Agreement and its needs.

Despite expecting higher stocks for this new crop, both globally and in the US, we are supportive of prices in the short-term.

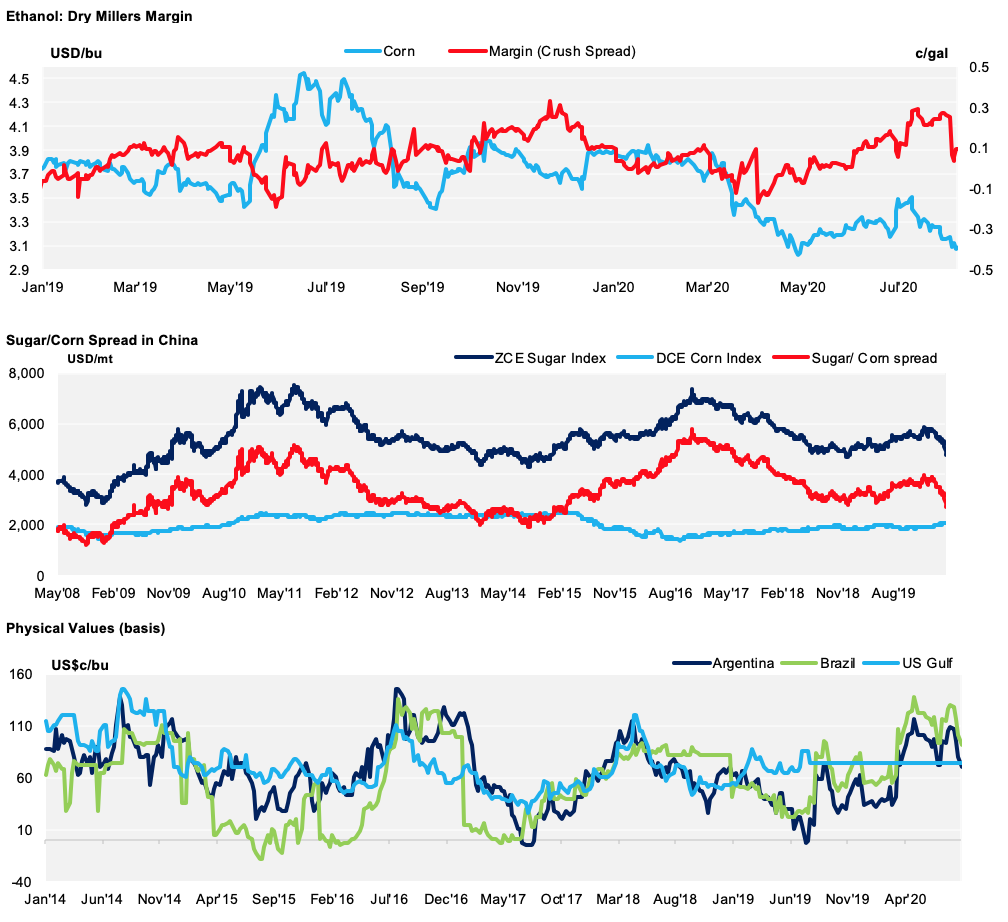

Price Action

Supply

WASDE Projections

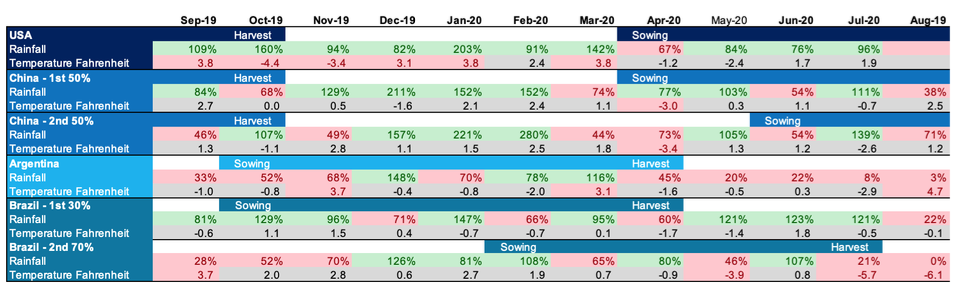

Weather in the Main Corn Growing Regions

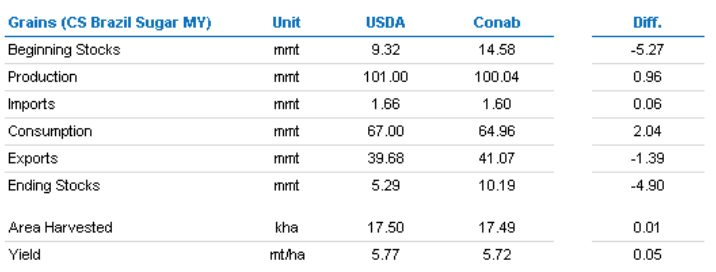

Brazil’s Balance

China

Demand

EU