- Brazilian, European and Chicago corn all rallied last week on the back of strong exports.

- However, Iowa fell 10% because they market expected the windstorms to cause more damage than they did.

- The Pro Farmer crop tour revealed that the real problem for US corn could actually be drought.

Price Action

Forecast

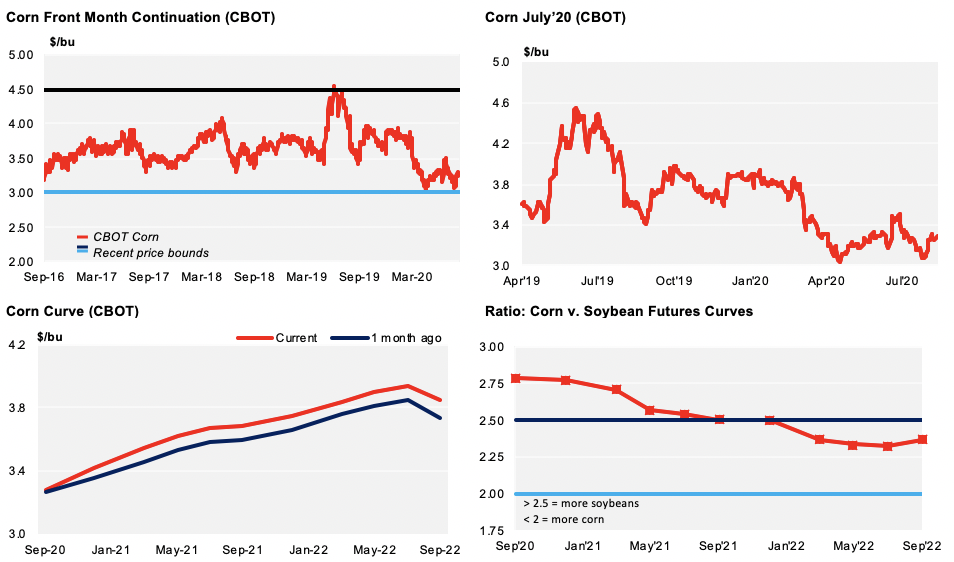

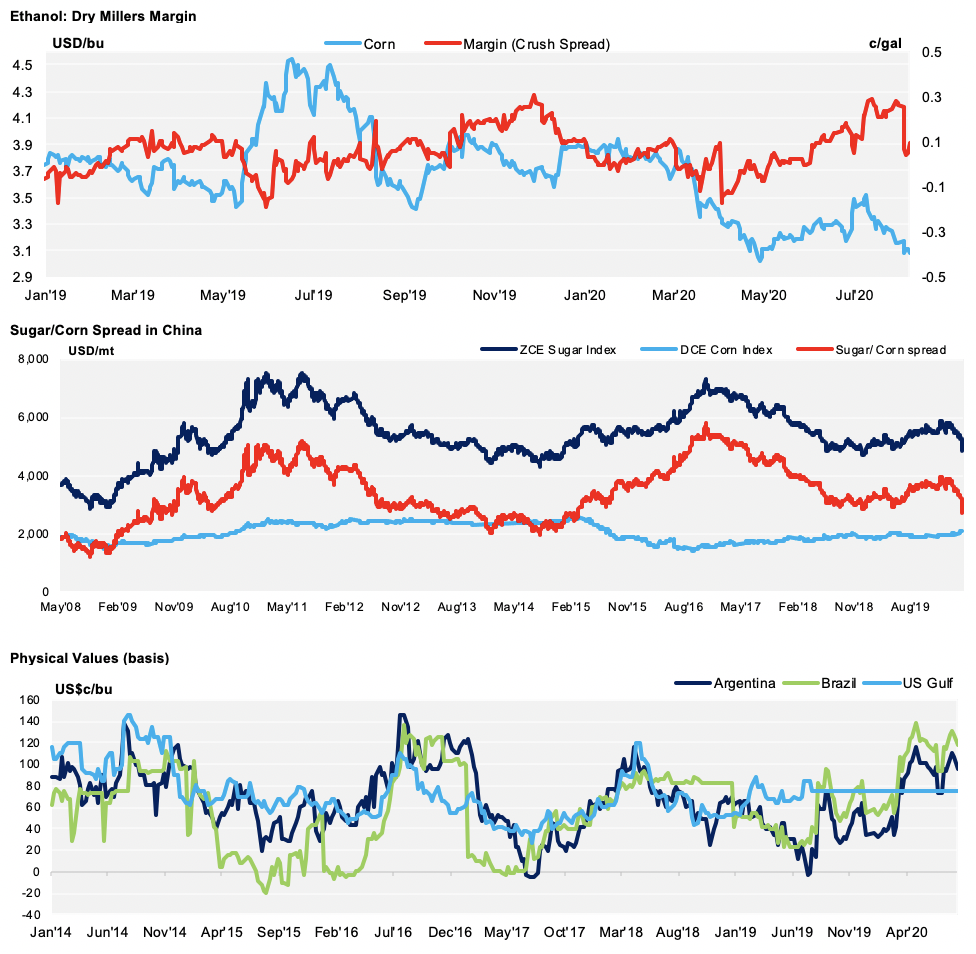

There are no changes to our forecast of 3.50 USD/bu for Chicago Corn on average for the 2019/20 crop (Sep/Aug). The year-to-date average is running at 3.54 USD/bu.

Corn

Brazilian Corn rallied a record 7.4% last week.

Chicago Corn rallied on the back of strong export numbers last week. This then then corrected itself throughout the rest of the week, recovering some of its losses last Friday and finally making finishing up 0.8% week-on-week.

European Corn also made weekly gains.

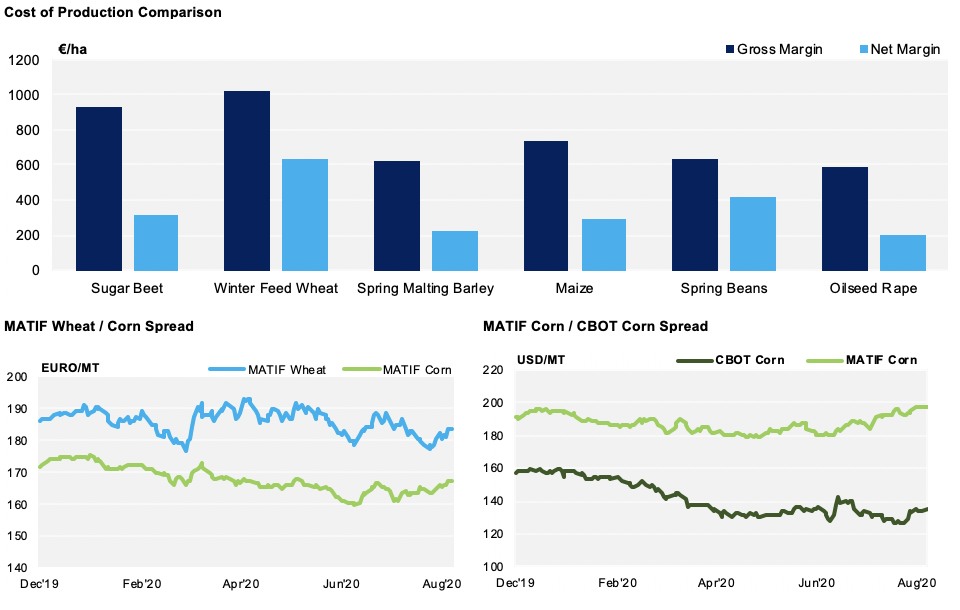

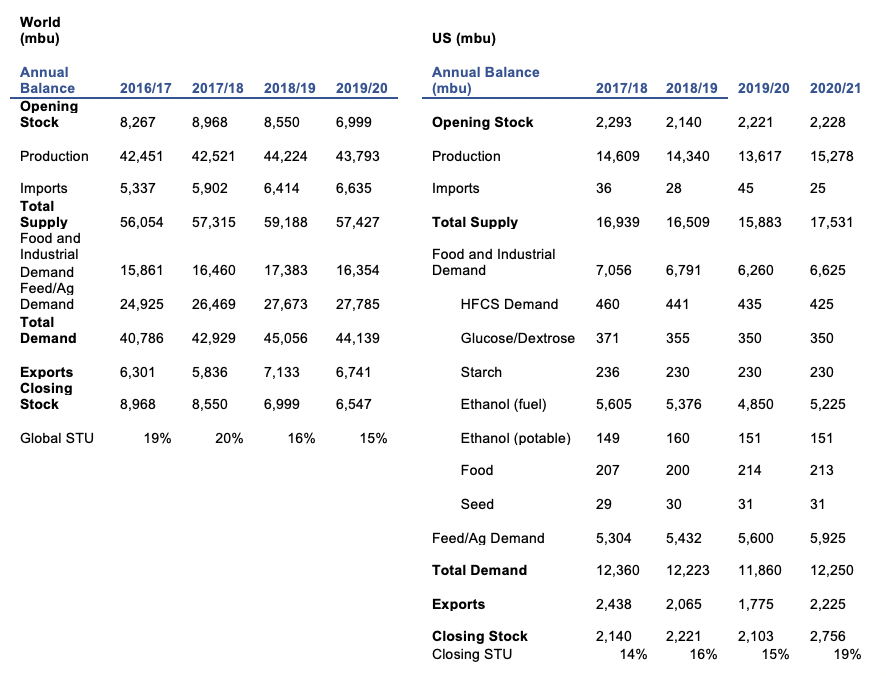

The damage from the windstorms (mainly) in Iowa is yet to materialise. However, we think there is no upside to Corn yields against the WASDE and the numbers can only be lower, creating risk to prices. Before the windstorms, we thought there was upside potential for Corn production versus the WASDE, but not anymore.

Iowa’s Agricultural Secretary recently estimated a loss of 3.5m acres and 57m bushels of storage capacity. The latter would force farmers to sell instead of store their Corn, meaning both pieces of information could offset one another.

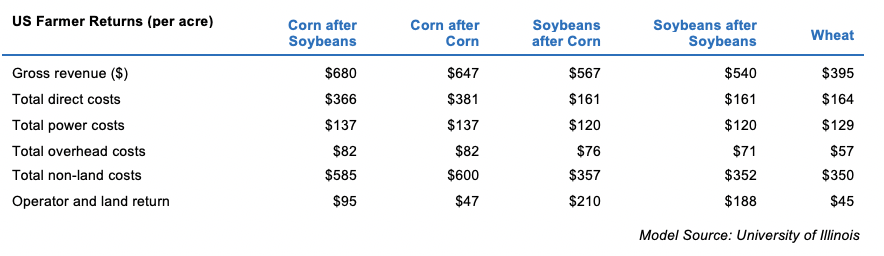

Corn export inspections were positive last week thanks to China.

The US’ Corn condition ranked 69% good-to-excellent, down 2% in the week and 56% year-on-year. Although Iowa fell 10% week-on-week, the market expected the windstorms to cause more damage meaning the market fell after the release.

The Pro Farmer crop tour revealed strong yields, which weighed on futures last Wednesday, as the market assumed the windstorm damage could not be so bad. They said the drought had been underestimated and the windstorms overestimated, meaning the drought will have a larger impact than the windstorms!

Trump indefinitely postponed the US-China trade talks last week, raising fears of a potential break of the agreement. In order to fulfill the agreement, China would have to buy four times more than normal. By the end of the week, China confirmed plans to talk with US officials soon, but there was no confirmation from US officials.

China’s pig herd was 13% higher year-on-year as it continues to recover from the culling carried out to prevent further spread of swine fever. This is bullish for Soybean and Corn demand.

Ukraine’s agricultural ministry lowered their Corn production forecast by 2m tonnes to 35m tonnes due to widespread dryness over the last few weeks. They harvested 35.9m tonnes last year. Local prices in Ukraine rallied due to concerns surrounding the impact of hot and dry weather and buyers worried that there might not be enough Corn at the start of the harvest, as was the case with wheat.

However, Brazilian Corn exports are heading towards another record this month, which is behind the strength in prices together with the lower Real, which has played a major role. The looming future (Sep’20) reached an all-time high last week.

The recent heatwave in Northern Europe continues to impact the French Corn condition. It fell for the seventh consecutive week and is now at just 62% good-to-excellent, down from 65% last week.

Weather uncertainties are having a significant impact in the short-term with the real damage to US and EU Corn still yet to be determined. This should justify some premium to prices which could be offset if there is no progress with the US-China trade talks.

Wheat and Soybeans

Chicago Wheat rallied 5% on the back of strong export numbers last week.

European Wheat also made weekly gains.

Soybeans rallied 5% on the back of strong export numbers last week.

Most of the weekly gains in wheat occurred thanks to last Monday’s rally in Chicago and Europe. Spec buying WASDE continued last week as well following the rally after the August.

Ukraine’s Wheat harvest is 96% complete with 25.5m tonnes harvested. This means the latest WASDE projection of 27.5m tonnes will unlikely be met. The Government has set the 2020/21 export cap at 17.2m tonnes compared to the 20.2m tonnes exported in 2019/20.

Russia’s harvest is 59.5% complete. IKAR increased its production forecast by 1m tonnes to 82m tonnes.

Supply

WASDE Projections

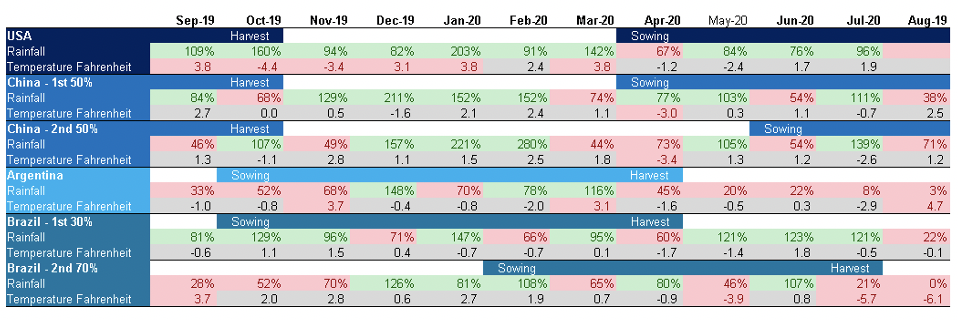

Weather in Main Corn Growing Regions

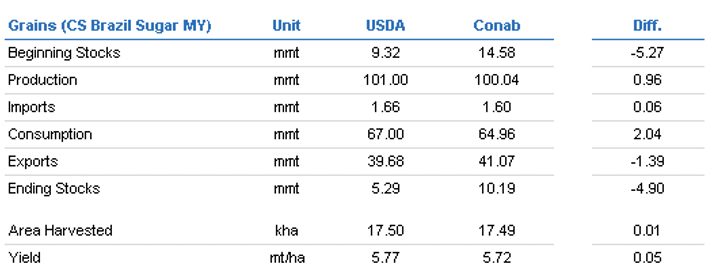

Brazil Balance

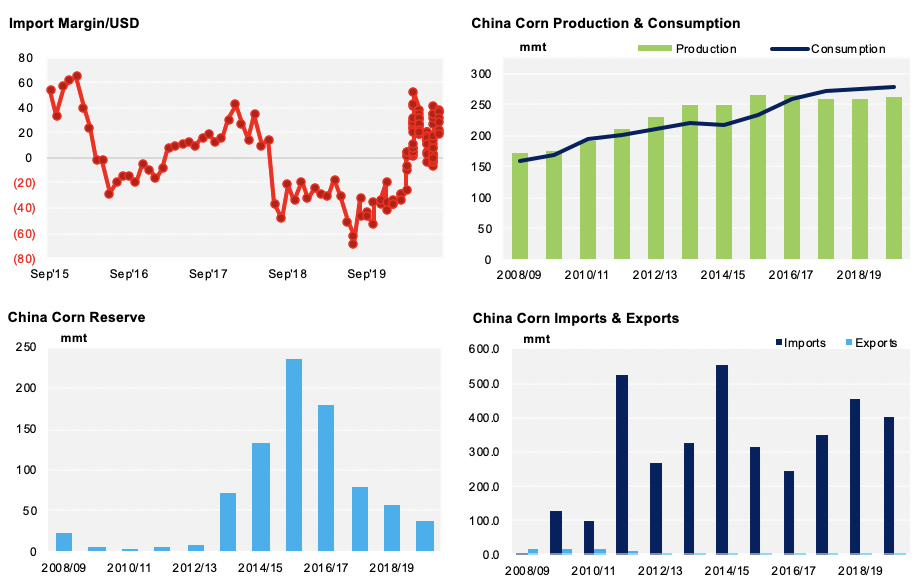

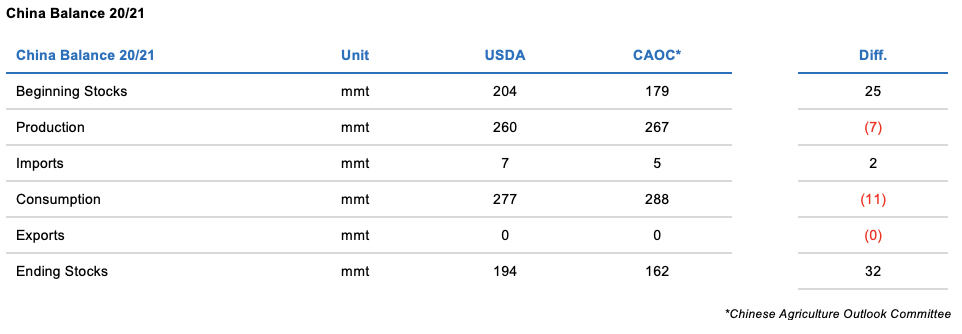

China

Demand

EU