Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

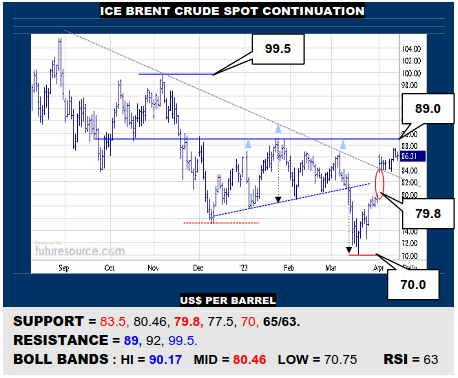

ICE BRENT CRUDE OIL SPOT

Brents’ bounce from the 70 H&S projection got added adrenaline from a wide 79.8 to 83.5 Opec gap as Q2 began that has broken the preceding year-long downtrend from 139. Nonetheless, to confirm this major trend escape will still require conquest of 89 to open the way to 99.5. If denied at 89, watch 83.5 as a potential stumbling block to steer out of the 80’s.

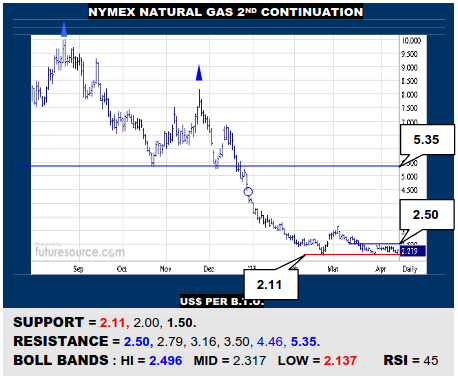

NYMEX NATURAL GAS 2ND CONTINUATION

Still the 2.11 support keeps warding off dips so the decline has clearly tailed off but Nat Gas must now score a decisive reflex back over 2.50 resistance to install an initial base that could act as a launch pad up to 3.16 and potentially on into the 4’s. If unable to trouble that 2.50 escape hatch, don’t yet discount breaking 2.11 and pressing to 1.50.

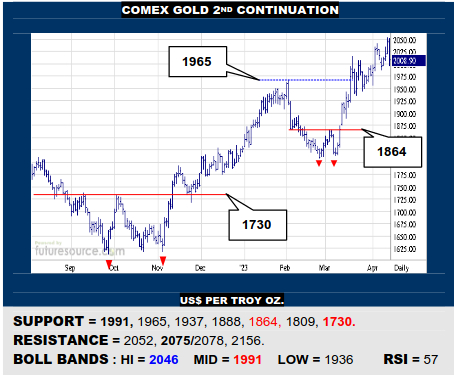

COMEX GOLD 2ND CONTINUATION

Golds’ break beyond 1965 has proven a bumpier process than originally seemed likely and long term peaks at 2075 have remained elusive, a sharper setback featuring Friday. Watch the mid band (1991) closely now as its demise would threaten a further gouge through 1965 back to 1864. Must grip at the mid band to instead refresh the advance.

LME COPPER 3-MONTHS

Copper has gradually developed an inverse H&S shape in early ’23 but must score a decisive exit across 9095 to complete the base and point on up to 9550 and later 9800. Watch Dollar index resistance at 102.8 meantime as its’ defeat could well undercut the basing effort here and a slip below the mid band (8873) would tip the balance back toward 8440.

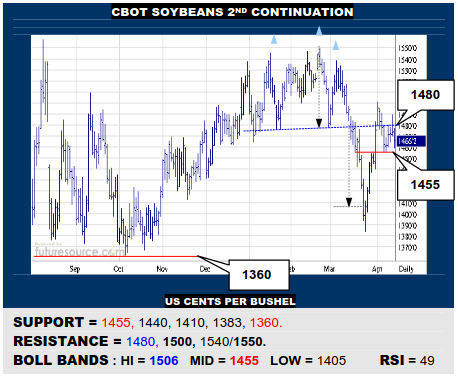

CBOT SOYBEANS 2ND CONTINUATION

The Mch delve to the 1380’s easily met a H&S projection and Beans have rebounded to stab at that top above 1480. Alas, early Q2 jitters will henceforth demand piercing 1500 to defeat the top and create scope on up to 1550. A fragile balance meanwhile as the mid band arrives at the nearby 1455 support, a break threatening a delve back to 1410.

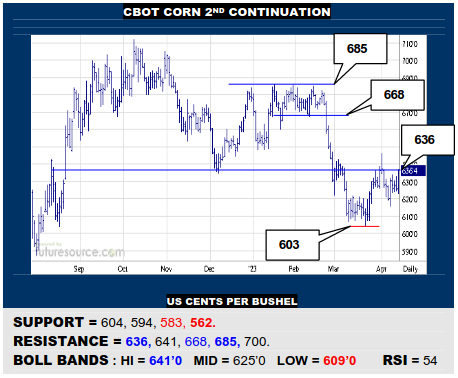

CBOT CORN 2ND CONTINUATION

Corn has weathered an initial rebuke from the 636+ top formation and resumed attacking it Friday via an outside day. If it can now bust through into the 640’s, make way for further gains to 668 and even 685. Only another denial and twist back under 620 would instead reassert the tops’ control and threaten a further break of 603 on down to 560.

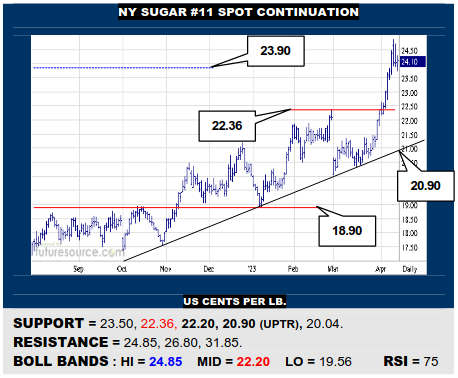

NY SUGAR #11 SPOT CONTINUATION

A very strong transition from Q1 to Q2 has seen Sugar pierce the prior ten year high of 23.90 and thus far maintain that break. This creates the chance for a bull flag if 24.85 could soon be overcome to expand sights to the 30’s. Some macro creaks meantime warn to mind 23.50 as a trigger for a correction back to the 22.36 support shelf instead.

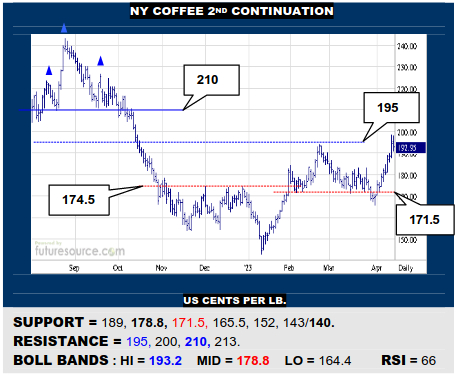

NY COFFEE 2ND CONTINUATION

Coffee quickly dispelled a Feb-Mch H&S as it rallied back strongly in Q2 and this instead suggests shrugging off a Mch correction, seeking a cleaner getaway across 195 to pave the way on to a former H&S lurking above 210. Cautious of an inside day Friday though so do watch 189 as a nearby stumbling block to force a dunk back to the mid band (178.8).

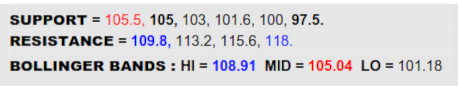

BLOOMBERG COMMODITY INDEX

A generally encouraging landscape for commodities at present as the B-Berg has pulled free of the year-long downtrend that followed the 140 spike at the start of the Ukraine war while the Dollar has returned to that key 100.8 precipice. Nonetheless, this useful first step to resuscitation does need a confirming escape across the hefty 109.8 threshold that will likely be linked in large part to whether Brent meanwhile conquers its comparable major hurdle at $89. Success would ratchet up the sights to first 118 and later the 125 region but be more wary of several stumbles in the face of 109.8, then watching a 105’s gap closely as a trapdoor back down into a murkier fray again.

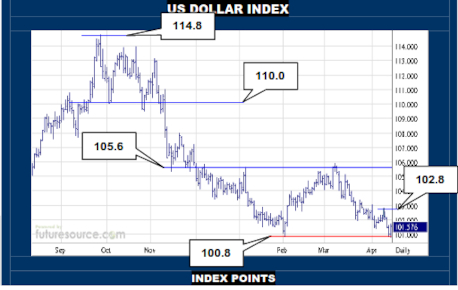

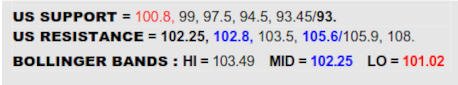

US DOLLAR INDEX

After a Feb correction, the Dollar has ground back down to dice with the preceding 100.8 low again. What transpires here should tell a broader tale as the 103 level originally looked like a major multi year base rim but was compromised so the fate of 100.8 will now serve to either resurrect that base structure or hail its total collapse. A marginal outside day Friday gives a first murmur of rebellion but must lead to a reflex on over the mid band (102.25) and 102.8 nearby apex to really shore it up and pose serious danger to the commodity revival. On the other hand, tipping over 100.8 would confirm the big base implosion and point on down to the 93’s before meeting a next significant buffer zone.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.