Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

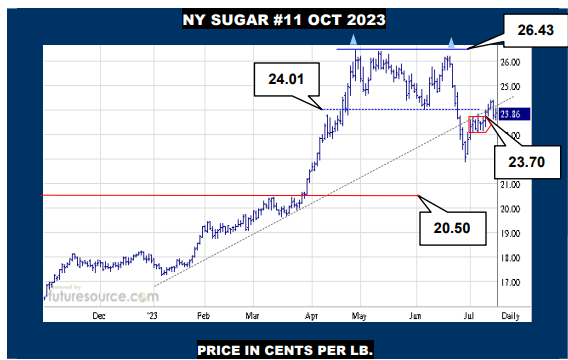

NEW YORK SUGAR #11 OCTOBER 2023

A gnarly little patch for NY to start the week as it picks at the 23.70 face edge of a prior small pennant shape after a swift expulsion from the top formation over 24.01. This creates a sense of hanging in a delicate balance as the market tries to decide if the departure of the Jly contract has lifted the weight from its back or not. In such fluid conditions, would want to see a second more persuasive thrust into the 24’s and a footing over 24.40 to bolster ideas of examining the 26’s again. Meanwhile a clearer cut snap of 23.70 could snowball on through 23.10 into deeper trouble.

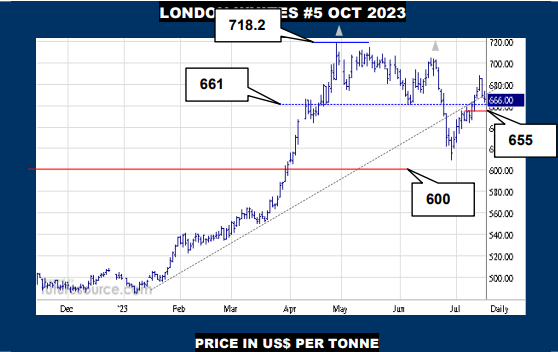

LONDON WHITES #5 OCTOBER 2023

London isn’t really helping to shed light in the shadows created by NY as it has slid back from the urgency of last week after bidding adieu to the Aug contract. If it can stabilize this wobble aboard the 655 ledge that is now hosting the mid band, no dire harm would have been done and there would be cause to still be open minded to a further foray topside into the 700’s. Alas though, if Raws were more overtly ditched from the 23.70’s and 655 cracked here soon after, it would have to be interpreted as a top rebuke and 600 would beckon once more.

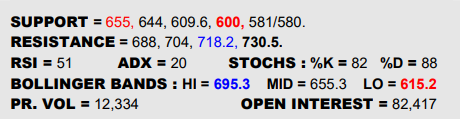

BLOOMBERG COMMODITY INDEX

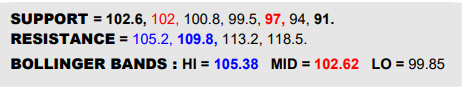

It continues to feel promising for the B-Berg as it has maintained its downtrend escape with a little consolidation over the past few days and is duly keeping the crosshairs pinned on the 105.2 resistance while the Dollar remains subdued. Busting free of 105.2 would serve to really underscore the trend reversal by pulling most of ’23’s action into a large if not absolutely textbook inverse H&S base. That could then serve as a springboard to take the fight to the only other serious obstruction in the shape of 109.8, beyond which an upmove could really gather steam. Only veering back under the mid band (102.6) would pick apart recent achievements and raise doubt about the commodity revival.

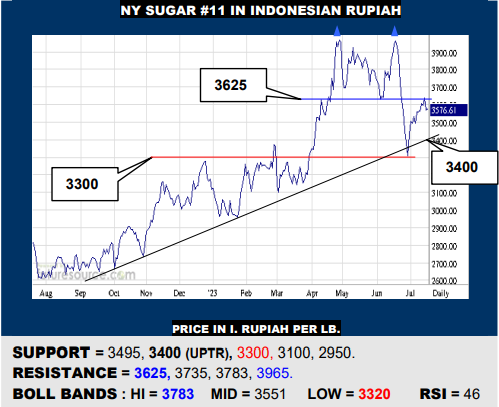

NY SUGAR #11 IN INDONESIAN RUPIAH

Rupiah priced Raws rebounded from near 3300 to thus sustain the uptrend from last summer but the bounce has been initially blunted by the 3625 rim of the Q2 double top. Must make a decisive impression into the 3600’s to start lighting passage to the 3900’s again then while currently wary of faltering and peeling back to try 3300 a second time.

INDONESIAN RUPIAH / US DOLLAR SPOT WEEKLY

Since the US rally stumbled as ’23 began, a large H&S has emerged and though stabbing back into it lately, the Dollar then flinched in early Jly via an outside week. This basically sets the task of clearing 15200 to dispel the top and restore a view of the 15700’s. Otherwise leery the outsider could lead to resumed scrutiny of pivotal 14600 support.

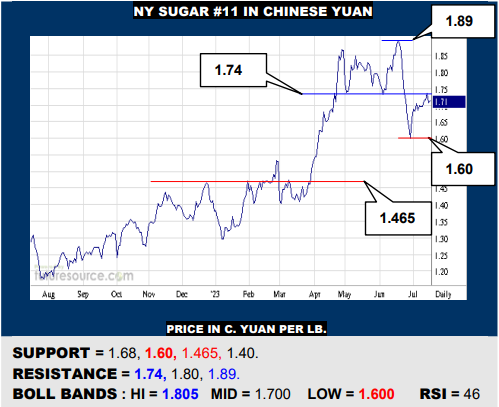

NY SUGAR #11 IN CHINESE YUAN

As above, the Jly bounce by Yuan priced Raws has been blocked by the 1.74 face edge of the Q2 top structure. Must bust decisively clear of that while ₵/lb. pops the 24.30’s to really make headway and bring the 1.89 peak into range again. Nearby jitters meantime warn to mind 1.68 as a tripwire back down to 1.60 and possibly on to the mid 1.40’s.

CHINESE YUAN / US DOLLAR SPOT WEEKLY

The ’23 trek back up from 6.70 was nearing last years’ 7.33 high but the US suffered a nasty flinch early in Jly. To help shake off from this, it must soon grapple back over the mid band (7.21), in which case giving the advance new legs again. If largely denied access over 7.21, beware further repercussions to the flinch and a drop towards 6.97.