Insight Focus

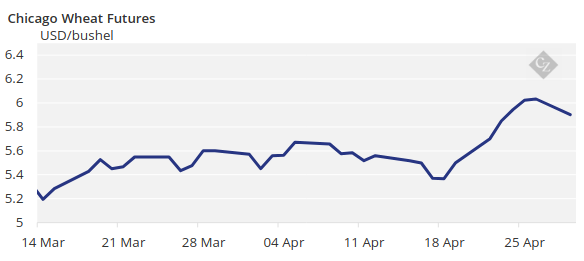

Wheat prices jumped as much as 10% in some markets last week. Weather and fund buying drove the rally and the lower prices this week demonstrate the potential for volatility ahead.

Wheat prices exploded last week, up around 10% depending on the market.

A combination of factors, which have been in the spotlight for some weeks, drove the market bulls. These included weather concerns for the 2024 harvests as well as the need for funds to buy in some of their shorts.

The rally caught the attention of potential sellers, who have applied pressure on values over the last couple of days.

The Markets

The charts below show the volatility over recent days.

A big uplift in prices last week has made way to a softer start to this week, as prices took a tumble on Monday and into Tuesday morning.

Chart 1 – Paris milling wheat, December 2024 contract

Chart 2 – London feed wheat, November 2024 contract

Chart 3 – Kansas hard red wheat, December 2024 contract

Source: Barchart Commodityview

A combination of factors came together to spark and fuel last week’s rally.

Weather

An expansion of the drought area in the US added some bullish sentiment to traders on that side of the Atlantic. This was especially relevant for hard red winter wheat areas, which saw a decline in ratings to add impetus.

In Europe, the ongoing concerns for the Western and Northern wheat crops added to the rally. The extreme wetness over a prolonged period, since planting, was replaced by further damage concerns, with freezing temperatures and hard frosts forecast for already struggling plants.

Further East, Ukraine has seen torrential rain, hindering spring wheat planting, which is 20% behind the normal pace.

In Southern Russia, dry weather has increased fears for a smaller harvest, as crops navigate their critical growing stages.

Not to mention, Russia’s targeted missile attacks on Ukrainian ports has yet again brought trade disruption into mind.

Fund Buying

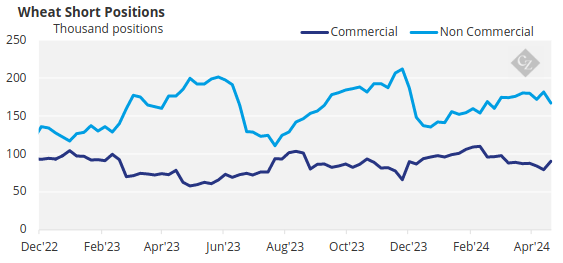

We have previously discussed the large short positions held by funds in the main wheat markets.

With time ticking until the fast-approaching notice and delivery dates for the May contracts, funds must consider their large open short positions.

Source: COT Report

Inevitably, as buyers began their buying spree, the fund shorts added to the party by frantically reducing their positions, buying in some of their shorts.

Funds may continue to buy in their shorts. If they do, it will be interesting to observe the actions of farmer sellers. With smaller crops on the horizon, there may be limited selling on their part to resist the funds’ buying activity.

Conclusions

Any swift and notable rally in prices will always take a breather. This allows for reflection before the next move, whether up or back down. This week has seen a step back in prices, as sellers of physical wheat have taken advantage of more profitable levels at which to sell parcels of wheat.

In the weeks ahead, there is a multitude of influences to watch which will steer prices. Nonetheless, we appear to have seen the bottom of the market for now. Wheat prices have been looking for a spark to drive them firmly out of the doldrums. The last 10 days has achieved this.

Some weather forecasts are dampening prices, as both the US and Southern Russia may see some rain on the horizon. This will no doubt be watched closely to see whether it actually materialises or not.

Wheat crops are at critical stages, whether it be in the Northern hemisphere growing towards harvest, or in the Southern hemisphere where planting of the next crop is in progress. The weather will thus be scrutinised at every turn over the weeks ahead.