Insight Focus

- The Mar’24 raw sugar futures expired last week.

- Both raw and refined sugar prices have since traded lower.

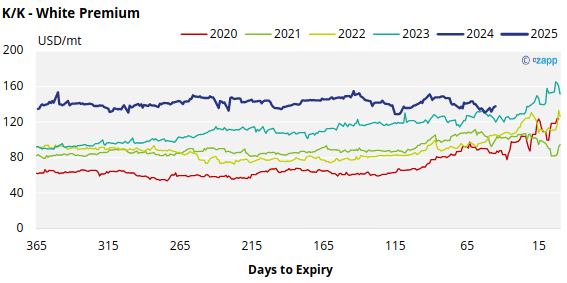

- The K/K white premium has strengthened, currently trading at 137USD/mt.

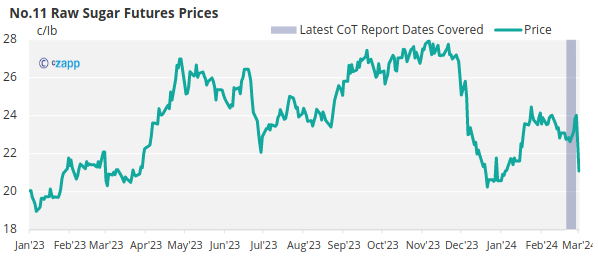

New York No.11 Raw Sugar Futures

The No.11 raw sugar futures expired last week, but prices have been moving lower, falling to 21c/Ib last Friday.

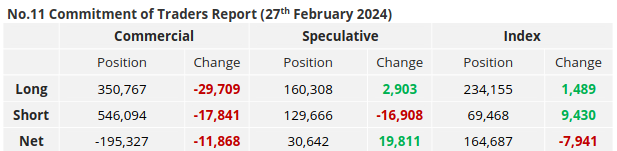

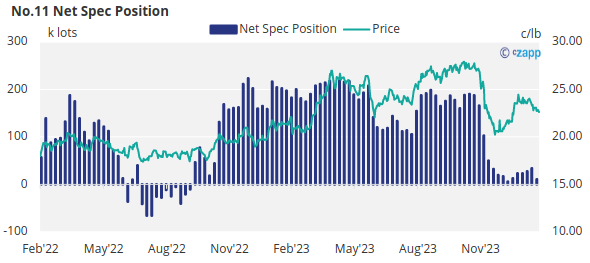

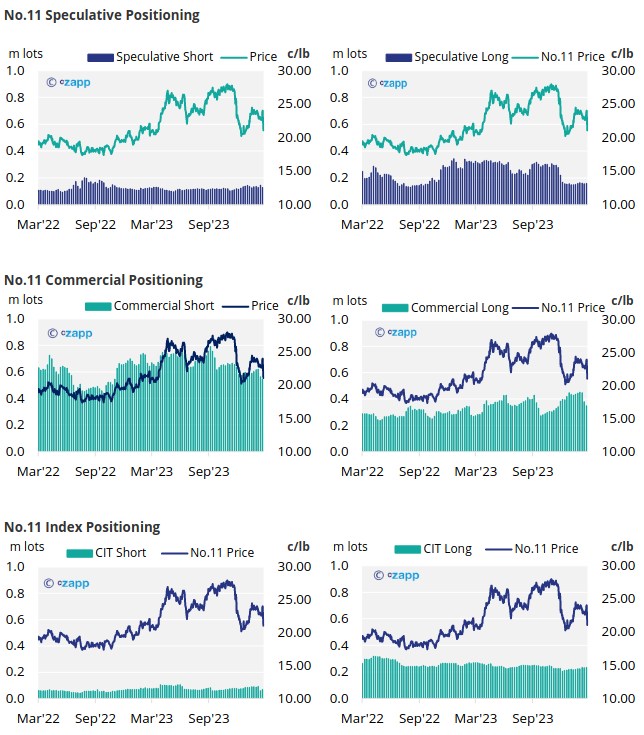

Starting with the speculators, they are largely on the sidelines of the sugar market. Over the last week, they have closed out 16.9k lots of spec shorts in favour of 2.9k lots of long positions. For speculators to re-engage and build on their long position, there needs to be some fresh news, but we just don’t have any yet.

Both producers and consumers are continuing to close their hedges, reducing the net commercial positions to 195k lots. With speculators out of the market, the focus is now on the mismatch between consumers (extremely well-hedged) and producers (adequately hedged).

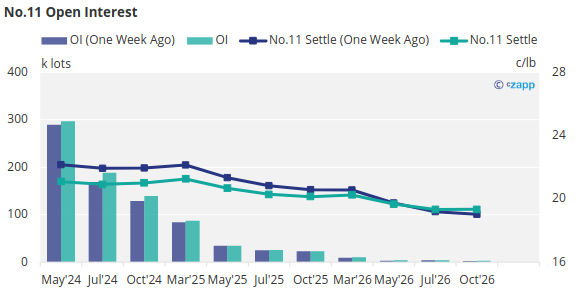

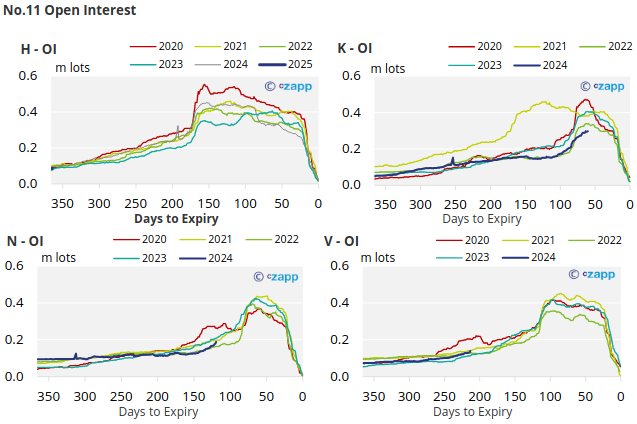

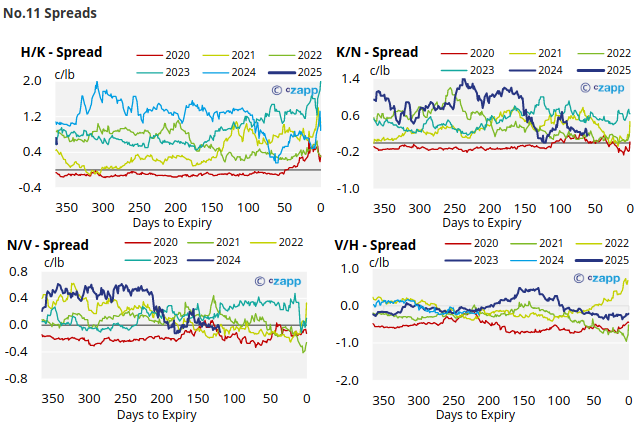

The No.11 raw sugar futures curve continues to remain broadly flat throughout 2024 before shifting to a slight backwardation in 2025.

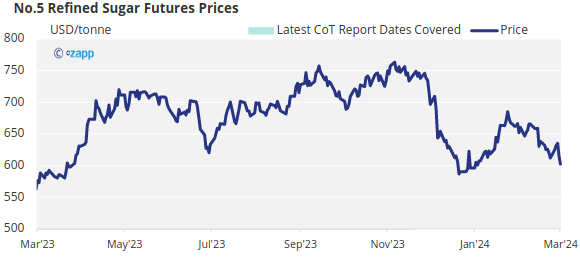

London No.5 Refined Sugar Futures

The No.5 refined sugar futures contract has weakened over the past week, falling from 624USD/mt at the start of the week to 602USD/mt by Friday’s close.

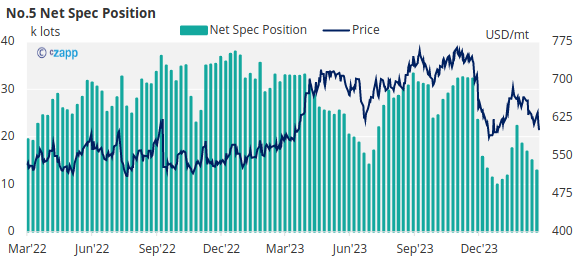

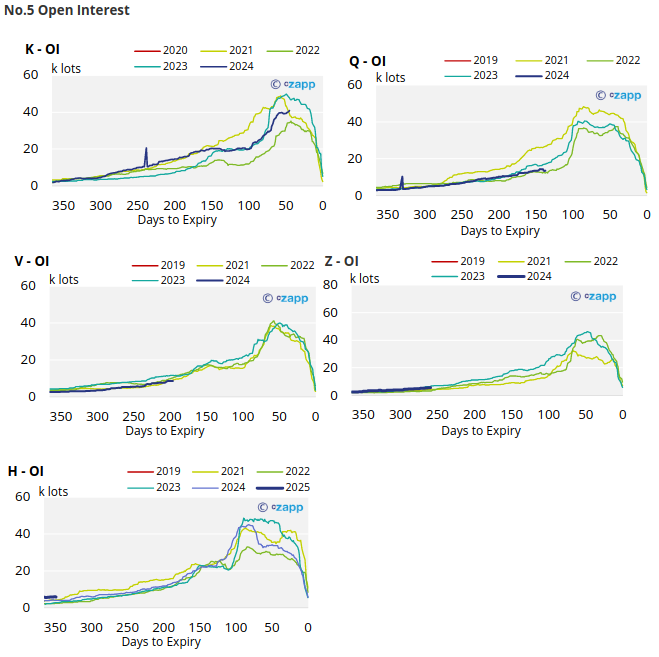

For the 4th week in a row, speculators of refined sugar have been closing off their long positions. In the past week they closed 2.2k lots of long positions, bringing the net spec positions down to 12.8k lots – the lowest number of positions held since Dec’23.

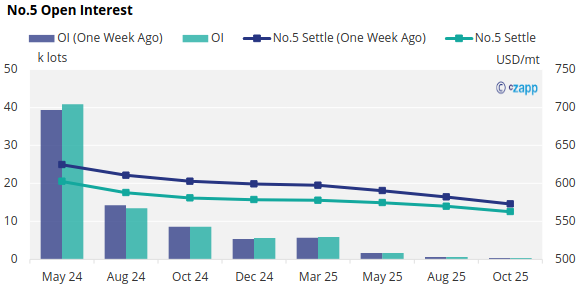

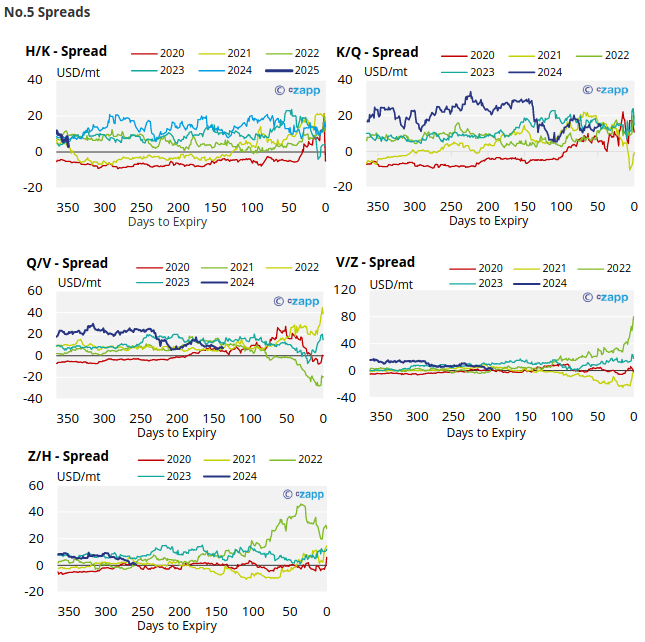

The refined sugar futures curve remains broadly flat in 2024 and the majority of 2025.

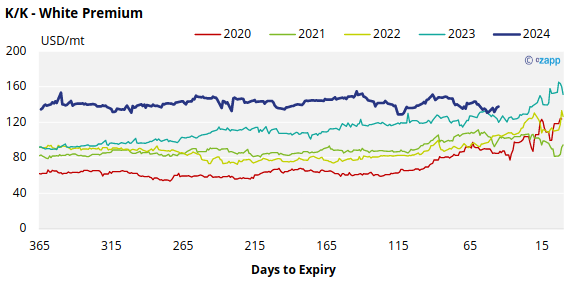

White Premium (Arbitrage)

The K/K white premium has strengthened over the past week, currently trading at 137.6USD/mt.

Many re-exports refiners need around 105-115USD/mt above the No.11 to profitably produce refined sugar, therefore physical values should still be necessary to bridge this gap.

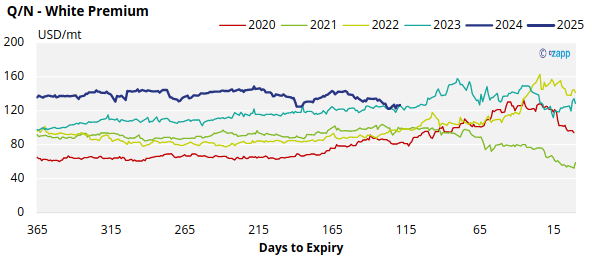

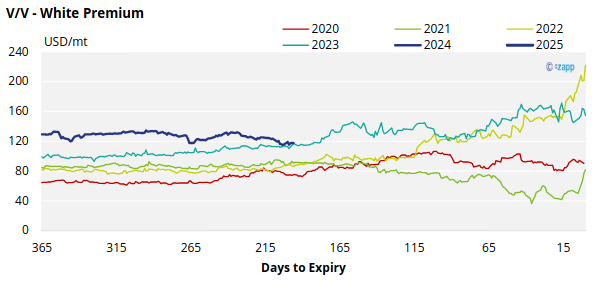

The refined sugar market is slightly undersupplied for the majority of 2024 and this is reflected in comparatively strong Q/N and V/V white premiums.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

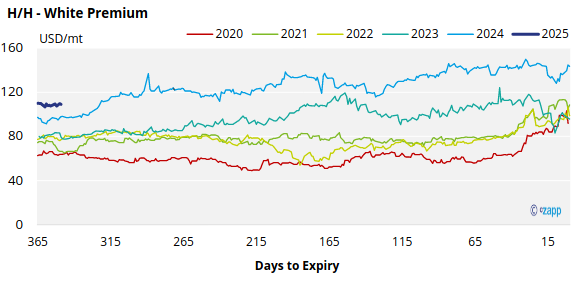

White Premium Appendix