Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

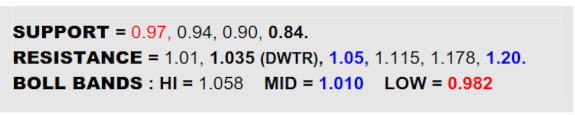

ICE BRENT CRUDE OIL SPOT CONTINUATION

Foiled a fortnight ago just inside the 97 rim of the large ’22 top, Brent has since still shown signs of fight this week to steer clear of the monthly base border at 86.7. This at least gives a chance for an inverse H&S if a next lunge higher could stay the course beyond 97 but a cleaner snap of 86.7 would instead reassure the new lid and light the way towards 65.

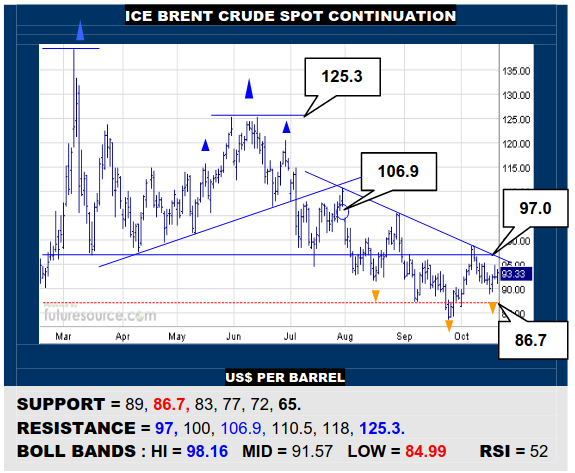

NYMEX NATURAL GAS 2ND CONTINUATION

Post H&S congestion around 7.00 has ultimately collapsed into a bear flaggish breakdown and Nat Gas has pressed on towards the pivotal

mid-year trough at 5.35. Gouging beneath there would form a major double top to point on south to 3.50. Must otherwise dig in at 5.35 and

react back over a low 6.70’s gap to signal a more hopeful outlook.

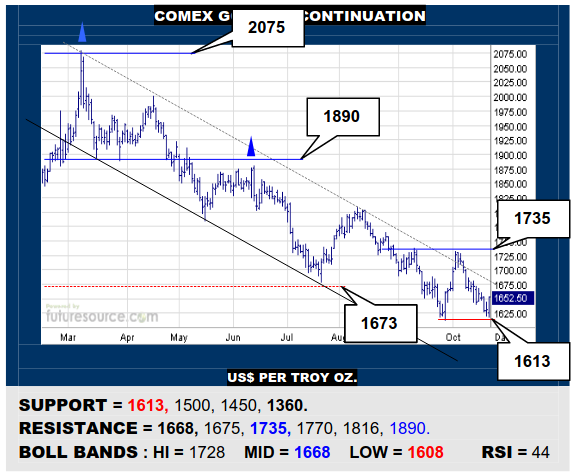

COMEX GOLD 2ND CONTINUATION

While a brief early Oct downtrend break was swiftly undone, Gold still showed some resilience Friday with an outside day just clear of its 1613 Sep trough. If it could hone this effort with a vault of the mid band (1668), ideas of a double bottom would begin to grow. If stunted by the mid band and forced below 1613 though, a dark cavern to 1360 awaits.

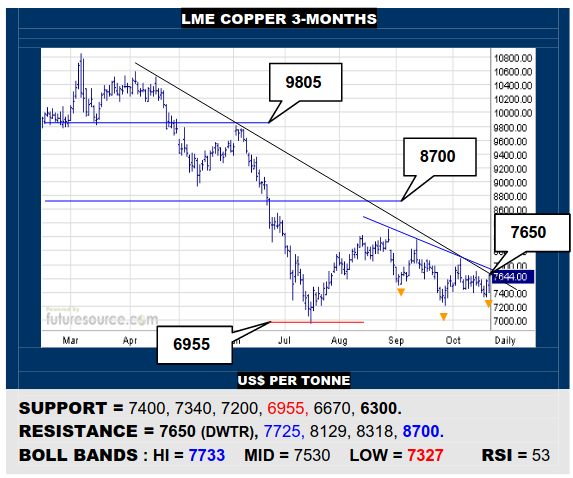

LME COPPER 3-MONTHS

Copper withstood a B-Berg rattle of pivotal 109.8 support and jabbed back up Friday to confront its midyear downtrend (7650). If it could bust free, an inverse H&S might soon follow via escape over 7725, beefing up the market for a rally to the big weekly frontier at 8700. If foiled in that 7650-7725 span however, beware swerving back down towards 6955.

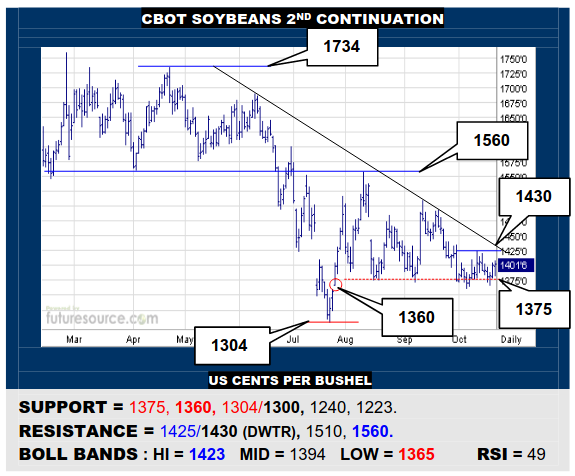

CBOT SOYBEANS 2ND CONTINUATION

Beans have continued to hold the 1375-1360 support to edge back over the mid band. For now this keeps the incoming downtrend within reach (1430) and breaking free from it would really shore up the footing with a small new Oct dual bottom, implying scope up to 1560. Keenly aware still however that 1360 must survive to prevent a much steeper drop.

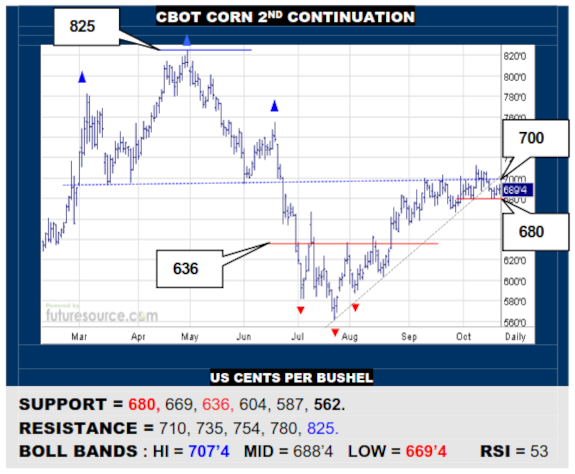

CBOT CORN 2ND CONTINUATION

Corn may have briefly jabbed the top above 700 but it then slipped back through its uptrend this week. This emphasizes the prior momentum decay so watch 680 very closely as a trigger for a sharper retracement to the 636 previous base rim. Otherwise only a close north of 710 would make the case for a more successful dispersal of the overhead top.

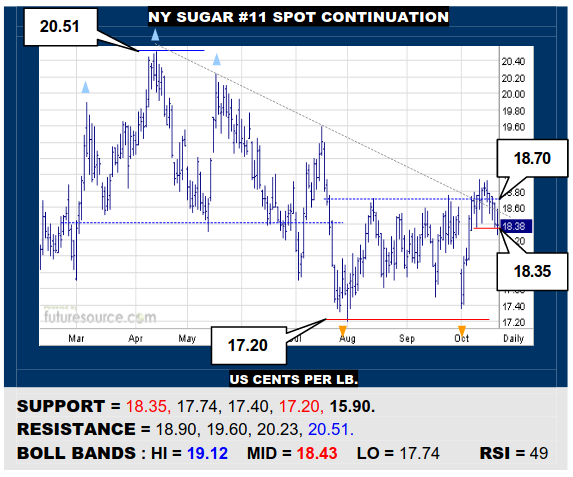

NY SUGAR #11 SPOT CONTINUATION

Sugar just couldn’t find traction over 18.70 and has slipped back to the 18.35 support ledge, gnawing away the mid band. If it cannot dig in here, the Q4 boost would unravel and there would be risk back into the lower 17’s once again. Only a quick new flurry to pop 18.90 could reassert the downtrend escape and spark a run into the 20’s.

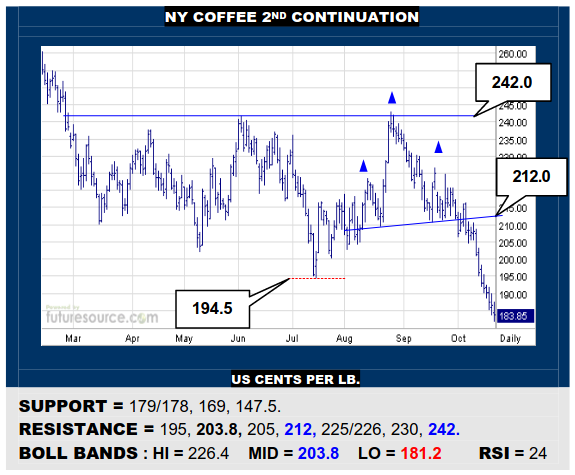

NY COFFEE 2ND CONTINUATION

Coffee has had no answer for the Aug-Sep H&S top and continues to cascade down the hill towards the 179/178 top projection zone. Would certainly cater for taking a breath if soon reaching the upper 170’s. Alas, it would meantime demand a close back over 195 to shake off the dive sooner and present a more immediate corrective chance towards 212.

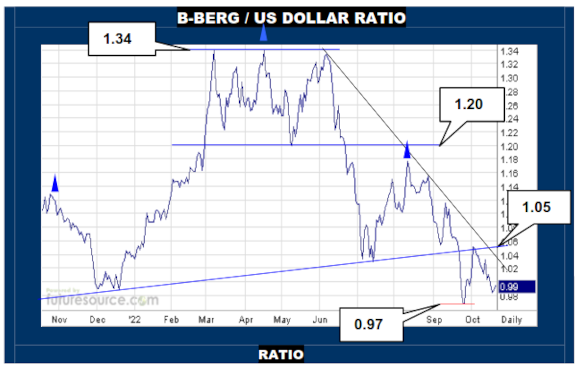

B-BERG / US DOLLAR RATIO

Dicey moments for commodities as the B-Berg has tagged 109.8 again and the Ratio shows the late Sep bounce was intercepted by the neckline (1.05) of the broad H&S dominating the past year. This implies a corrective breath has come and all but gone where loss of 0.97 alongside 109.8 would reiterate a broader topping out of the commodity sector, exposing very sparse ground below with jus a minor ledge at 0.90 on the way down to somewhat better bracing at 0.84. Teetering on the brink then and only gritting the teeth here and pivoting back up across the downtrend (1.035) and that shadowing neckline would mark a critical catch to significantly tip the balance the other way.