Insight Focus

- Raw sugar futures reluctant to break above 24c/Ib.

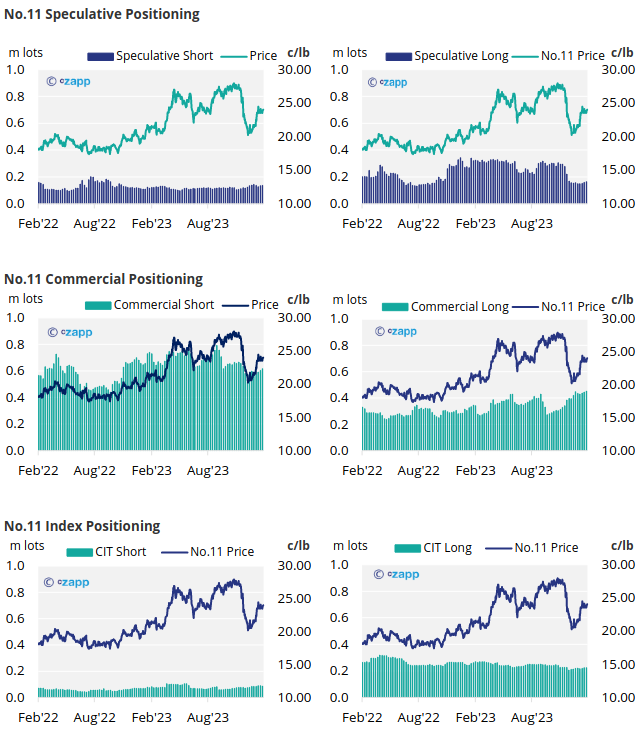

- Speculators remain uncertain about the market’s direction.

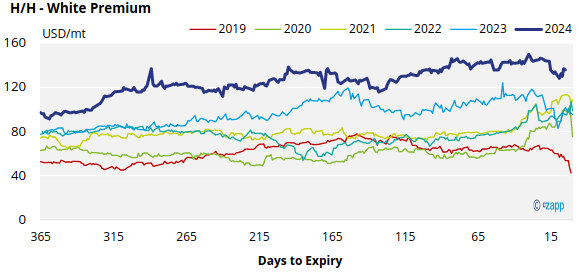

- The H/H white premium has weakened, currently trading at 136USD/mt.

New York No.11 Raw Sugar Futures

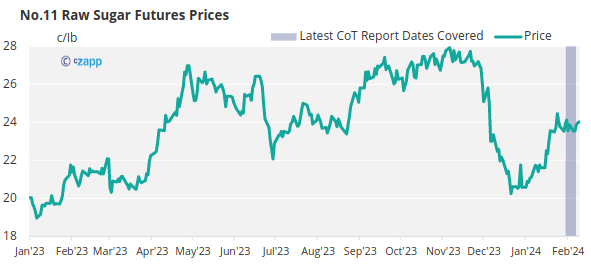

The momentum in raw sugar futures has faded, with prices remaining sideways, hesitant to break above 24c.

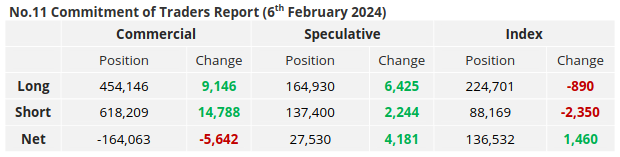

With the Mar’24 expiry only two weeks away, commercial participants have been busy locking in prices, with producers adding 14.8k lots of new hedges and consumers adding 9.1k lots.

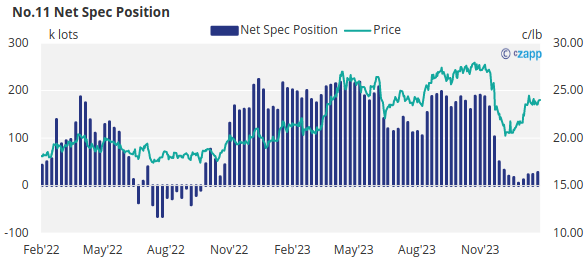

Turning our attention to the speculators, for the second week in a row, they have opened a number of long and short positions, unsure which direction to take given that the raw sugar market is currently caught between a bearish macro environment and bullish fundamentals.

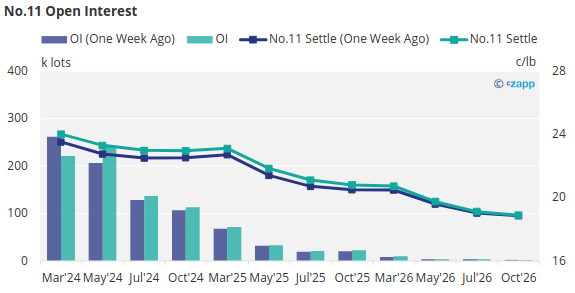

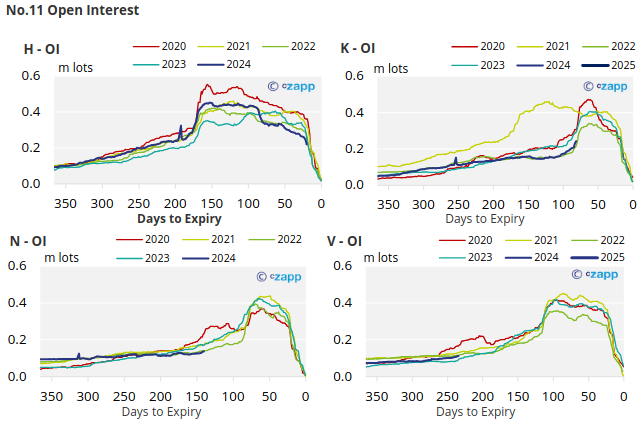

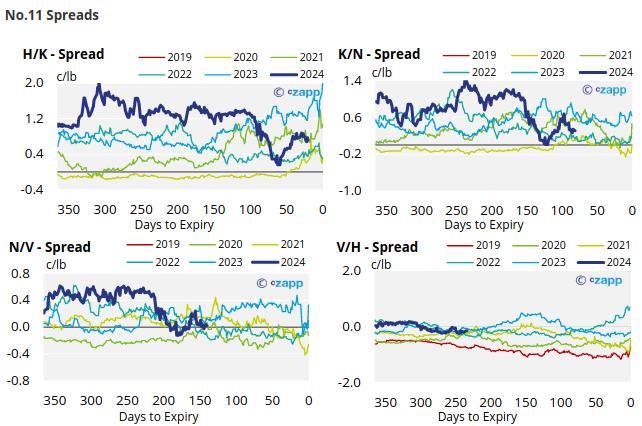

The No.11 forward curve continues to remain backwardated throughout 2024 until Mar’25, when we may see some market stress due to supply constraints, before becoming backwardated again until Oct’26.

London No.5 Refined Sugar Futures

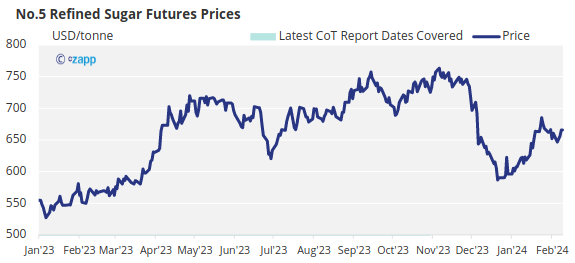

With only a few days until the No.5 refined sugar futures expiry, prices have risen over the last week, going from 646USD/mt at the start of the week to 665USD/mt by Friday’s close.

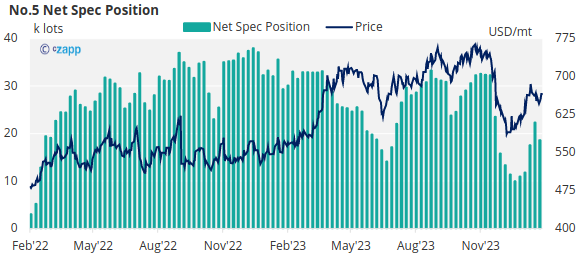

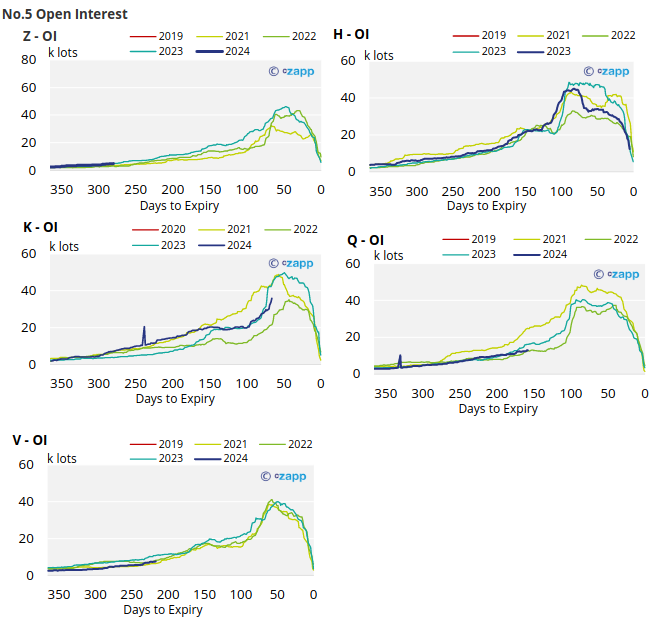

During this time frame, speculators decided to close 3.7k lots of long positions, bringing the total net spec position down to 18.6k lots.

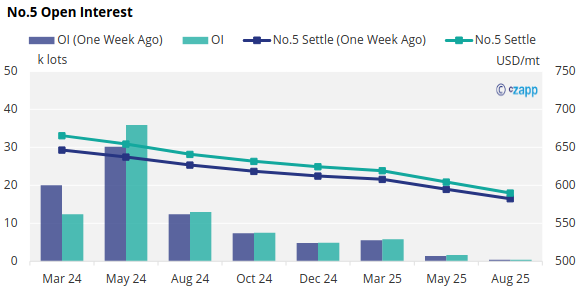

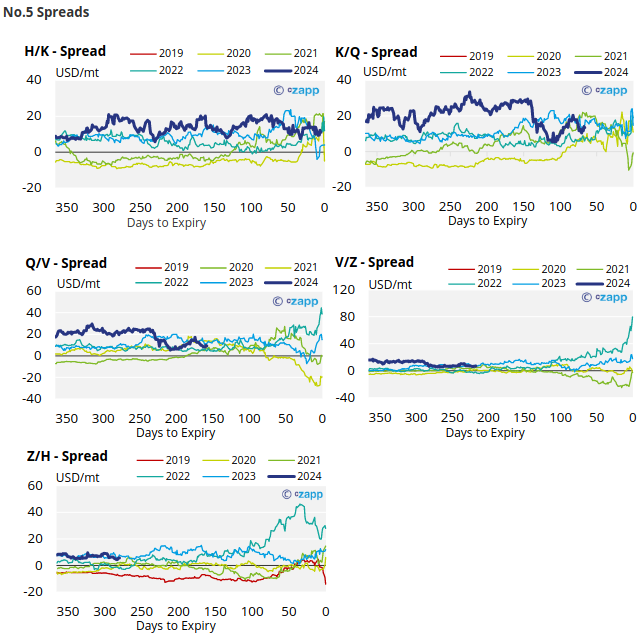

With contracts strengthening across the board, the No.5 forward curve remains backwardated through to Aug’25.

White Premium (Arbitrage)

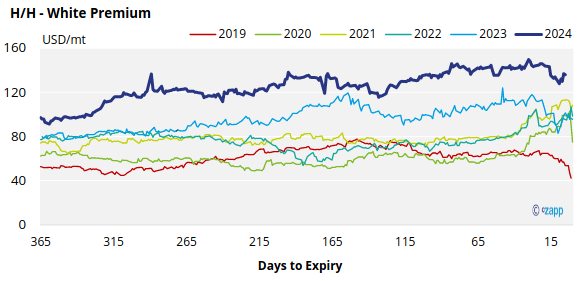

The H/H white premium has weakened slightly over the past week, and is now trading at 136 USD/mt.

We think re-exports refiners need around 100-115USD/mt above the No.11 to profitably produce refined sugar, therefore physical values should still be necessary to bridge this gap.

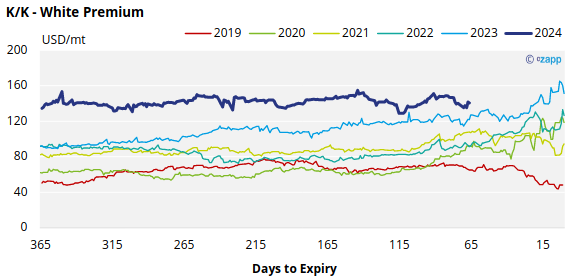

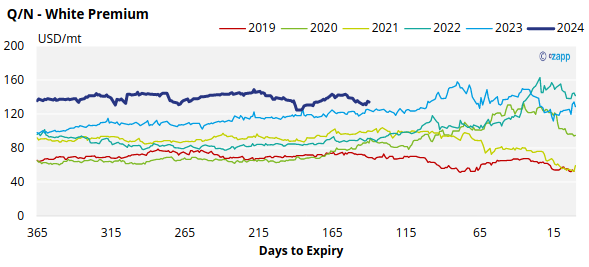

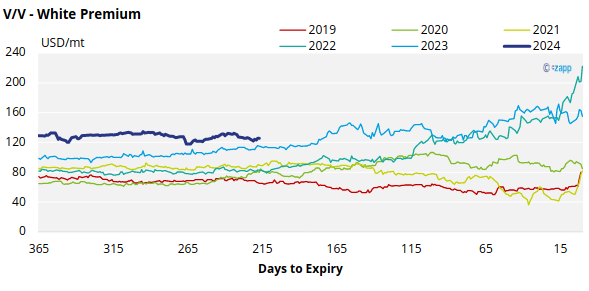

The refined sugar market is undersupplied for the majority of 2024, and this is reflected in comparatively strong K/K and Q/N white premiums which are both pushing toward 139USD/mt.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix