Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

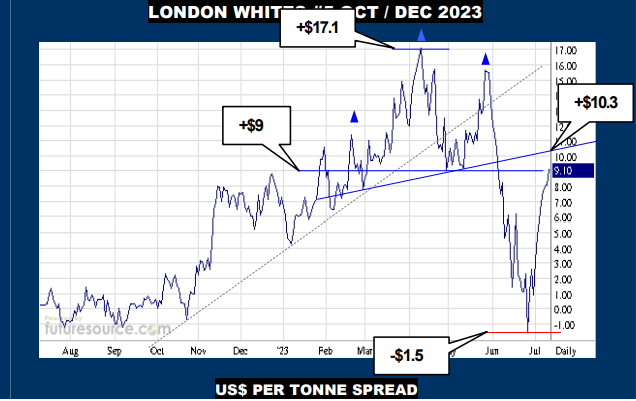

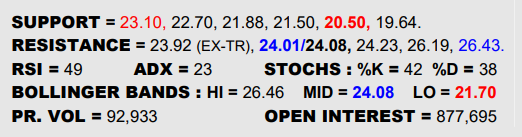

NEW YORK SUGAR #11 OCTOBER 2023

Pistols at dawn for NY as it arrived smack on the 24.01 doorstep of the prior double top Wednesday, the mid band lurking close by (24.08). Meantime the Dollar has taken a swat to new mid term depths so there is some macro coaxing in that regard but then Grains are having a wobbly time, Soybeans looking pretty toppy. Keen to see what occurs in the low 24’s to decipher what is liable to come next then, a decisive lunge clear of 24.23 liable to fan the flame towards the 26’s whereas nervous stabs that failed to grip would instead warn to keep watching the 23.10 trapdoor.

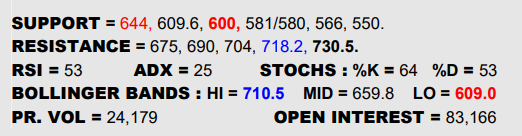

LONDON WHITES #5 OCTOBER 2023

London remains the hare as it overcame the mid band and 661 dual top frontier Wednesday. In isolation, this looks like a successful dilution of the previous top and brings the 700’s into the viewfinder but it simply isn’t realistic to totally ignore the critical battle that appears to be ensuing in the 24’s stateside. Naturally, swift entry to those 24’s in NY would allay concern to keep looking higher but in the interim day or two as that picture hopefully resolves itself, do also keep watch on the 644 pivot as twisting back below would signal a reversal.

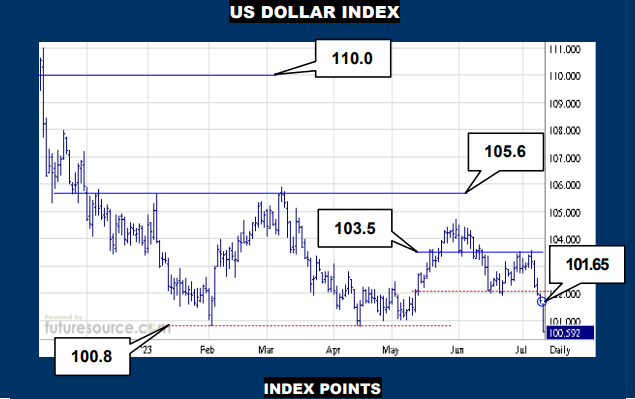

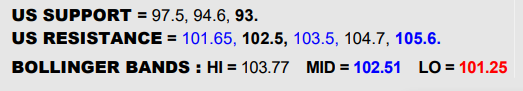

US DOLLAR INDEX

Recent fumbles in the mid 103’s have translated into a much sharper swat lower for the Dollar that rippled on to new depths under the Feb / Apr troughs of 100.8 Wednesday. So in spite of attempts to level out in ’23, the sequence of descending highs was never ultimately disrupted and the first half of the year winds up looking more like just a delay as opposed to an actual turn, RSI initially endorsing the decline with new lows of its own. The next prominent support terrain isn’t until the 94/93 ballpark so the only thing that creates a glimmer of doubt is exceeding the lower Bollinger band (101.25) but it would take a swift reflex over a tiny 101.60’s gap to instead hint at a false breakdown.

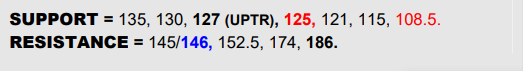

#5 / #11 WHITE PREMIUM OCT 2023

VALUE : $141.3

Briefly on the rocks in mid Jun, the Oct Premium uptrend still ultimately prevailed and has sparked a third venture into the 140’s. Third attempts are typically the ‘make or break’ events so the 145/146 peaks are bathed in the spotlight. Driving through would be an emphatic endorsement for the prior uptrend catch and would cast the past three months in a broad flag-like role, in that case setting a projection on up into the 170’s. Be much more cautious if the road started to get bumpy shy of 146 however, a third apex up here and twist back through 135 then starting to tip the balance the other way where any next slip through 125 would threaten at least testing 108.5 and could even leave triple digits.

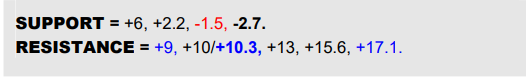

LONDON WHITES #5 OCT / DEC 2023 SWITCH

VALUE : +$9.1

“Take you right into the danger zone.” That song maybe more about F-14’s than #5VZ’s but it suitably highlights the Whites switch arriving at a pivotal juncture as it knocks at the door of the large H&S dominating the first half of ’23 (+$9). What happens between here and the +$10.3 pure neckline should give a clearer idea of the success (or failure) of the recent bounce. If Oct flat price can cement its arrival in the 660’s and aid conquest of the +$10’s, the road to +$17 would beckon anew. If blocked somewhere around +$10 however (a Fib retracement) while Oct was promptly expelled from the 660’s due to Raws perhaps failing at 24₵, be prepared for a sharp new backlash towards level-money.