Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

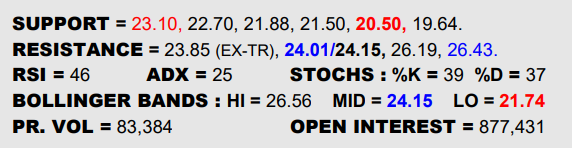

NEW YORK SUGAR #11 OCTOBER 2023

More hopeful macro events as the Dollar labored and Crude livened up combined with a feistier Whites market kept NY poking at the upside Tuesday, even if still not yet making anymeasurable headway to bother the looming top formation. To really shake things up, it is going to take a vault of the top rim and the mid band (24.01/24.15), in which case getting out onto a clearer road towards the 26’s again. Plenty of residual spec longs make it a very delicate balance meantime though so watch 23.10 carefully as a tripwire into a new dive towards 20.50.

LONDON WHITES #5 OCTOBER 2023

London was much more the attack dog Tuesday as it probed through the 661 double top border at the ex-uptrend now just beyond (663). Can’t claim a clean break yet though so these are pivotal moments as the battle rages but an outcome is still unclear. If the market can bust decisively into the 660’s ad dilute the top, it would be a promising step, though inevitably still needing to tug NY into the 24’s to feel truly confident ofmaking a new foray into the 700’s. Watch 644 as a key pivot below meanwhile, a reversal beneath pulling out the rug.

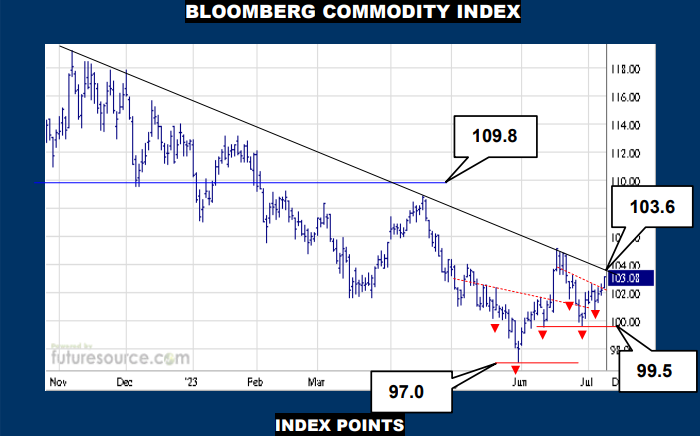

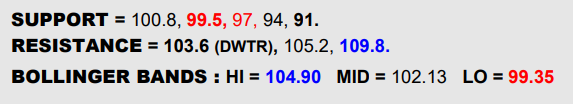

BLOOMBERG COMMODITY INDEX

Another lull in Dollar ‘Fed fear’ syndrome and a resulting slip from the 102’s alongside Brent making an initial foray over previously stubborn $78.5 resistance has given the B-Berg an encouraging jog out of a new small inverse H&S towards its main downtrend again (103.6). If it can overcome that trendline, the basing qualities of the past couple of months would intensify and an escape over 105 while the Dollar broke 100.8 would really sway the macro pendulum to the positive, sights then being raised to 109.8. Only yet another trend refusal and reversal below 99.5 would upend these seemingly hopeful developments and dull the commodity chant once more.

NY SUGAR #11 IN THAI BAHT

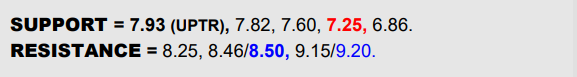

The view of NY Raws in Baht resembles the ₵/lb. chart itself as opposed to the more distorted top shape presented by NY priced in Real. Right here there is a quite uniform double top situated above 8.50 and, while a recent post-Jly contract bounce initially speaks to a ’23 uptrend (7.93), it has been a relatively tame uptick unable to reach that overhead border. That duly piques some hint of a bear flaggish vibe so the trend needs watching closely as the tripwire to resolve a flag and warn of a next flurry of losses to arrive at generally better support beginning at 7.25. Must otherwise hike clear of 8.50 to underscore the trend candidacy and give more cause to doubt that Q2 was the crest of the upmove, wherein 9.20 could come back into consideration again.

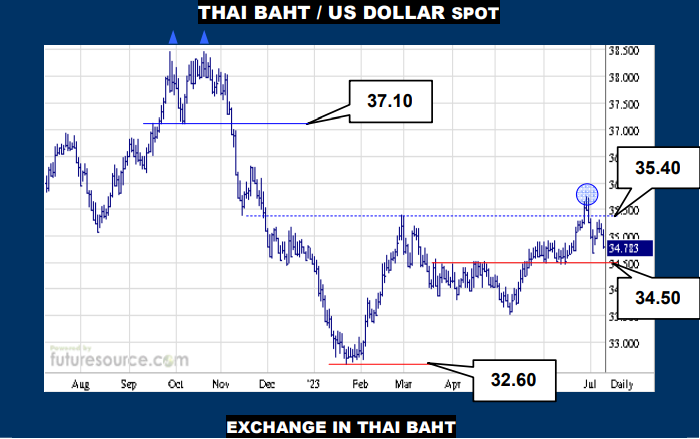

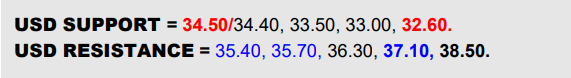

THAI BAHT / US DOLLAR SPOT

VALUE : 34.78

The Dollar poked beyond the 35.40 resistance late in Jun but it was a very short lived affair and the manner in which it was undone gives a distinct rumble of a false breakout. However, to confirm that impression will still require an ongoing drop to break the 34.50 support shelf. If that gave way, Jun-Jly would merge into more of a top and losses could soon intensify back through 33.50 towards the early ’23 low at 32.60. The greenback must grip above 34.50 otherwise if it is to have any chance to disprove the false breakout theory and make a more enduring getaway over 35.40 to test the 37.10+ late ’22 top.