Insight Focus

- Soybean meal demand seen growing despite high prices

- Poorer countries not deterred from buying soymeal by price

- Question mark over Argentina’s continued dominance of world soymeal, soya oil markets

The USDA has published its first 2022/23 forecasts for global oilseed supply and demand. USDA’s Oilseeds: World Markets and Trade provides the comprehensive review of USDA’s thinking for the coming year across soy, palm, rape/canola, and minor oilseeds’ production, domestic consumption, imports, and exports.

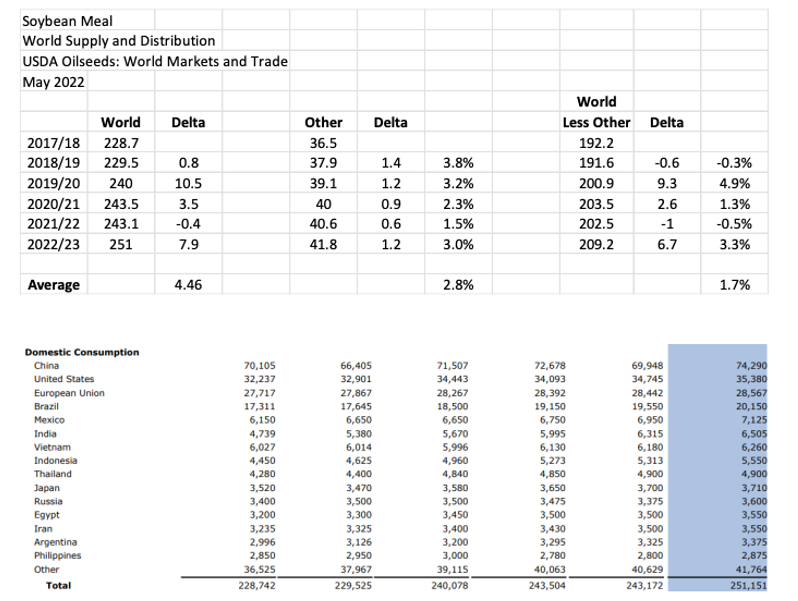

Take a look at the table below, which reflects the USDA’s soybean meal forecasts for the 2022/23 crop year (October–September):

In thinking through this demand table please remember that many analysts, consultants, and commentators fret about the consequences for soybean meal prices and percentage contributions to crushing margins due to the impending significant growth in US soybean crush capacity to meet demand for soybean oil from the renewable diesel industry. I am not one to fret about this as many of my posts suggest.

Is there anything from the report to give us some insight into what the USDA, collectively, would have to say if we asked them this very important question: Do you fret or don’t you?

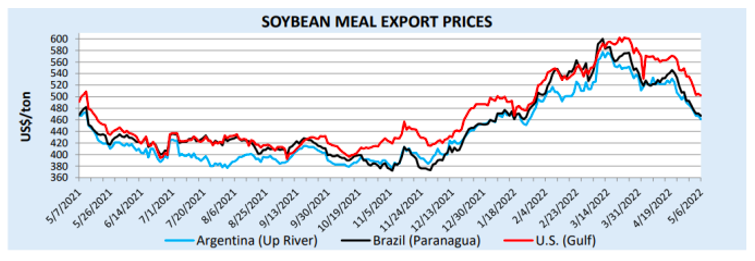

The USDA stepped up the pace of global soybean meal consumption by 7.9m tonnes for 2022/23, typical of the lumpy global growth that comes in big chunks a la the 10.5m tonnes of growth in 2019/20. The big difference — prices in 2019/20 averaged USD 338/tonne, significantly lower than prices this crop year which have averaged USD 463/tonne with April monthly prices averaging USD 524/tonne. The point: Even with significantly higher prices for soybean meal the USDA is still forecasting a lumpy step-up in demand, which should give pause to those who think the price of soybean meal in the future and the percentage contribution to crush margins will necessarily move sharply lower. If global soybean meal demand can grow 7.9m tonnes in one year at USD 463/tonne how much lower would soybean meal prices need to trade to incentivise even greater expansion? My answer: “Umm, not much.”

I want to focus on the “other” category, the catch all category for unnamed global consumers below 3 million tonnes of annual soybean meal consumption. Combined the “other “category is the second largest global consumer of soybean meal, less than China but significantly greater than the US.

What’s going on with “other”? Answer: steady growth averaging just under 3% annually (while the world less “other” grows at 1.7%). So, the USDA forecasts steady, average growth in soybean meal consumption for the poorer nations, the countries that do not make it above the 3m tonne bar and get named because these countries are not predictable large-scale consumers (but combined, they are). The USDA forecasts demand growth for poorer nations even with higher soybean meal prices and yet analysts fret about the future of soybean meal oversupply? Hmmm. My question for those who fret: Why is the function of soybean meal prices to go lower to incentivise global demand when demand increases on higher prices, even for the poorest consumers?

************************

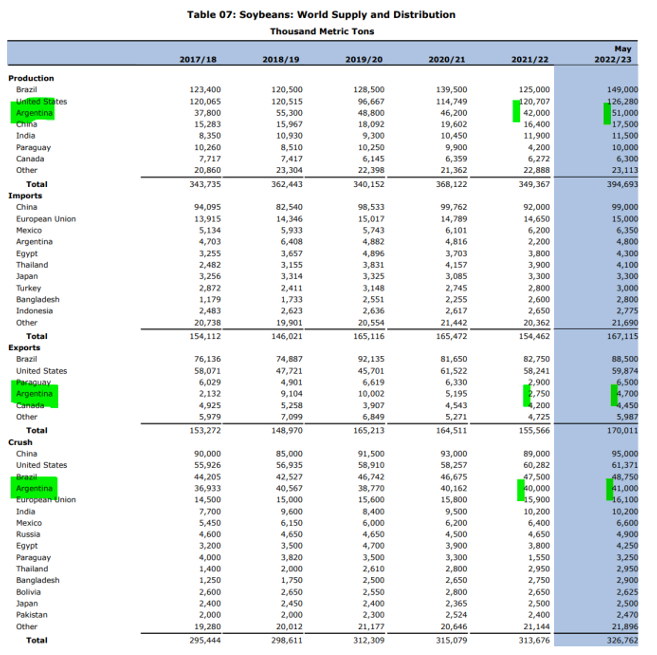

Many of you who read my posts or have attended one of my speeches on the future of the US soybean crushing industry know that I spend a lot of time focusing on Argentina and question its ability to hold on to its dominant market share in global soybean meal and soybean oil markets (Argentine production meets nearly 50% of both soybean meal and soybean oil import demand).

Let’s see if Argentina can pull off 9m tonnes of soybean growth next year and increase crush by 1m tonnes. I have my doubts.

I have highlighted USDA’s forecasts in green below.

For further information, please email waltercronin@msn.com.