For more than twenty years TechCom has been providing insightful technical analysis to brokers, trade houses and individual investors. Technical analysis uses certain terminology all its’ own (support, resistance, double tops, flags etc…) but in otherwise employing a concise everyday writing style and clearly illustrated charts, TechCom readers don’t have to sift through a sea of jargon to try to understand the outlook for each featured market.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

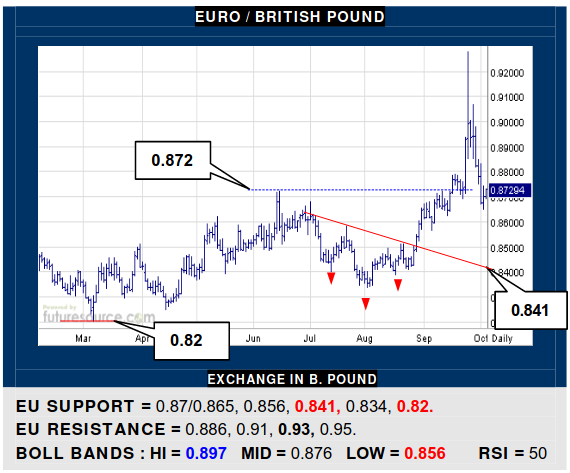

EURO / US DOLLAR

The EU has managed a prompt retrieval from the foot of the overall descending channel (0.945) but now faces the channel ceiling (1.006). Must pop this while the US Index is ousted from the 110’s to signal amore enduring catch and a shot at the next 1.035 hurdle. If blocked by the downtrend, beware loss of 0.974 leading back down to 0.95.

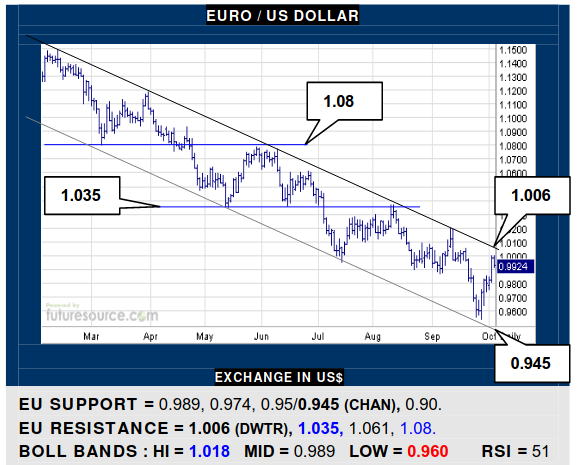

JAPANESE YEN / US DOLLAR

Still fumbling in the face of the 145 resistance but the US is thus far balancing on its mid band (143.8). ‘Something’s gotta give’ and that should tell the tale going forward. Dispatching 145 would point on to 149.5/150. A slip below the mid band would instead signal growing fatigue and a delve back towards the 139.4 early Q3 base rim.

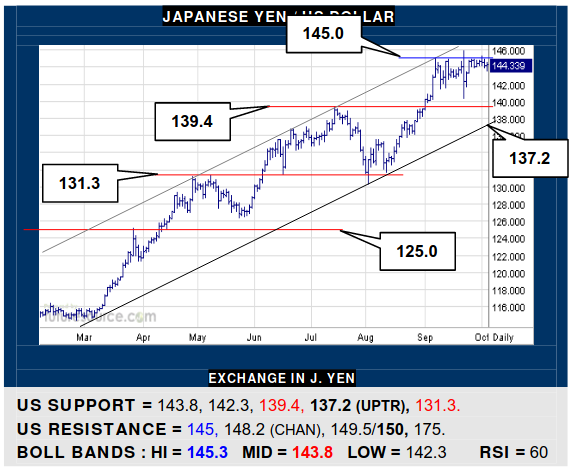

BRITISH POUND / US DOLLAR

A new all-time low under ‘85’s tag of 1.05 but the BP has jolted back up to the ’20 post-Brexit low of 1.14. It must now find grip aboard the mid band (1.128) to tag that prior slump as a false breakdown exhaustion of the broader decline. If quick to fall back out of the 1.12’s, beware squandering this bounce and dropping towards 1.05 again.

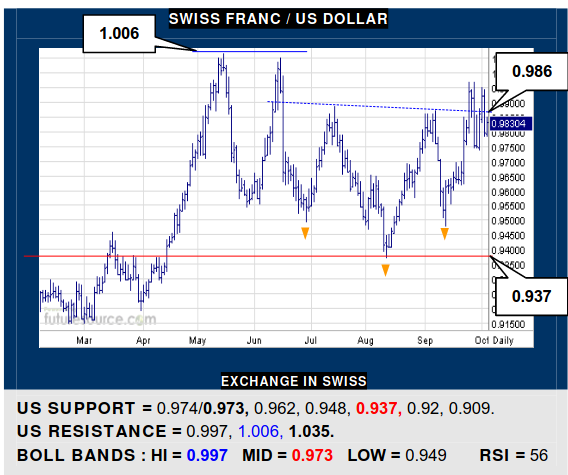

SWISS FRANC / US DOLLAR

A very choppy fortnight means the jury’s still out about the Q3 inverse H&S. The US must push free of 0.986 and grip to better declare that new base and with it scope to overhaul 1.006 and reach to the next big monthly hurdle at 1.035. Eying the mid band (0.973) like a hawk meantime as the trapdoor to pull out the rug back to the 0.95 area.

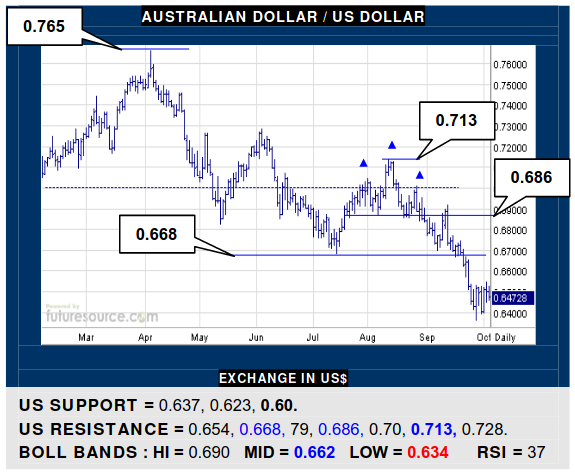

AUSTRALIAN DOLLAR / US DOLLAR

Just piecemeal ledges all the way down to the ’20 trough at 0.55 but the AD is making a bid to hold at 0.64. Would duly cater for jabs at the mid band (0.662) but it will demand a hop back over 0.668 to claim a more persuasive turn. Meantime, if failing to reach the 0.66’s, beware a bear flag risk, a break of 0.637 pointing on down to 0.60.

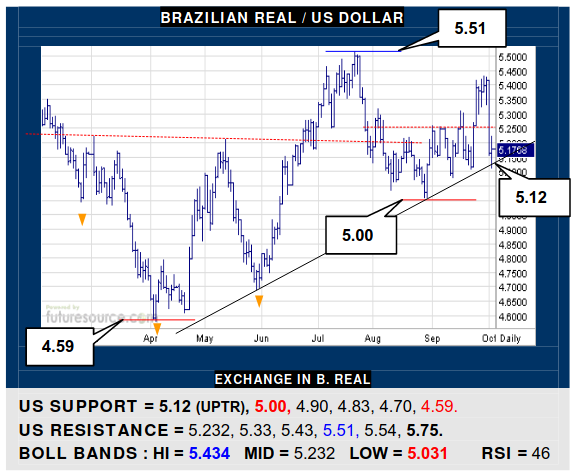

BRAZILIAN REAL / US DOLLAR

A foray towards 5.51 lost the scent late in Sep and the US has twisted back into the sub-5.25 base to attack its mid-year uptrend (5.12). If able to stabilize aboard the trend, a jog over the mid band (5.232) could get the wheels turning anew. However, snapping the trend would do more serious damage and likely resolve a broader top by falling from the 5’s.

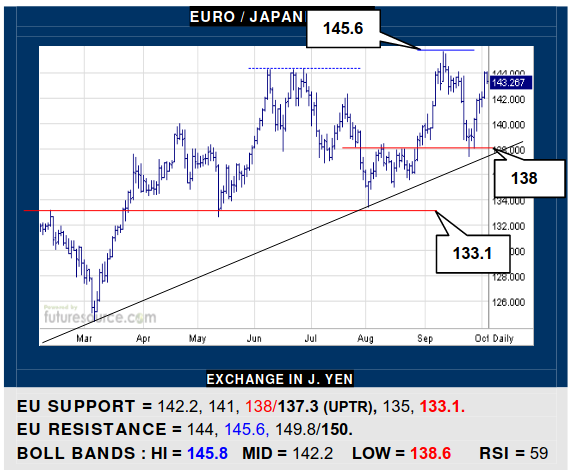

EURO / JAPANESE YEN

The EU stumble was mopped up by the 138 brace that now has the ’22 uptrend drawing in close behind (137.3). This has brought the prior 145.6 apex back into range and a break beyond would dial in focus on a ’14 high just shy of 150. Very turbulent all in all though so watch 141 meantime as a tripwire back to that key 138 / trend crossroads.

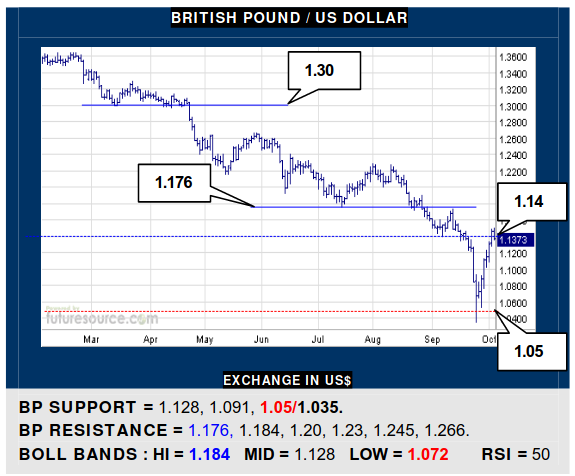

EURO / BRITISH POUND

A briefly very wobbly BP saw the EU lunge to the 0.93 realm where the air has always been thin over the past six years and it duly failed yet again. After a sharp backlash, the 0.87/0.865 area is its best chance to grip and try higher again. Breaking 0.865 would otherwise warn of delving all the way back to the 0.841 inverse H&S neckline.