Insight Focus

- No.5 (White Sugar) Appendix Both Raw and Refined sugar futures have strengthened in the past week.

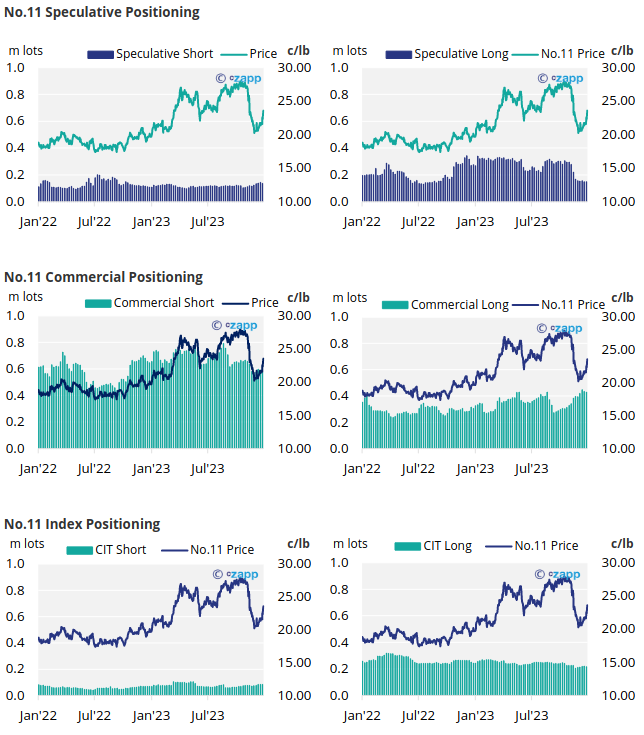

- Speculators close out a number of their short positions.

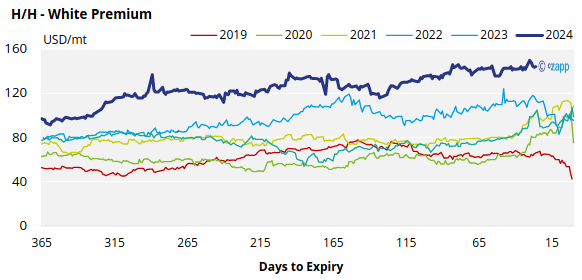

- The H/H white premium has traded sideways, now standing at 144USD/mt.

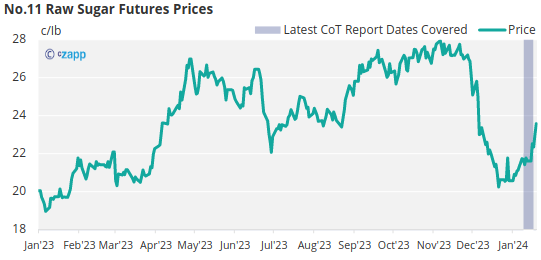

New York No.11 Raw Sugar Futures

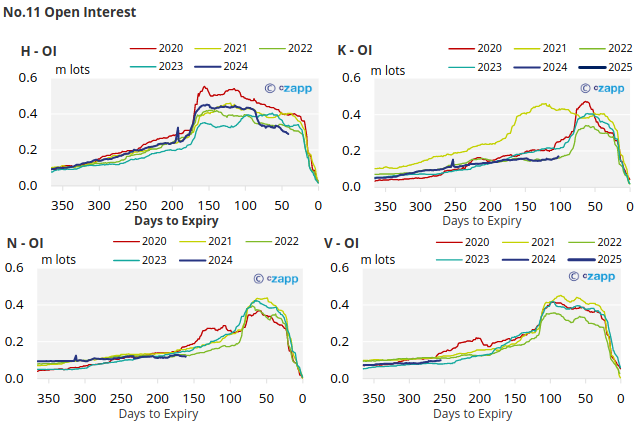

The No.11 raw sugar futures strengthened by 2c over the last week, going from a low of 21.5c at the start of the week to 23.6c/Ib by Friday’s close.

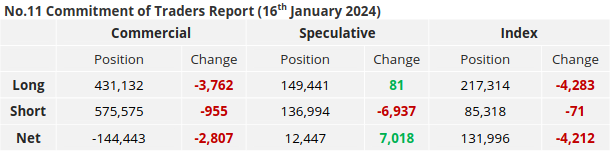

Looking at the commercial participants, both groups closed a number of positions, reducing the net commercial position to 144k lots.

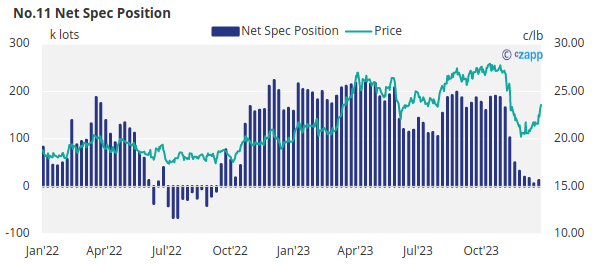

In the span of one week, raw sugar speculators closed out the majority of their short positions built up since Dec’23, opting instead to open a few long positions. Given the market’s current fragility, we can expect speculators to begin rebuilding their long positions with the right news flow.

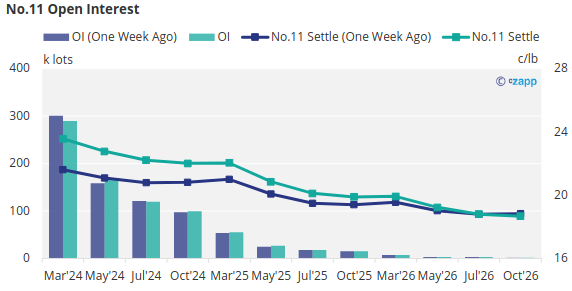

With contracts strengthening across the board, particularly the nearby Mar’24 contract, the No.11 forward curve is backwardated in 2024.

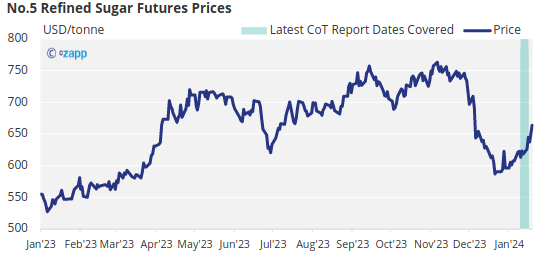

London No.5 Refined Sugar Futures

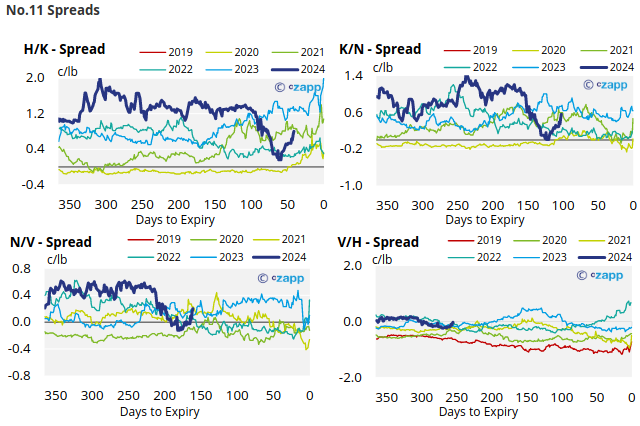

Following a similar trajectory to the No.11, the No.5 refined sugar futures has also strengthened in the past week, closing at 663USD/mt last Friday.

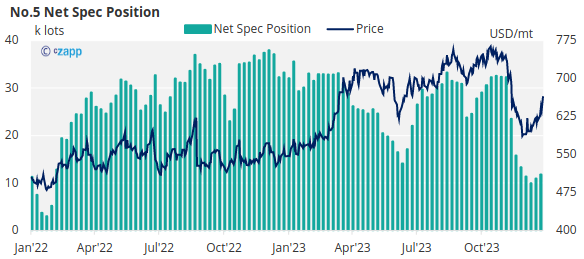

That said, speculators of refined sugar have chosen to extend their long position by around 0.9k lots, bringing the overall net spec position back up to 11.8k lots.

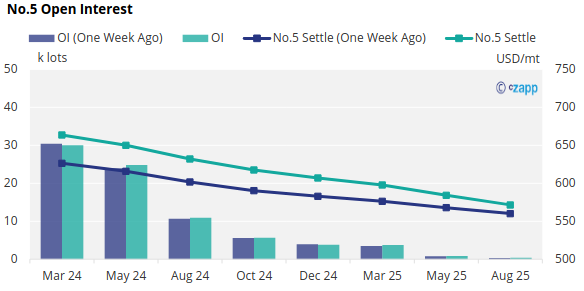

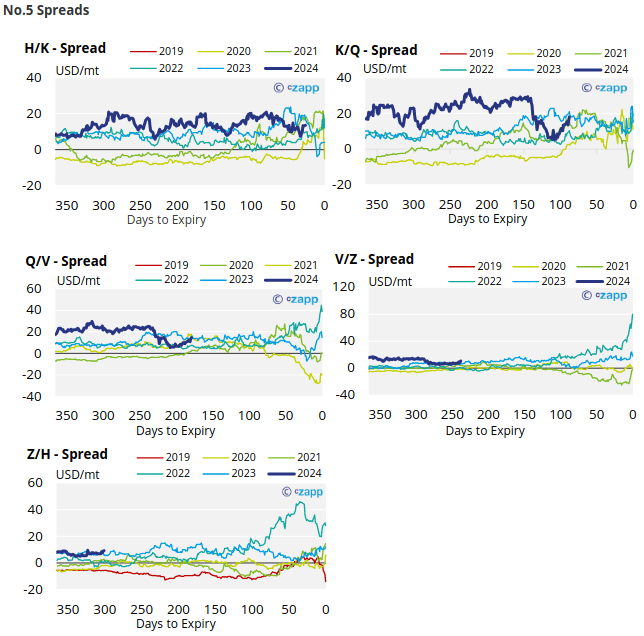

With contracts strengthening across the board, the No.5 refined sugar forward curve remains backwardated through to Aug’25.

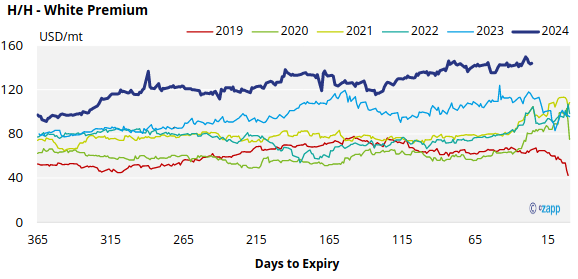

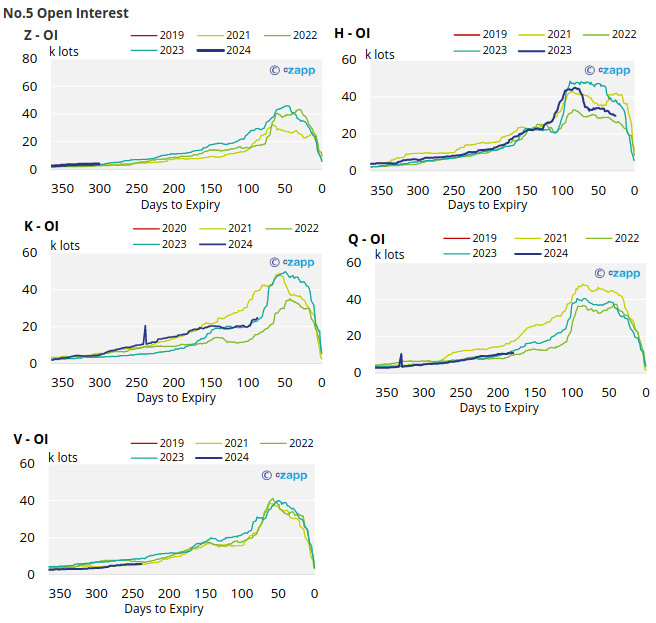

White Premium (Arbitrage)

With both the No.11 and No.5 making similar moves in the past week, the white premium has remained flat, trading at 144USD.

That said, we think re-exports refiners need around 100-115USD/mt above the No.11 to profitably produce refined sugar, therefore physical values should still be necessary to bridge this gap.

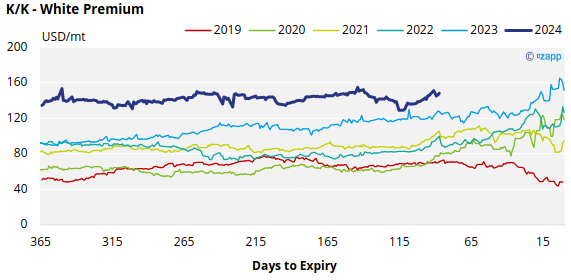

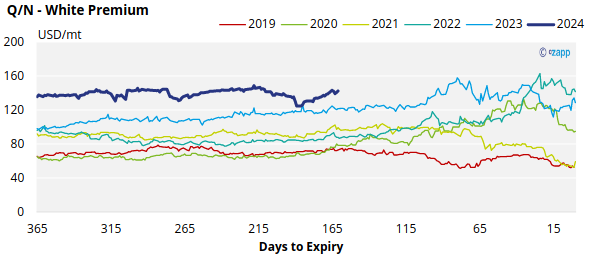

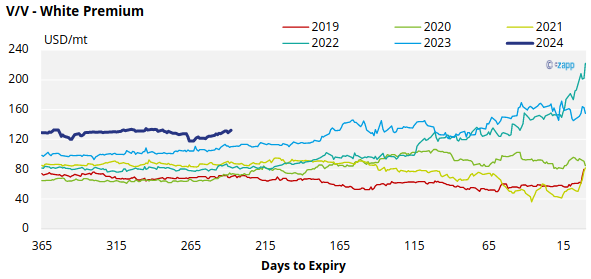

The refined sugar market is a undersupplied for the majority of 2024 and this is reflected in comparatively strong K/K and Q/N white premiums which are both pushing toward 145USD/mt.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix