Opinions Focus

- An extraordinary year but wheat markets look more stable for the year end.

- The Black Sea Grain corridor extended.

- Harvest 2023 may be reason for optimism.

Introduction

2022 has been an extraordinary year for all commodity markets as Russia’s war in the Ukraine has disrupted the historical norms.

As we head into the final weeks of the year there may be a greater sense of normality returning to the World’s wheat markets.

Weaker Prices

Looking at wheat prices over the last month, we have seen a possible air of relief from buyers as values have fallen.

Harvests have been reaped in the Northern Hemisphere and global stocks appear to be stabilising, following a consistent period of declining forecasts.

The Black Sea Grain Corridor

The expiry of the UN and Turkey brokered Black Sea Grain Corridor on 19th November maintained a certain level of anxiety over wheat markets.

This was highlighted by Russia’s withdrawal in the last days of October, as a consequence of the attacks on their naval base in Sevastopol, Crimea. As we discussed previously, there were many reasons as to why Russia’s President Putin would not maintain this stance for long, which saw his U-turn in a matter of days.

The deal has duly been renewed for a further 120 days.

This has brought relief for the largest importers in North Africa knowing their biggest sellers would continue to ship wheat.

2022 Harvests

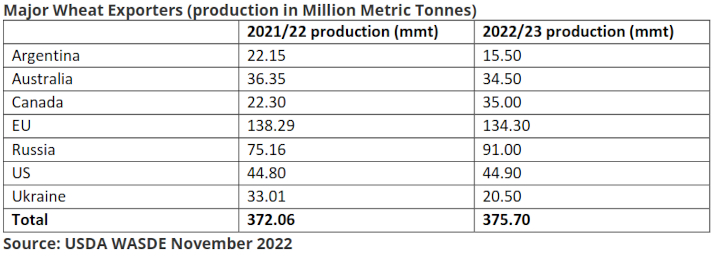

With the most of the major exporters having completed this year’s harvest, there is a growing sense of security from production estimates.

Although Argentina and Australia have yet to gather their wheat crops there is increasing acceptance of Argentina’s lower production, with another large crop anticipated from Australia.

Russia’s war in Ukraine resulted in a significant drop in Ukrainian production. Nonetheless, the World’s largest exporters have maintained robust supplies for the many poorer nations making up the biggest importers.

Supply dramas have ultimately been calmed, despite some scary price volatility along the way.

2023 Production

Climate change has been an important and consistent news headline throughout 2022. Record heatwaves, droughts, flooding and much more have given rise to production concerns.

Looking towards potential wheat supply in 2023, there is certainly reason for optimism.

European weather has seen favourable autumn planting conditions and prospects for 2023 look good.

Reports from the United States suggest that wheat area for the 2023 harvest may rise some 20% or more. Poor crop conditions at present are only of minor concern, as plants are still many months from maturity.

India, a huge producer of wheat at 103mmt in 2022, anticipate circa 15% greater plantings at 10.1 million Hectares (mha), up from 8.8 mha year on year.

Weather still has its part to play but early indications show a promising 2023 with the possibility of rising global stocks.

Conclusions

Buyers and sellers have endured unprecedented volatility and prices throughout 2022, brought about by Russia’s war and compounded by weather extremes.

Producers worldwide have demonstrated great resilience by continuing to grow adequate wheat to feed nations.

Logistics and shipping, disrupted by Russia’s war and ongoing Covid fallout, have continued to deliver, encouraged by diplomacy as seen in the Black Sea Grain Corridor.

With early prospects for 2023 looking hopeful, we may yet see a building of wheat stocks in the year ahead.

Calmer markets may be presenting themselves as we head into the final weeks of 2022; a reminder of the ultimate long-term stability we see in the world of wheat.