Insight Focus

- The No.11 and No.5 sugar futures moved sideways in the past week.

- Speculators of refined sugar opened a number of long positions.

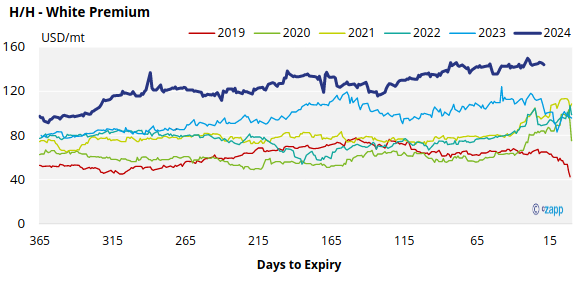

- The H/H white premium has traded sideways, now standing at 144USD/mt.

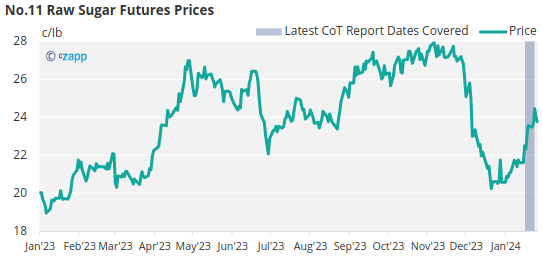

New York No.11 Raw Sugar Futures

The No.11 raw sugar futures traded sideways over the past week, hovering around 24c/Ib.

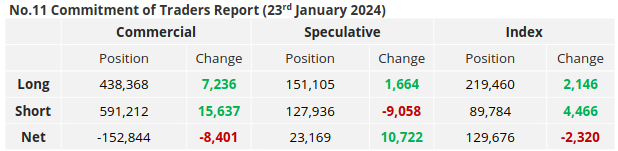

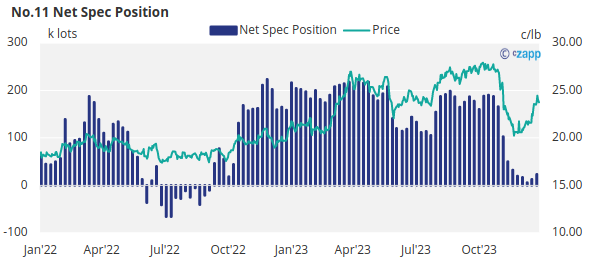

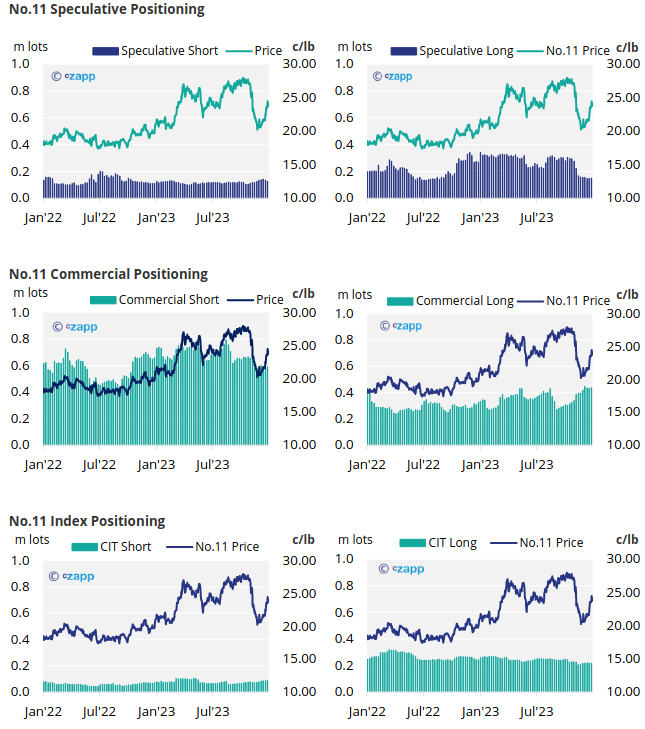

For the second week in a row, raw sugar speculators have closed out a large number of short positions in favour of opening a few long positions.

As a result, the total net spec position has increased by 10.7k lots to 23k.

The commercial participants have also been quite active in the past week, with both consumers and producers adding new hedges.

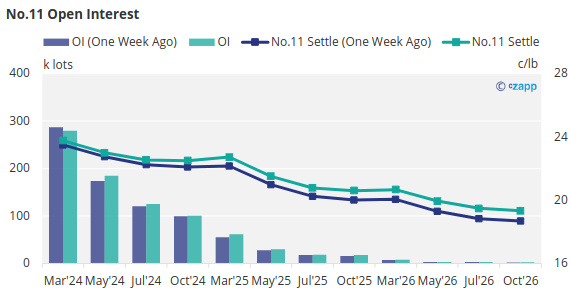

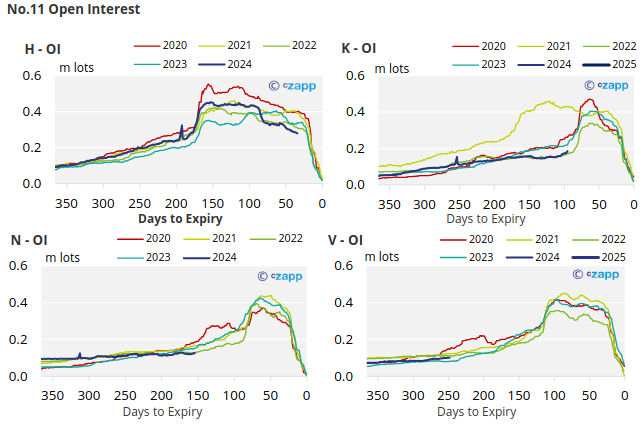

With contracts strengthening across the board, the No.11 forward curve remains backwardated in 2024.

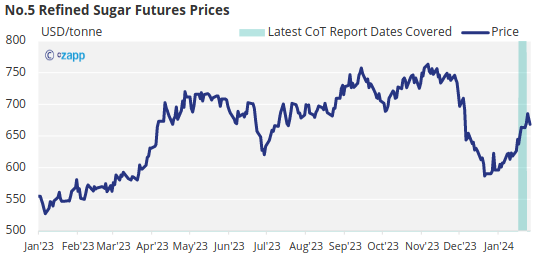

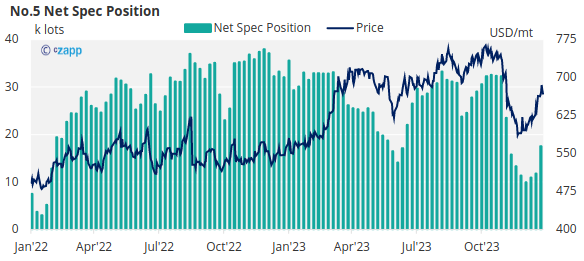

London No.5 Refined Sugar Futures

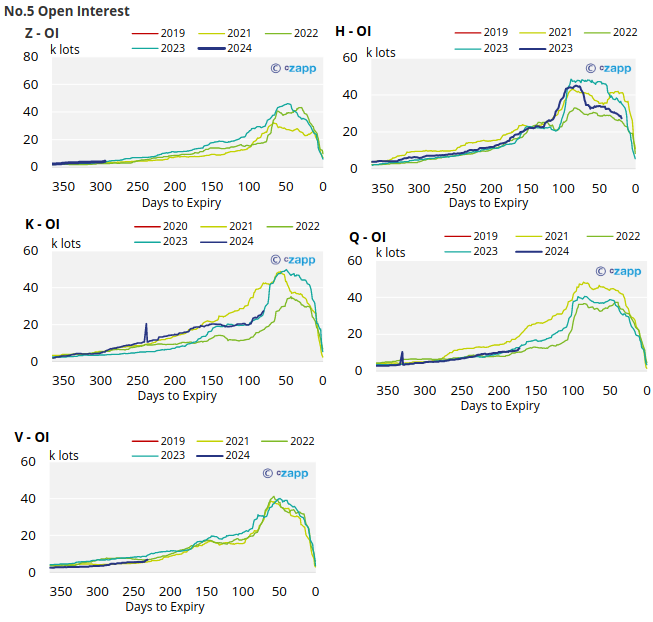

Refined sugar futures prices have also moved sideways over the past week, closing at 668 USD/mt last Friday.

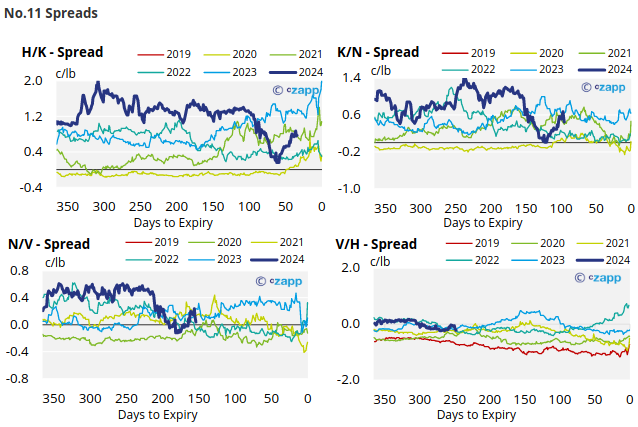

During this time frame, speculators opened 5.7k lots of long positions bringing the overall net spec position to 17.5k lots.

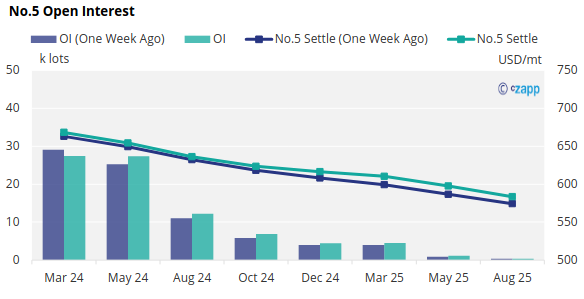

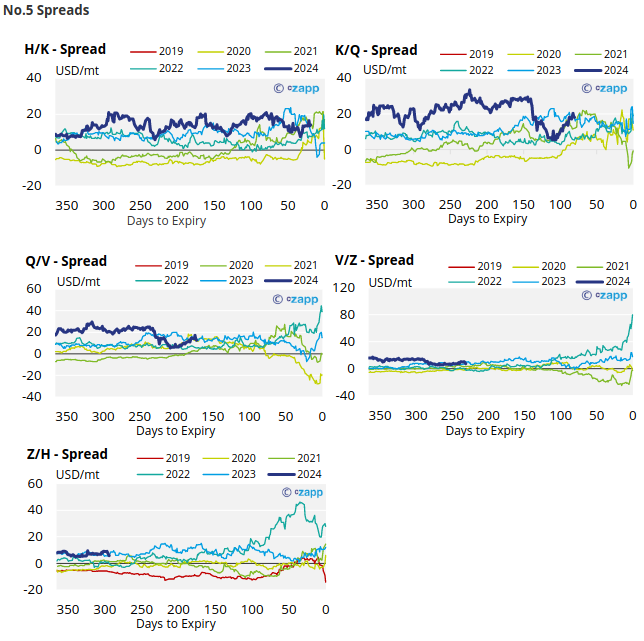

The No.5 forward curve remains backwardated through to Aug’25.

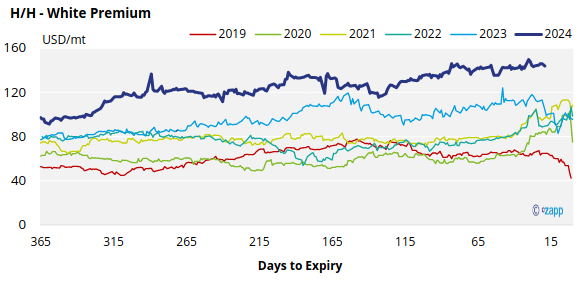

White Premium (Arbitrage)

With both the No.11 and No.5 making similar moves in the past week, the white premium has remained flat, trading at 144USD.

That said, we think re-exports refiners need around 100-115USD/mt above the No.11 to profitably produce refined sugar, therefore physical values should still be necessary to bridge this gap.

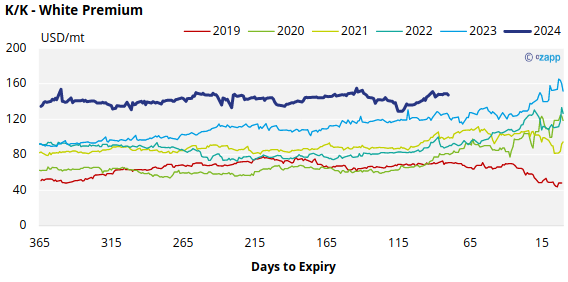

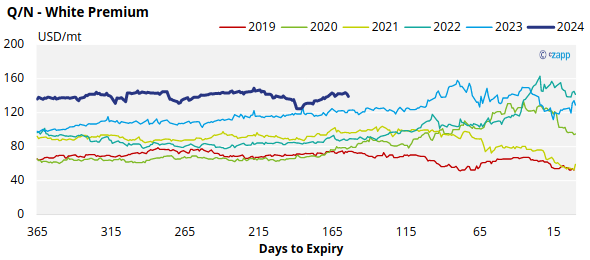

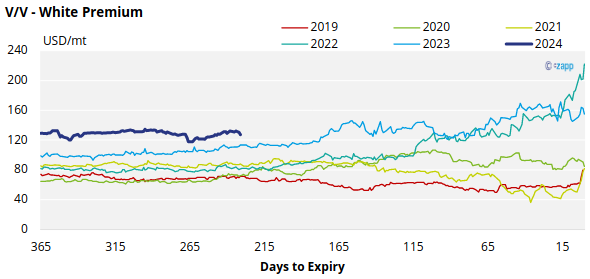

The refined sugar market is a undersupplied for the majority of 2024 and this is reflected in comparatively strong K/K and Q/N white premiums which are both pushing toward 145USD/mt.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix