Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

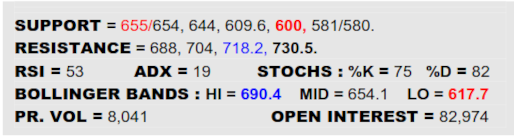

NEW YORK SUGAR #11 OCTOBER 2023

By and large NY has survived its dip back to the preceding small pennant at 23.70 this week and edged up again Wednesday from it. Still trying to achieve a clearer cut entry into the dual top beyond 24₵ therefore and 24.40 looks like a better graduation point that could adjacently see top breakthroughs in other ‘Sugar’ currencies. With the B-Berg managing another step to the good meanwhile, the market duly gets the benefit of the doubt until proven otherwise but, of course, in this instance ‘otherwise’ isn’t too far away because it is represented by that 23.70 ledge.

LONDON WHITES #5 OCTOBER 2023

London was also seeking to get back in the saddle Wednesday and posted a livelier outside day higher after recently leaving its mid band and 655 support ledge unscathed. The outsider could be quickly validated if the market hustled on by 688, in that case claiming a sort of brief flaggish kind of dip this week and lighting passage on towards the 718.2 high. Would have to be more cautious if 688 kept the lid on however, things staying quite murky in that case and insisting the 655 prop wasn’t necessarily out of the woods yet.

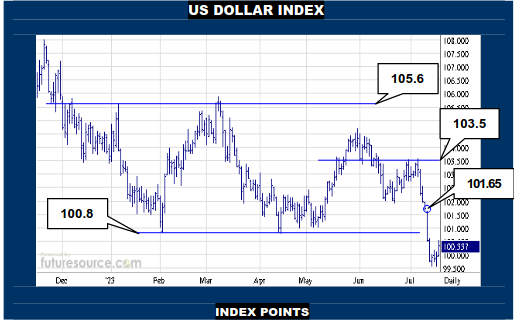

US DOLLAR INDEX

While the B-Berg was emerging over 105.2 Wednesday to enhance its basing credentials, a recently benign Dollar was also getting a bit perkier. The concern here relates to the identity of a 101.60’s gap, initially viewed a ‘breakdown’ but now hinting at a lesser ‘measuring’ gap as values rebound from a lately met 99.65 goal. If this bounce was hastily intercepted at preceding 100.8 lows, so any currency concerns could soon wane again and the cavern on down to the 93’s would keep beckoning. A jolt back over 100.8 would heighten fears of just a brief ‘measuring’ gap dip however and crossing the 101.60’s gap itself would signal the Dollar becoming a bona fide problem for commodities again.

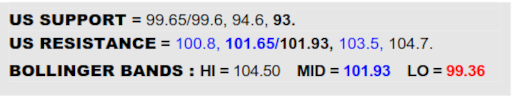

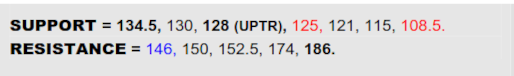

#5 / #11 WHITE PREMIUM OCT 2023

VALUE : $141.3

The White Premium came ripping back up from the 120’s uptrend test in Jun but, despite a glimpse beyond prior $146 highs Friday, it couldn’t initially find any traction there. This isn’t a dire situation as yet if still able to put in some consolidation in the lower 140’s, the chance to make a cleaner escape to new ground then remaining where Q2 might be viewed as a broad flag that would measure on up to $174. Alas though, if the nearby twitch brought further erosion back through the mid band ($134.5), it would leave the recent spike looking like a false breakout and the alarm would start to sound at the uptrend ($128).

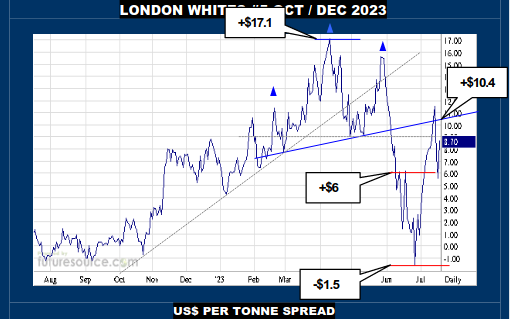

LONDON WHITES #5 OCT / DEC 2023 SWITCH

VALUE : +$8.7

Thrashy stuff for Oct/Dec Whites as a lunge at the first half ’23 H&S over +$10.4 has been refused but without becoming an emphatic rebuke as the switch has since been gathered up by its first ledge of support at +$6. Still in with a shot at contesting the top structure further therefore but the +10’s must be clearly overcome to disperse it and insist that things were truly on track to the +$17 high again. Meantime keeping the niche between +$6 and the approaching mid band (+$5.1) under watch as a critical driver. If rejected by the +10’s again and the mid band succumbed, so the Q3 revival would implode and renewed rummaging in negative terrain could later be expected.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.