Insight Focus

- We have reduced our global production forecast for 2022/23.

- This means that the surplus over consumption has shrunk to just over 2m tonnes.

- Our consumption estimate is unchanged this month.

2022/23 at a Glance…

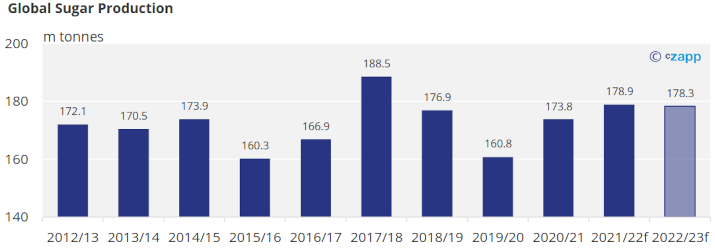

Global Sugar Production

In 2022/23 the world will produce 178.3m tonnes of sugar, the third largest on record after 2021/22 and the huge 2017/18 crop year. This forecast is 1.5m tonnes lower than in our November update.

The 1.5m tonne reduction comes from changes to a variety of minor sugar producing nations including Vietnam, Egypt and Japan.

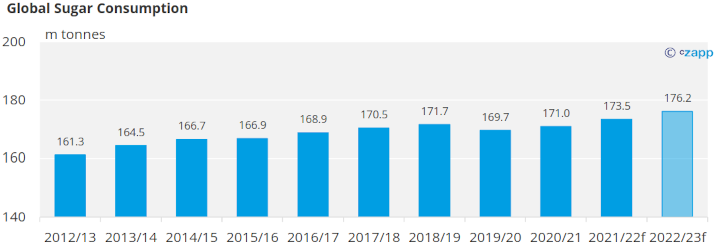

Global Sugar Consumption

In 2022/23 we think the world will consume over 176m tonnes of sugar, this will be the highest on record and represents almost 3m tonnes more than the Covid-19 affected 2021/22 season.

With news that the 8 billionth child has been born this month it is worth noting that population growth is the main driver of consumption growth in many parts of the world, particularly in more developed regions. We have not made any changes to this forecast since the last update.

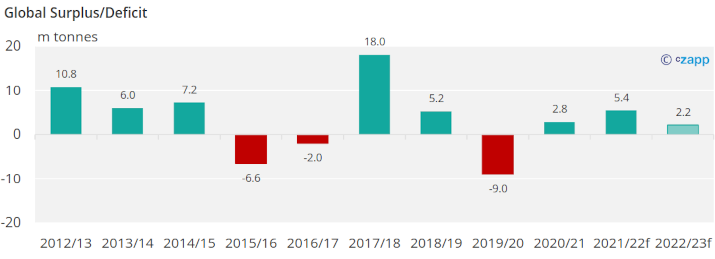

Small Production Surplus

With downward revisions to production in Russia and several minor sugar-producing countries, the global surplus forecast in 2022/23 has shrunk to 1.9m tonnes since the start of November.

Strong growth in consumption since 2021/22 and a small fall in production means this is just over half the size of the surplus observed in 2021/22.

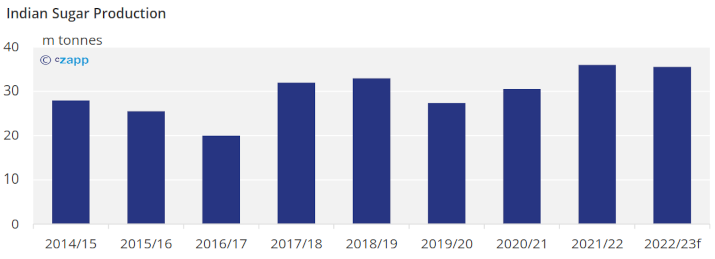

India Sugar Production Update

We think that India will produce 35.5m tonnes of sugar from the 2022/23 season, which is now underway. This is around 0.5m less than the record 2021/22 crop despite slightly higher planted area this year.

The Indian government has mandated that gasoline must be blended with at least 20% ethanol by 2025, an ambitious goal. This means that the increase in acreage will be more than offset by a larger increase in sugar cane diverted to ethanol production.

In order to prevent mills exporting too heavily this season leaving the country with too little in stocks, an export quota has been introduced. 6m tonnes of sugar exports have been permitted for the first half of the season, with an expectation of further export volume to be permitted later in 2023.

This means that total exports for the season are expected to fall shy of the 11.2m tonnes of sugar shipped in 2021/22.

Other Sugar Producers at a Glance…

If you have any questions, please get in touch with us at Will@czapp.com.