Insight Focus

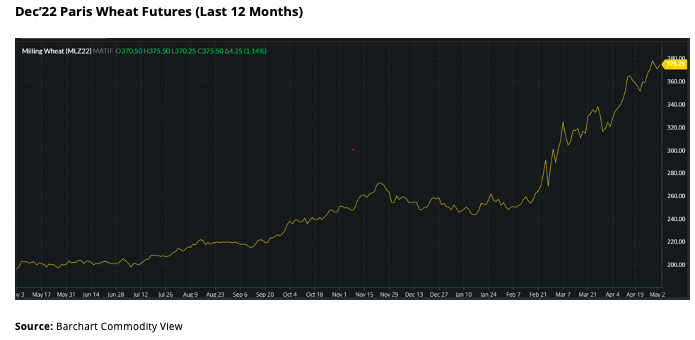

- Russia’s invasion of Ukraine has pushed wheat prices to unprecedented highs.

- With Northern Hemisphere harvests only weeks away, prices may be moved by production forecasts.

- Ukraine’s first grain cargo leaving from Constanța in Romania is cause for optimism.

Although the Russian invasion of Ukraine triggered an exponential rise to record high wheat prices, there had previously been a steady upward trend as world stocks dwindled year on year.

The USDA’s April WASDE put global ending stocks for 2021/22 at 278.42m tonnes, a five-year low.

Having reached incredible highs, it’s worth examining the fundamentals potentially influencing a continuation of the upward trend or the triggers that will lead to a reduction in prices.

Prospects for the 2022 Wheat Harvests

Production estimates have emerged for the upcoming harvests in recent weeks.

United States: Wheat plantings are estimated at 47.3m acres (up 600k acres on the year), with production of up to 47m tonnes (up 2.3m tonnes on the year). However, winter wheat conditions are not ideal and spring planting is making slow progress. La Niña presents a risk of dryness through the summer.

EU: Soft wheat crops look reasonable, with production estimates similar to 2021 at 130m tonnes.

Ukraine: A big unknown due to the Russian invasion, with a large range of 2022 estimates thus far from 16.5 to 23.4m tonnes (versus 33m tonnes in 2021).

Russia: With reportedly plentiful fertiliser supplies and good crop conditions, the 2022 harvest is forecast by SovEcon at 87.4m tonnes (75m tonnes in 2021).

North Africa: Drought looks to be a factor, as seen with Morocco’s Agriculture Ministry predicting a 53% drop in production.

China: Conditions are improving, with spring planting catching up after a slow start.

India: There’s optimism for a record 110m tonne crop (versus 109m tonnes in 2021), with increased export potential. In addition, Egypt, the world’s largest wheat importer, has recently added India to its list of approved suppliers.

Argentina and Australia: We’re still a long way from any solid projections for harvest at the end of the calendar year, but suggestions are for marginally smaller crops than were seen in 2021.

Logistics and Trade Flows

The major unknown here revolves around the Black Sea exports from Russia and Ukraine.

As we’ve previously written, it seems likely that pressure will build on President Vladimir Putin over the summer months, both domestically and internationally, to aid vessel movements through the Black Sea ports. This will allow grain shipments to the neediest in North Arica, as well as those further afield in the Middle East and Asia.

Interestingly, Ukraine has reached agreements with Romania and Bulgaria in recent days to ship from Constanta and Varna respectively. This will help wheat exports if Ukraine’s Azov and Black Sea ports remain dysfunctional.

With few harvest disasters envisaged for other leading exporters, Europe, the US, Argentina, Australia and India should continue to fill gaps left by the Black Sea.

Conclusions

The above harvest thoughts may not indicate a record global wheat crop in 2022, but a reasonable yield is probable.

Current high prices, in conjunction with global war-induced economic woes, seem likely to create a degree of demand erosion for wheat, as discussed in our last article.

Whether from its own Black Sea ports, or those of its neighbours, we hope to see a return to some wheat exports from Ukraine in the coming months.

Pressure on Putin may well force his hand to encourage Russian Black Sea exports, regardless of his war efforts.

As harvests begin, wheat becomes more readily available and the potential for Black Sea exports increases.

Without a major escalation in Russia’s war, the indicators point to a cooling of wheat markets as we head through the summer months.

Wheat price contract lows on the horizon are doubtful, but an easing to more sustainable levels is a realistic possibility.

Other Insights That May Be of Interest…

Making Sense of a War-Torn Wheat Market

What the Conflict Between Russia & Ukraine Means for Wheat

Russian Invasion Could Make India a Major Global Wheat Player

Explainers That May Be of Interest…