Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

Only available in March, Free 2-week trial to TechCom’s daily Sugar Technical Review. Please just reply ‘Yes’ with your e-mail address here.

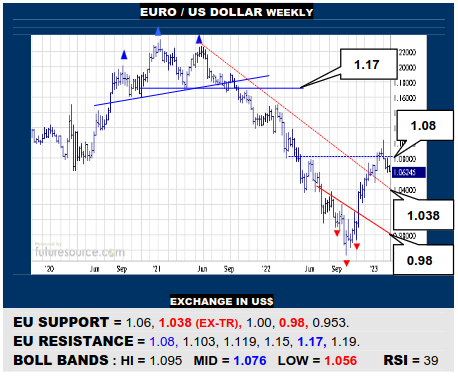

EURO / US DOLLAR WEEKLY

Though lunging through heavier 1.07/1.08 weekly resistance, the EU then posted a key reversal week as Feb began and has faded there- after. It must resurface over 1.08 to retrieve this flinch and restore the upside course. Meantime, slipping from the 1.06’s would threaten to test the ex-downtrend (1.038) and even return to 1:1 if it succumbed.

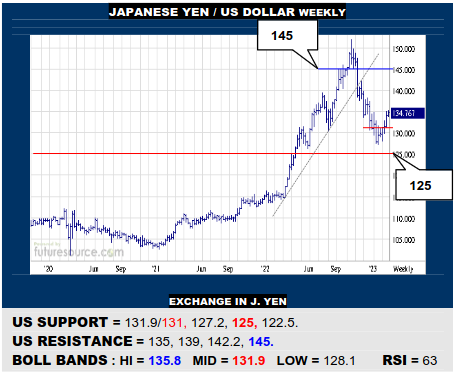

JAPANESE YEN / US DOLLAR WEEKLY

An early Feb outside week helped the US install a messy little base under 131 as it veered away from a major 125 brace and proceeded higher to erode a next 134.5 obstacle. A promising turn then that shifts sights back up towards 145. Only veering away down through the 131’s would undercut and threaten to actually test 125.

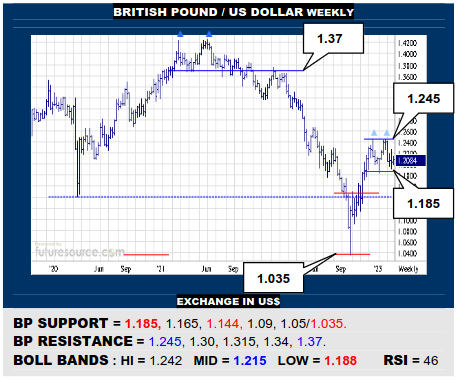

BRITISH POUND / US DOLLAR WEEKLY

Dual rebukes from 1.245 either side of new year has created a much toppier landscape and 1.185 must be watched as the tripwire for a quick drop back to 1.144 and, if unable to grip there, a more extensive downswing would threaten. Only hanging tough above 1.185 would keep 1.245 in range as a springboard on into the 1.30’s in due course.

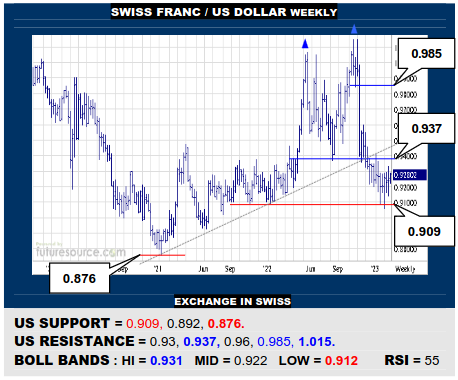

SWISS FRANC / US DOLLAR WEEKLY

Support at 0.909 has proven tougher than it initially looked and the US continues to give hints of a basing effort. Even so, to reach fruition it must score an escape over the 0.937 neckline of the big ’22 dual top. Success would imply a pivotal shift to expose an open road to 0.985. If held in check at 0.937 though, 0.909 could yet be whittled away.

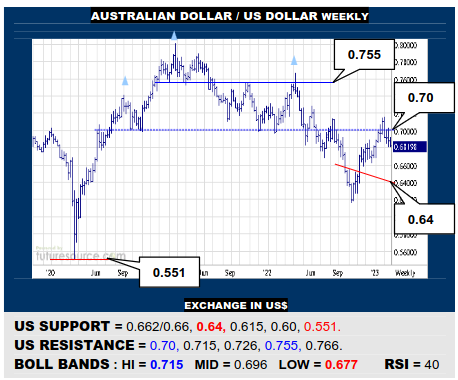

AUSTRALIAN DOLLAR / US DOLLAR WEEKLY

An early Feb key reversal week swiped the AD from the 0.70’s and it has gnawed back through 0.686 support. This makes it vulnerable to further retrenchment to a 0.66 ledge and quite possibly on back to the 0.64 neckline of a Q4 inverse H&S. Must otherwise pluck a decisive new lunge over 0.70 from the hat to revive any hope towards 0.755.

BRAZILIAN REAL / US DOLLAR WEEKLY

A Carnival lull just above the mid band (5.157), which the US needs to balance on to preserve the rebound from a glance under 5.00 and so bolster ideas of reaching towards the high end of the range at 5.51. A slip through the mid band would instead spotlight the 5.00 figure again and it is doubtful a second delve below could be so easily rescued.

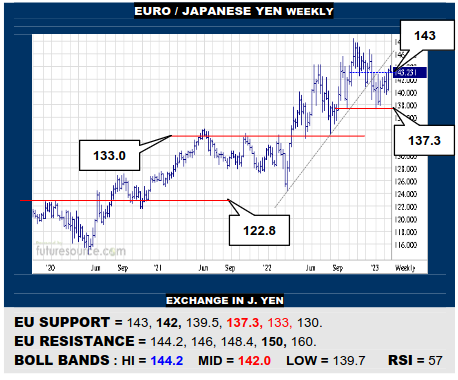

EURO / JAPANESE YEN WEEKLY

The EU has scored a provisional jab over its 143 resistance but must secure this to declare a new base. If so able, look for a run at the ex-uptrend (146) and even on through to try the 148 resistance again. Only quickly veering back under the mid band (142) would totally dilute the base impression and return focus to 137.3.

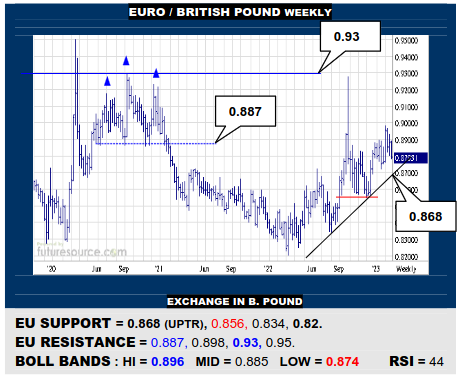

EURO / BRITISH POUND WEEKLY

Another stab into a former ’20 H&S over 0.887 has failed to find any traction. Would duly be wary of ducking back to confront the mid term uptrend (0.868). If the EU could dig in there, further efforts across 0.887 could occur to perhaps finally open a path to 0.93. If the uptrend snapped though, beware breaking on down through 0.856 as well.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.