Insight Focus

- Black Sea ports remain closed for wheat exports as war continues to rage in Ukraine.

- USDA puts global wheat stocks at five-year low for 2022.

- Record high wheat prices could hit demand.

Russia’s invasion of Ukraine has been ongoing for 56 days, with no apparent end in sight. Wheat markets continue to rise as the major seaports in the Azov and Black Sea have been brought to a standstill. The USDA put global wheat ending stocks for 2022 at a five-year low in its April WASDE (World Agricultural Supply and Demand Estimates). Continued war and record prices could lead hit demand for wheat and its products.

The War

As Russia continues to inflict devastation on the seaports of Ukraine, the prospects for wheat exports in the coming weeks look slim at best.

Mariupol, Ukraine

Russian President Vladimir Putin and his military have a mammoth task ahead if they’re to seize control of the Southern coast of Ukraine on the Black Sea and thus its wheat exports. Either way, as our last piece suggested, pressure on Putin, both internally and internationally, may well mount as the summer months progress and buyers need Black Sea wheat.

The Markets

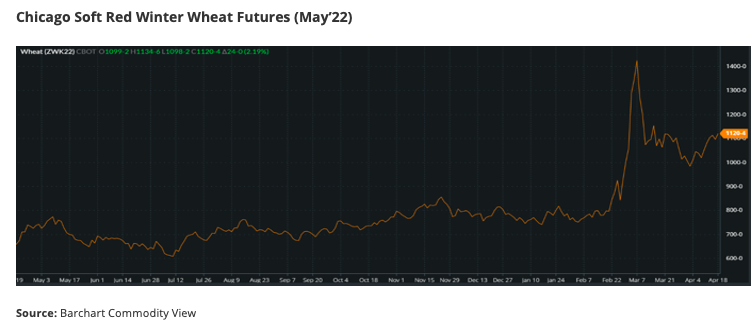

Wheat markets continue to trade at dizzying heights, recording news highs in Europe.

Prices are being supported by ongoing concern as to how the markets will compensate for the lack of Russian and Ukrainian wheat exports, which would usually be flowing from the Black Sea, into the Mediterranean and onto destinations such as North Africa or the Middle East.

Europe, North America, Argentina, and Australia are currently being viewed as potential sellers to fill the gaps. India could also play its part. Nonetheless, both Russian and Ukrainian wheat is needed in the medium- to long-term to satisfy predicted levels of demand.

The USDA’s April WASDE

Last week’s WASDE raised global wheat consumption for 2021/22 by 3.8m tonnes, to 791.1m tonnes. Global wheat ending stocks for 2021/22 were lowered by 3.1m tonnes to 278.4m tonnes, a five-year low.

The Possibility of Demand Erosion

One must wonder how sustainable today’s prices are in the event that Black Sea supplies don’t return soon enough to dampen market fears.

Ultimately, as with most markets, higher prices generally drive the most marginal buyers away as they struggle to afford increased values.

With the prevailing wheat prices and well documented food inflation at the same time as potentially troubling macro-economic outlooks ahead, there are areas of wheat use that could suffer.

Over several years, populations in the developing world have become more affluent and demanded more of a Western-type diet. This has led to an increase in meat consumption and hence the amount of wheat consumed per capita.

The Feed Conversion Rate (FCR) to produce meat from wheat is variable. However, if we assume anything from approximately 2 for some poultry up to 8-10 for beef, there’s opportunity to reduce some wheat demand in the short-term without fundamental change to diets.

For example, a family eating meat three times a week would significantly reduce its wheat requirements by eating meat just twice per week.

In addition, the poorer nations and largest importers in North Africa are likely to import more hand-to-mouth due to the cost of imports. A small reduction in stocks could equally lessen demand in the short-term if supplies look more plentiful from the Black Sea in the longer-term.

Concluding Thoughts

Wheat prices remain extraordinarily high across the globe.

The war in Ukraine is stifling exports from the region, driving prices, and adding logistical costs to the trade.

The USDA in its April WASDE pointed to continued demand and reducing global stocks. However, it would seem inevitable that demand erosion is only around the corner if prices remain as high as currently seen.

We see calmer waters ahead for the wheat markets and hope for peace in Ukraine.

Other Insights That May Be of Interest…

Making Sense of a War-Torn Wheat Market

What the Conflict Between Russia & Ukraine Means for Wheat

Russian Invasion Could Make India a Major Global Wheat Player

Explainers That May Be of Interest…