Insight Focus

- The Mar’24 refined sugar futures expired last week.

- Speculators of refined sugar opted to close out a number of long positions.

- The K/K white premium remains steady at 140USD/mt.

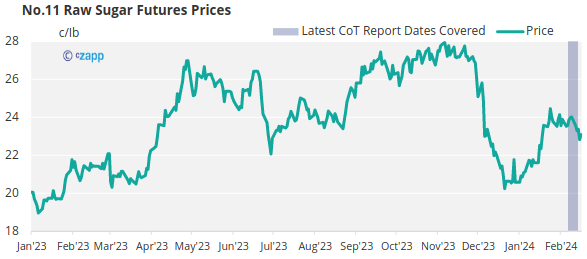

New York No.11 Raw Sugar Futures

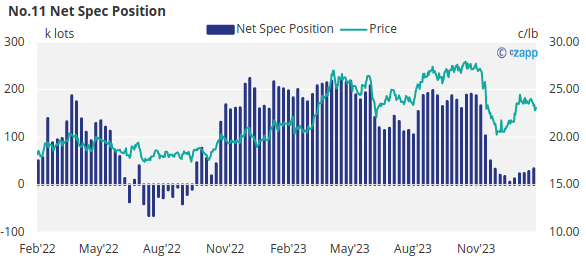

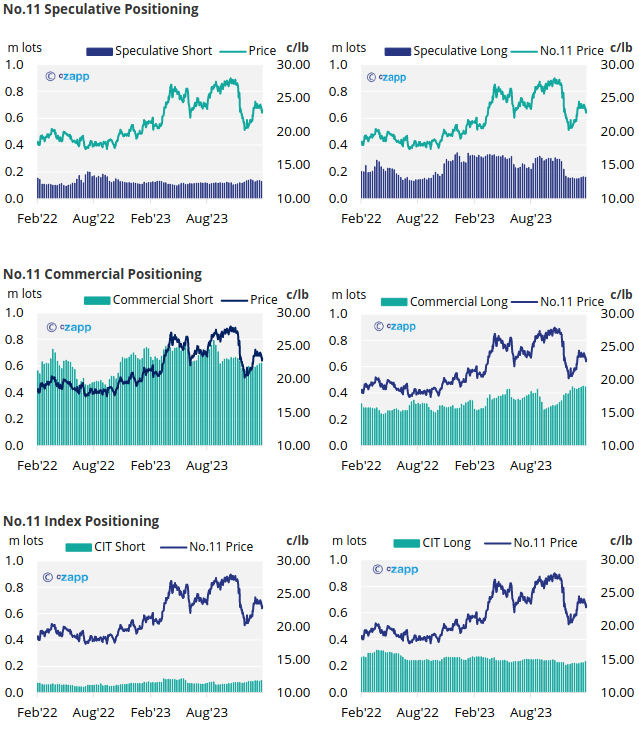

The momentum in raw sugar futures has faded, with prices holding steady within the 23-24c/Ib range.

Consumers of raw sugar find themselves in a favourable position leading up to the Mar’24 expiry, with little urgency to acquire additional futures contracts.

Producers, too, find themselves in a favourable position, as evidenced by the limited addition of new hedges in the past week. Given that current raw sugar prices remain significantly higher than the production costs of all major producers, it is expected that further producer selling could happen, especially if prices continue to trade sideways for an extended period.

Turning to the speculators, they are holding firm on their recently established long position and have opted to close out a number of their recently opened short positions instead.

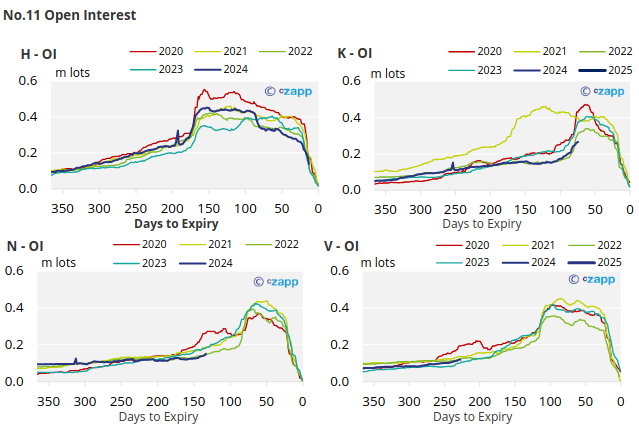

The No.11 raw sugar futures curve has levelled off, remaining mostly flat through 2024 before shifting to a slight backwardation in 2025.

London No.5 Refined Sugar Futures

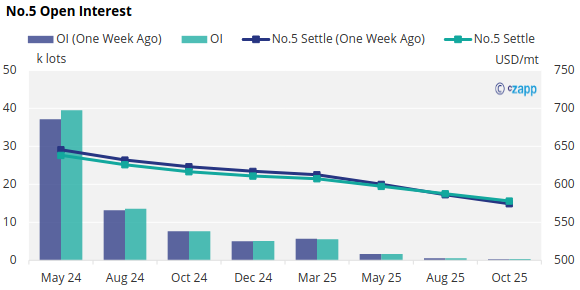

Last week, the Mar’24 refined sugar futures expired at 630 USD/mt. Since then, the May’24 futures has seen a slight uptick, closing at 638 USD/mt last Friday.

In this period, speculators opted to close out 1.7k lots of long positions, reducing the total net speculative position to 16.9k lots.

The refined sugar futures curve remains broadly flat in 2024 and the majority of 2025.

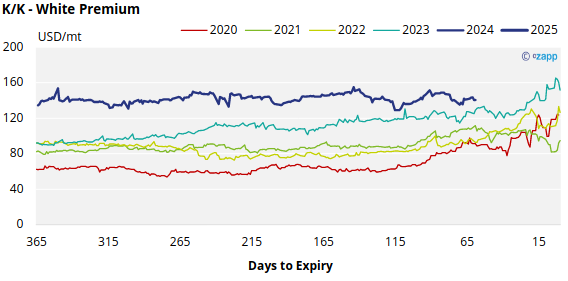

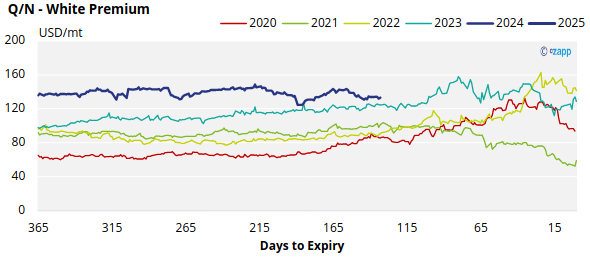

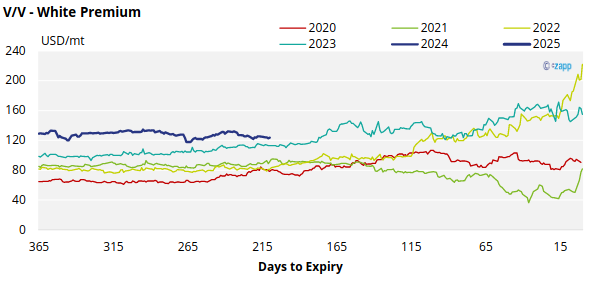

White Premium (Arbitrage)

The sugar white premium has broadly moved sideways over the last week, steady around 140USD/mt.

Many re-exports refiners need around 100-115USD/mt above the No.11 to profitably produce refined sugar, therefore physical values should still be necessary to bridge this gap.

The refined sugar market is slightly undersupplied for the majority of 2024 and this is reflected in comparatively strong Q/N and V/V white premiums.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix