649 words / 3 minute reading time

- China has reported no new domestic cases of Coronavirus. Are things heading back to normal?

- Stockpiling. Short-term demand, but maybe we’re getting back to wheat business as usual?

- Russia and Saudi Arabia/the Organisation of Petroleum Exporting Countries (OPEC)’s disagreement has crushed oil and Ruble values.

Are Things Back to Normal in China?

- China has gone a day with no reported domestic Coronavirus cases. Are we seeing things get back to more of a normality?

- The Chinese are rumoured to be on the lookout for US wheat; both Hard Red Winter (HRW) and Hard Red Spring (HRS) wheat.

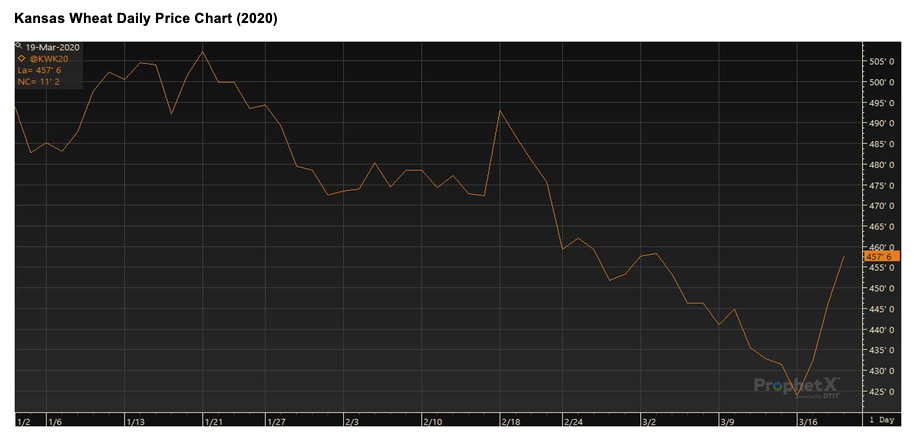

- As a result, the Kansas HRW market has rallied 30c/bu over the last few days.

- Having traded within 2c/bu of the contract low on the new crop Dec’20 contract, we have seen buying interest and market support for now.

- Coming out the other side and a desire to honour the ‘Phase One’ trade agreement with the US should spur Ag products trade, with wheat a potential target.

The Stockpiling Continues

- We have seen stockpiling in many countries, as the coronavirus outbreak has worsened, with people stripping the shops of bare essentials.

- The food supply chain is not geared up for this and it has created a spike in demand for the wheat market.

The Idea

If we all buy two loaves of bread, as opposed to our normal one, the chain breaks. This short-term demand has stopped the market crash in its tracks, but for how long? If we all revert back to buying our one loaf of bread and maintain that, with the extra one we bought last week in the freezer, the market reverts back to normal. Demand is normal, supply is normal, trade is normal.

- This, in theory, could be the catalyst for a return to normality in the market and potential return to pre-Coronavirus prices, that could be 10% higher than we find the markets today.

Oil Disputes Cause Wheat Market Stir

- To be clear, I am certainly not an oil market expert!

- It appears, however, that Russia want high production for low oil prices to push out the US shale and marginal producers.

- OPEC appear to want to maintain a controlled level of production to support prices. This has all fallen apart as the Cartel cannot agree.

- Together with coronavirus, this has resulted in the oil price crashing over the last weeks, from over $65/barrel to around $25/barrel.

- More importantly for wheat, this has instigated a Russian Ruble crash.

- A weaker currency results in more competitive export prices and potentially higher domestic prices.

- Russia don’t want high domestic food inflation and certainly do not want food shortages.

- Any major fall from the estimated dizzy heights of 80m tonnes plus for the 2020 wheat crop may result in wheat export taxes or restrictions of some sort.

A 2020 Wheat Crop Update

- Western and Northern Europe still have poor crop ratings and low plantings due to excessive rain.

- Further east, some crops need more rain. Crops in Ukraine and Russia are ahead of normal, but potentially at risk if a cold front appears soon.

- Locusts continue to grab headline space for Africa, the Middle East and now Pakistan, India and China.

- Australia have had rain (!) and crop estimates for 2020 range from 21m tonnes to 27m tonnes, compared to 14.5-15.5m tonnes in 2019…27m tonnes is huge!

- The US have variable crop ratings on what is a record low acreage of wheat.

But…the Wheat Markets Holds the Line!

- Tenders and export numbers keep showing that trade is continuing and most certainly has not fallen off a cliff, as with certain other commodities and retail products around the world.

- We find ourselves in unchartered waters, with many people concerned about what the future holds.

- The world needs to be fed, so fear not, the wheat market will always hold the line!