- Wheat prices across the globe are either at or approaching record highs.

- Are these heights driven by supply, demand, stocks, a combination, or something else?

- Understanding the major factors will help the decisions ahead.

Extraordinary Times

The last couple of years have proven to be some of the most unprecedented times of recent generations.

The COVID pandemic has wreaked havoc among markets, livelihoods, entire economies, and normally robust supply chains.

Wheat prices have not been spared from turmoil. Lockdowns have created unheard of problems for logistics and the supply-chain on a global scale.

So, as the world’s nations continue to struggle with a return to some sort of normality, the wheat price continues to soar ever upward.

The Market Drivers

Looking at the bullish factors which have been fuelling this bull run demonstrates why prices have moved so much.

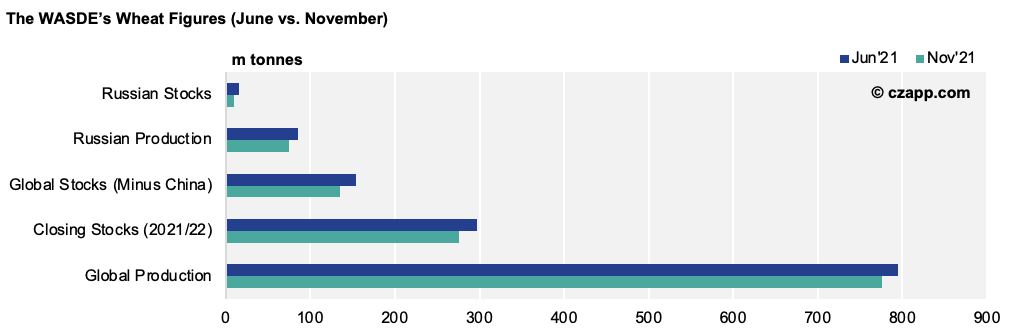

Recent numbers from the monthly USDA’s (United States Department of Agriculture) WASDE (World Agriculture Supply and Demand Estimates) show how production and stocks have been tumbling since June, when the Northern Hemisphere’s harvests began.

These reducing supplies and stocks pushing markets ever higher have created a sense of real concern. In recent days, we’ve seen Russia, the world’s second largest wheat exporter, bring forward export quotas in the New Year due to internal soaring prices for wheat and flour products.

Putting the Prices into Perspective

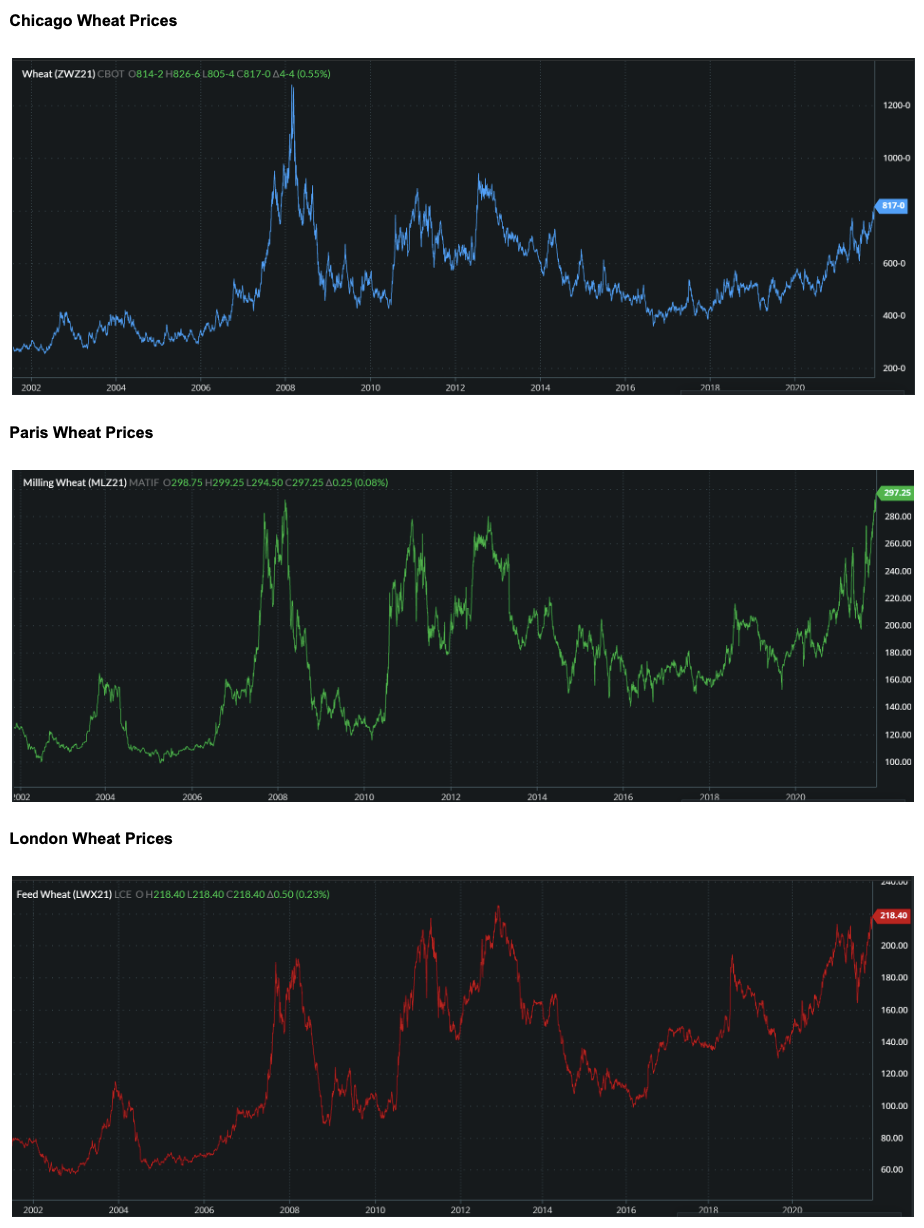

The charts below show Chicago, Paris, and London wheat over the last 20 years. They clearly demonstrate the dizzy heights at which the current prices lie.

Looking Ahead

With the charts above in mind, what will 2022 bring for wheat prices?

Despite all the global turmoil at present, there’s an interesting point to be taken from the three charts above. Where prices rise too high, supply tends to pick up, due to the high margins for producers and, as quickly as markets rose, they slip back down to more historical levels.

A rapid drop in prices would be welcome over the coming months, with the likes of the large North African importers concerned with food security and the not-so-distant memories of the Arab Spring Uprisings prompting huge political instability.

However, although it’s ultimately likely prices begin to drop off at some point, there’s the topical issues of other price inflation.

Fertiliser prices have gone through the roof and do not look like cooling off. Add this to the increased costs being seen in manufacturing of farm buildings, machinery and the like, margins will be squeezed with any reduction in wheat values.

Conclusions

The above charts suggest that when supply is reduced, prices rise. This stimulates higher production, which generates increased supply and ultimately drives prices lower again.

Additional expenditure to the farmers’ overheads and inputs may lead to a price struggle between the big importers and the largest exporters for months to come.

The side that comes out on top and controls prices will likely depend on prospects for supply from the 2022 harvests.

What is for sure is that times are extraordinary and predicting the future appears a hard task for now.

Other Opinions You Might Be Interested In…